Are Stalling Property Prices a Boon for First Home Buyers?

As the nation’s capital city property prices continue to stall, softer market conditions might present first home buyers the opportunity to take that first step on to the property ladder.

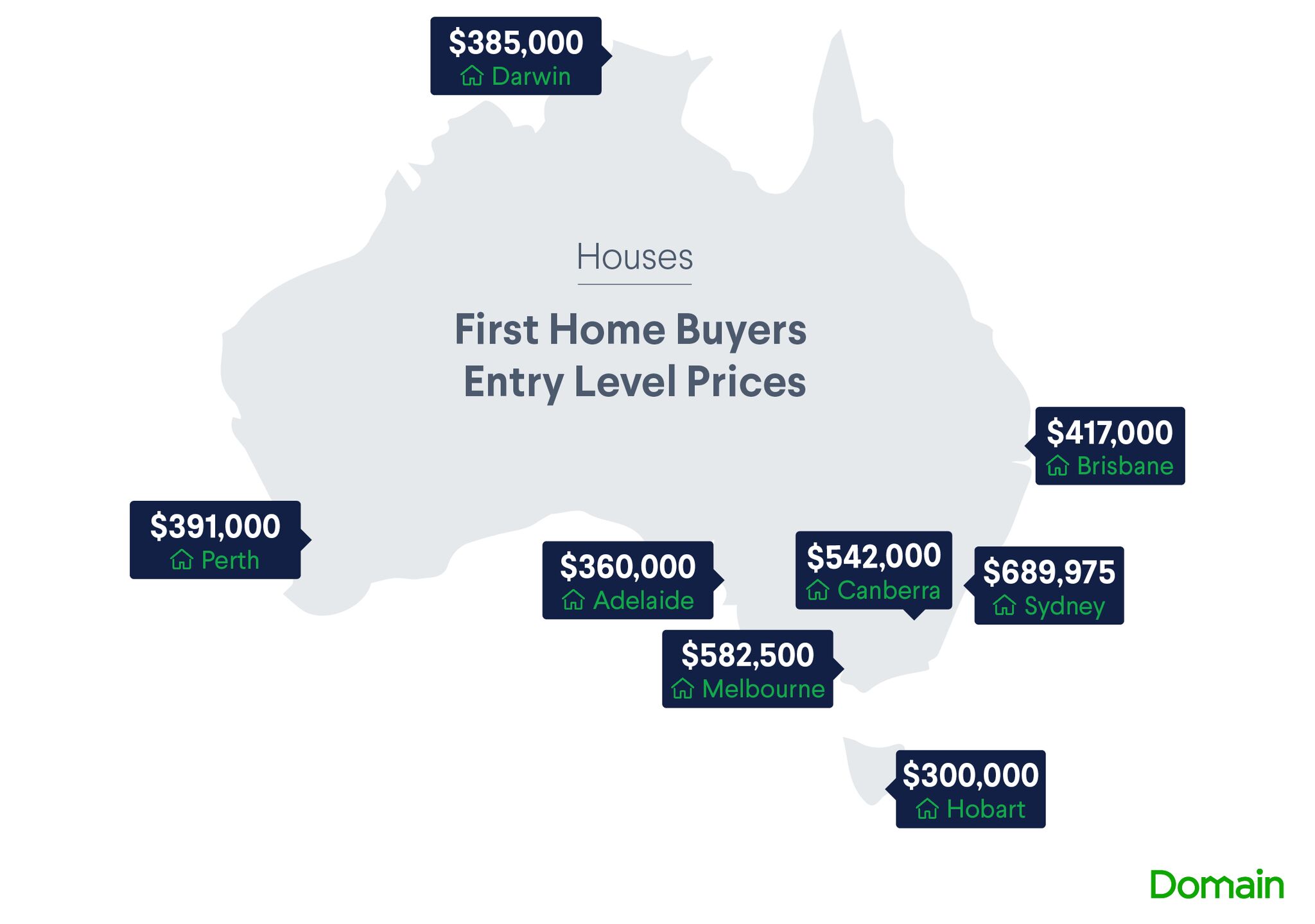

A new First Home Buyers report, released by Domain, reveals the locations offering the lowest entry prices in capital cities across the country.

