Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

SubscribeProperty industry mainstay and developer Lang Walker’s company Walker Group Holdings has reported a net profit of $675 million for the 2021-2022 financial year.

The company earned a revenue of $1.13 billion and posted an increase by 226 per cent in its net profits on the previous financial year.

The upsurge in revenue came from the company’s development and investments portfolio.

Walker said the company had managed to navigate the various pitfalls over the past few years of operation.

“Our mindset has just been about putting our heads down and getting on with the job and our results are reflective of our strong teamwork during some of the toughest economic conditions in recent memory,” Walker said.

The company’s total assets increased by 21 per cent to $8.2 billion and it has cash reserves of $394 million.

Its investment property portfolio increased to $6.6 billion.

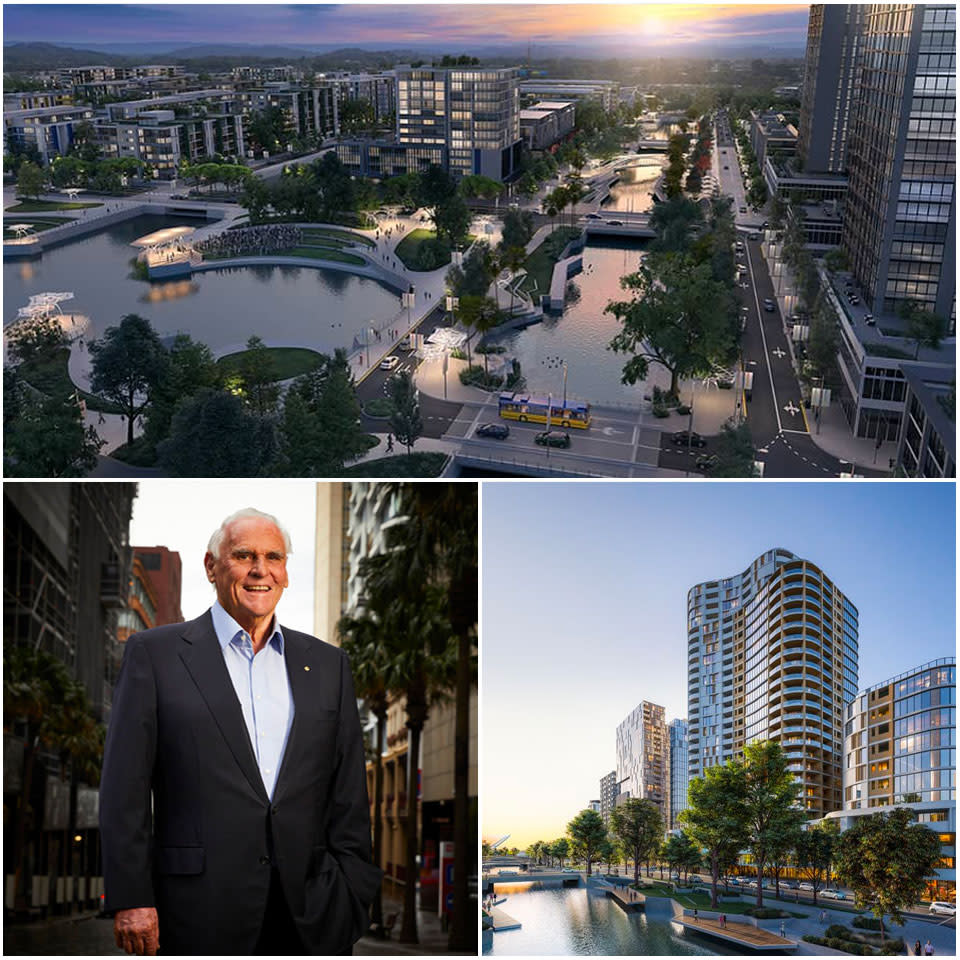

The company is now at practical completion at its Parramatta Square development.

“Parramatta Square is complete and we have secured long-term tenancies with major companies who have shifted their workforces out of the Sydney CBD and into our premium office towers,” Walker said.

“We also benefited from an impressive 12 months of over 1000 residential sales at Riverlea, South Australia’s biggest masterplanned community.”

The Riverlea project was estimated to cost $3 billion with a retail precinct worth $80 million.

Lang Walker is also listed as the third-richest person in Australia in 2022 with a net worth via Walker Corp of $5.03 billion.

The next year also looks promising as SunCentral has approached WalkerCorp to develop the rest of its Maroochydore CBD, foreshadowing the company investing nearly $2.5 billion into the new city centre over the next 15 to 20 years.

“In an emerging office market like Maroochydore, you’ve got to start building,” WalkerCorp development director Peter Saba told The Urban Developer.

“We are right at the beginning of this journey—but even that being said, we have at least a dozen proposals out there at the moment, which is exciting to see enquiries roll in and interest start to grow.”