Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

Approvals for apartments, particularly those of more than nine storeys, slumped over August, pushing total approvals down 6.1 per cent on the previous month.

The total number of homes approved fell to 13,991, after an 11 per cent rise in July, according to seasonally adjusted data released by the Australian Bureau of Statistics (ABS).

ABS head of construction statistics Daniel Rossi said a 16.5 per cent fall in approvals for private homes excluding houses had pushed total approvals lower, after a July increase.

“The movements in dwellings excluding houses continue to be the result of volatility in apartment approvals, with the broad environment around apartments remaining subdued,” Rossi said.

“Private sector house approvals continued to slowly rise, up 0.5 per cent.”

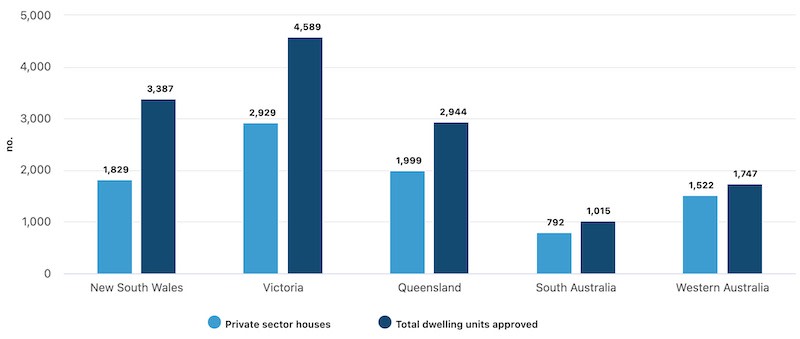

Private sector house approvals rose 0.5 per cent to 9338 homes to be 8.4 per cent higher than August of last year.

New South Wales recorded the largest rise of the states with 3.9 per cent.

Western Australia continued to track higher, 1552 houses, the most since June, 2021.

Private sector homes excluding houses fell to 4418 homes, 6.1 per cent lower than a year ago.

The August result was driven by a decrease in approvals for high-density apartments. There were 1214 apartments approved in blocks of nine or more storeys in August compared to 2504 in July.

The value of total building approved fell 0.2 per cent to $13.25 billion after a 6.9 per cent rise in July.

Total residential building value fell 6.7 per cent to $7.96 billion, primarily driven by a fall of 7.9 per cent in the value of new residential building approved to $6.81 billion. Alterations and additions rose 1.4 per cent to $1.14 billion in seasonally adjusted terms.

The value of approved non-residential building rose 11.5 per cent to $5.30 billion, after a 2.8 per cent July increase.

Oxford Economics Australia senior economist Maree Kilroy said the data suggested the worst for house approvals had passed.

“Apartment feasibilities will remain challenged near term,” she said.

“Delays, higher debt costs and rebased build tender prices will continue to cause headaches for developers.

“It is forecast house commencements will gain 6 per cent in the 2025 financial year, lifting national total dwelling starts by 2 per cent to 158,900.”

Kilroy said with the upturn spreading across all build forms and states, a sharper uplift was forecast for 2026.

“Mortgage rate cuts will aid the release of pent-up housing demand, while traction on the housing policy front will become increasingly obvious,” she said.

“However, industry capacity will act to limit the velocity of the recovery.”

Meanwhile, national home prices rose 0.04 per cent to a new peak in September, according to the latest PropTrack Home Price Index.

While home prices were flat in the combined capital cities over September, they had increased 5.88 per cent over the past year, as growth remained varied across the capitals, PropTrack said.

Adelaide (0.53 per cent), Perth (0.24 per cent), and Brisbane (0.20 per cent) recorded the strongest growth in September, while Hobart (-0.31 per cent) and Melbourne (-0.30 per cent) were the only capitals where prices fell.

“The pace of growth has been fastest in Perth, Adelaide and Brisbane for much of the past two years, and this trend persisted in September with the cities seeing annual growth of 22.34 per cent, 15.05 per cent and 13.31 per cent respectively,” the report said.

“Bucking the trend of the past year, regional areas (up 0.11 per cent) outpaced the combined capital cities (up 0.01 per cent) for home price growth in September.

“Performance was also diverse across regional areas as regional WA (15.47 per cent) and regional Queensland (10.98 per cent) led annual growth in September, while regional Victoria recorded the largest falls (down 1.32 per cent).”

PropTrack senior economist and report author Eleanor Creagh said the upswing in Australia’s home prices has persisted into the spring selling season, although growth had slowed with buyers enjoying more choice.

“The number of homes listed for sale has lifted, providing more choice and slowing price growth,” Creagh said.

“However, the pace of growth remains varied with differing supply and demand conditions driving diverse performance across the country.

“July’s tax cuts boosted borrowing capacities and buyers’ budgets, while the persistent growth in home prices is likely motivating some to overcome affordability challenges and transact.”