Related: Home Ownership Falling Among the Young and Poor: Grattan Institute

Sydney

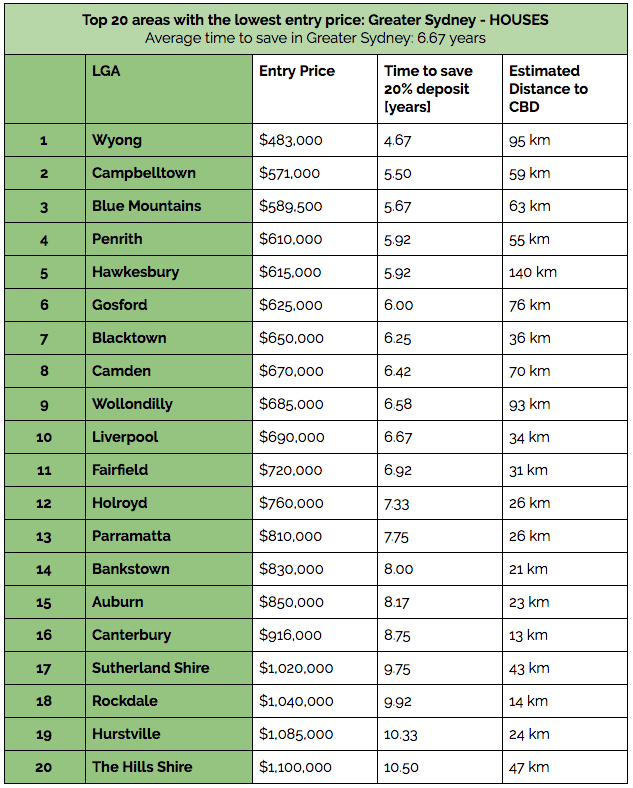

Notoriously pricey Sydney may finally offer potential home buyers relief due to its cooling property market.

Strong investor demand has traditionally been a key driver of the Sydney and Melbourne residential markets, but thanks to tightening credit conditions and regulatory changes this demand has significantly dropped off.

Domain’s data scientist Dr Nicola Powell says securing your first home has also been improved by government policies.

“From July 2017 to April 2018 almost 23,000 first home loans were financed in NSW, jumping 76 per cent from the year prior,” she said.

Powell suggests areas such as the Central Coast’s Wyong as a viable first home buyer suburb due to its entry price at $483,000, and Campbelltown which sits 59 kilometres from Sydney’s CBD at $571,000.

“Those looking for something closer to the city centre can consider units in the area of Canterbury, approximately 13 kilometres from the Sydney CBD, with an entry price at $475,000 and a time to save of 4.6 years.”

Related: Developers Should be Incentivised to Deliver Affordable Housing

Melbourne

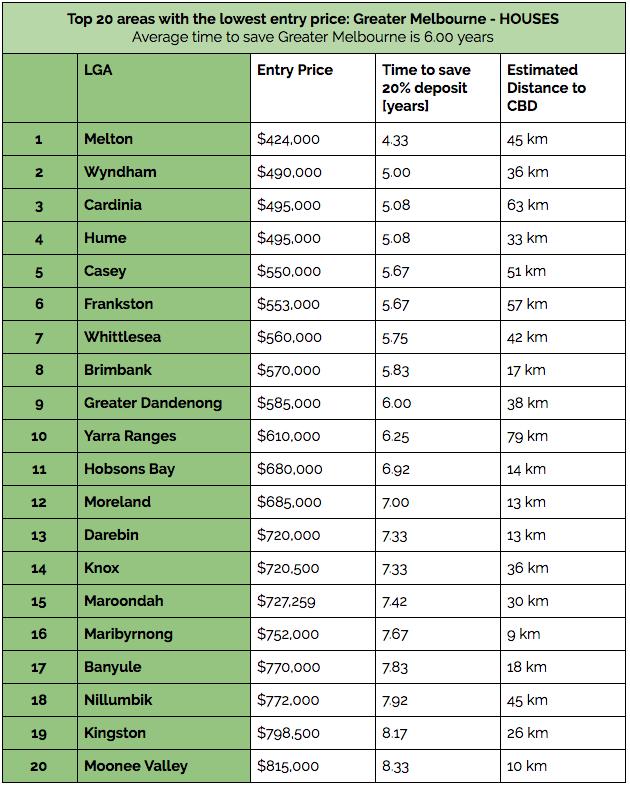

Homebuyers looking to purchase quickly, Powell suggests areas such as Melton with the entry level price is $424, 000, or Wyndham which sits 36-kilometres from Melbourne’s CBD with its lower entry price of $490,000.

“For house hunters looking to be closer to the CBD, areas like Maribyrnong, approximately nine kilometres from Melbourne’s CBD, are a strong option with unit entry prices at $360,000 and a time to save of 3.7 years.”

Related: First Home Buyers Hit Five-Year High

Brisbane

Figures show first home buyers have increased in Queensland. The state is home to the most generous First Home Owners’ Grant at $20,000, introduced in 2016 but soon to be reduced to $15,000, available for homes priced under $750,000.

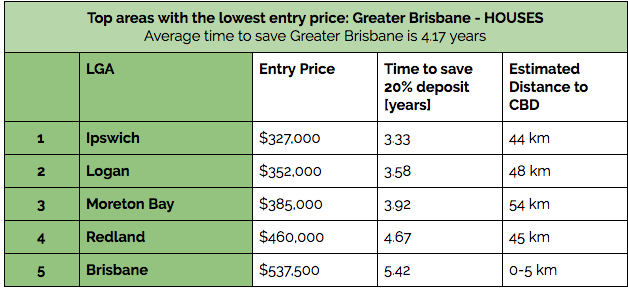

Domain figures show the average time to save a 20 per cent deposit in the greater Brisbane region is 4.17 years, with the lower entry housing prices at $327,000 in Ipswich, $352,000 in Logan and $385,000 for Moreton Bay.

Greater Adelaide and Greater Perth come out on top with some of the lowest entry prices and quickest paths to purchase for houses, nationally. For the unit market, Greater Adelaide, Greater Perth and Greater Hobart offer areas with the lowest entry point and the shortest time for first home buyers to save a deposit.