Rents, Homes Prices Help Push Inflation to Five-Month High

Inflation has hit a five-month high, according to new data from the ABS, with home prices and rents driving the rise.

The monthly Consumer Price Index (CPI) indicator for September rose to 5.6 per cent, its highest point since April’s 6.7 per cent.

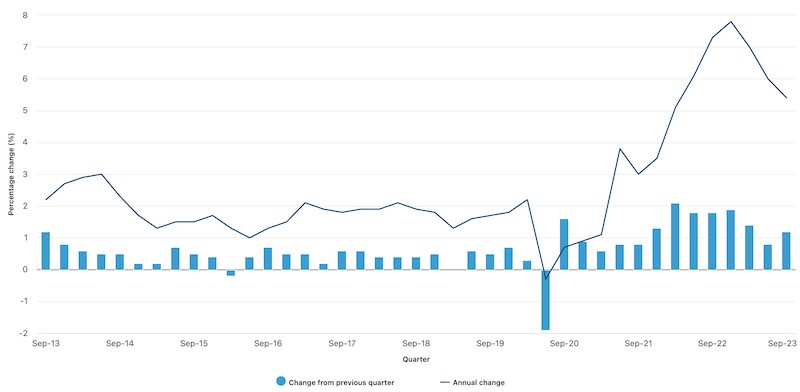

The CPI rose 1.2 per cent for the September quarter and 5.4 per cent annually.

ABS head of prices statistics Michelle Marquardt said the figure for the September quarter was well above the 0.8 per cent rise of the previous quarter.

“The rise this quarter, however, was lower than those throughout 2022,” she said.

The most significant contributors to the rise in the September quarter were automotive fuel (7.2 per cent), rents (2.2 per cent), new homes bought by owner-occupiers (1.3 per cent) and electricity (4.2 per cent).

Rents rose 2.2 per cent after a 2.5 per cent rise in the June quarter.

Rental price growth for apartments is continuing to outpace houses.

The increase in rents this quarter was moderated by changes to Commonwealth Rent Assistance.

From September 20, the maximum rate available for Rent Assistance increased by 15 per cent on top of the CPI indexation that applies twice a year.

“This is the largest increase in Commonwealth Rent Assistance for 30 years and, while the increase applied for only part of the quarter, it reduced the overall increase in rents by 0.3 percentage points,” Marquardt said.

Prices for new homes rose 1.3 per cent for the quarter, though they continued to ease from rises seen in 2022 due to subdued new demand and easing material costs.

Automotive fuel rose 7.2 per cent after two quarters of price falls, the largest quarterly rise in fuel prices since March, 2022 and was mainly caused by higher global oil prices.

Food prices (up 0.6 per cent) also rose; however it was the softest quarterly rise since September 2021.

Child care fell 13.2 per cent, and was the largest contributing fall this quarter. Changes to the Child Care Subsidy raised the amount of subsidy received for over a million families and came into effect on July 10.

Annually, the CPI rose 5.4 per cent, with new homes (up 5.2 per cent), rents (7.6 per cent), electricity (14.5 per cent) and automotive fuel (7.9 per cent) the most significant contributors.

“The September quarter’s annual increase of 5.4 per cent is lower than the 6 per cent annual rise in the June 2023 quarter,” Marquardt said.

“This is the third quarter in a row of lower annual inflation, down from the peak of 7.8 per cent in the December 2022 quarter.”

All groups CPI Australia, quarterly and annual movements (per cent)

“While many industries price increases are slowing, automotive fuel has had large annual increases in the past two months, which has been driving the movement higher.”

Master Builders Australia chief executive Denita Wawn said housing costs remained a significant source of inflation pressures.

“Rental prices are up by 7.6 per cent over the past year, close to a 15-year high,” she said.

“The rental market continues to be hurt by a prolonged drought in new apartment building and the negative consequences of rising interest rates.

“Housing costs have a major impact on wages and costs right across our economy.

“The ball is now in the court of state and territory governments to deliver on their commitments on planning reform.

“For many builders and developers, initiating large-scale home building projects in the current environment is simply too risky.”