Housing Pipeline Weakens as Nation’s Home Approvals Drop

Australia’s building approvals fell again in October, deepening concerns about the nation’s housing pipeline as demand continues to rise.

ABS data shows total home approvals declined 6.4 per cent for the month to 15,832, reversing September’s short-lived rebound.

Private-sector house approvals fell 2.1 per cent to 9251, while approvals for apartments and other multi-unit homes slid 13.1 per cent to 6253.

The decline in higher-density approvals has prompted the most concern from the industry given its role in supplying affordable rental and investor housing in major cities.

The latest monthly figures continue a longer pattern of undersupply, with fewer than 192,000 homes approved nationally during the past 12 months, well below the volume needed to keep pace with population growth and migration.

Industry groups say the contraction in approvals risks pushing Australia further off track from national housing targets agreed under the federal–state housing accords.

The drop in apartment approvals is being viewed as a sign that developers are delaying or shelving projects due to rising costs, unstable project economics and worsening labour pressures.

Many apartment and townhouse projects are still struggling to achieve feasibility as finance, materials and labour remain more expensive than in previous cycles.

Industry bodies say the October decline highlights structural weaknesses in the approvals pipeline, particularly for medium and high-density projects that require significant upfront capital and planning certainty.

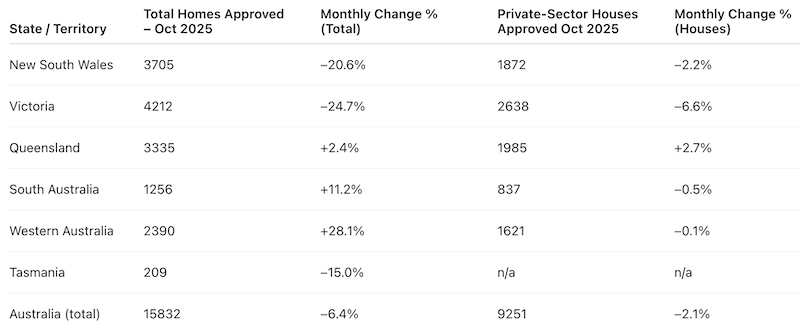

Across the states, the October decline was broad but uneven, with the east coast markets recording the sharpest pullbacks in multi-unit approvals.

Approvals by state, September v October

Market analysts warned that unless November and December data show a marked rebound, Australia could close the year with one of the weakest approval tallies since the mid-2010s.

Oxford Economics Australia senior economist Maree Kilroy said uncertainty has increased regarding the timing and likelihood of any further interest rate cuts.

“Nonetheless, there is considerable pent-up housing demand ready to fuel the upturn,” she said.

“The accumulation of rezoning, planning concessions, institutional investment incentives, and social housing renewal will play a defining role.”

Property Council Group executive policy and advocacy Matthew Kandelaars said that after a rise in September, it was disappointing to see apartment approvals go backwards again.

“Apartment approvals are volatile, but seeing a fall after some positive figures in September is frustrating,” he said.

“[The] data shows complex and rigid planning systems continue to hold us back. We need wholesale reform and an unfailing focus on structural improvements to approvals processes.”

Master Builders Australia chief executive Denita Wawn said there was a clear gap between policy ambition and reality.

“Builders are struggling to make the numbers work. Construction costs have jumped more than 40 per cent since 2019, and rising finance and insurance costs are pushing too many projects off the table,” she said.

“Without urgent action to ease pressures and restore confidence, more projects will stall before they even start.”