Sydney's Property Market: From ‘Closed’ to ‘Open,’ A Changing State Of Play and the Unexpected Beneficiaries.

TUD+ MEMBER CONTENTThere’s no hotter topic in Australia right now than housing affordability, particularly across Sydney's property market and, it’s no surprise, given that Australia is also now home to five of the top 20 least affordable cities in the world; Brisbane, Adelaide, Perth, Melbourne and Sydney.

According to the Annual Demographia International Housing Affordability Survey, Sydney’s median house price has rocketed to $1,032,000, while the average median household income has remained steady at $84,000. The average home now costs over 12 times the average income, raising concerns about Sydney’s attractiveness as a global city.

So as Australia’s major cities grapple with affordability issues, why is Sydney's property market in its current predicament and what is the impact of this on nearby locations?

In a recent interview with REA Group’s Chief Economist Nerida Conisbee, The Urban Developer investigated why the challenge currently exists and how Sydney’s sky-rocketing housing prices were driving a spike in interest in regional locations.

Causation or Correlation: Understanding Why to Understand How?

On the surface it seems as though the issue of affordability is predominantly a social problem, however when you investigate Sydney’s challenges, you realise there are economic factors that far outweigh the industry challenges.

“Lack of affordable housing is an economic problem. An economy can’t run with only very high income earners. You also need people on more moderate incomes such as nurses, teachers and trades to support hospitals, schools and building. Sydney is too expensive and it makes it very difficult for people on average salaries to rent or buy,” said Conisbee.

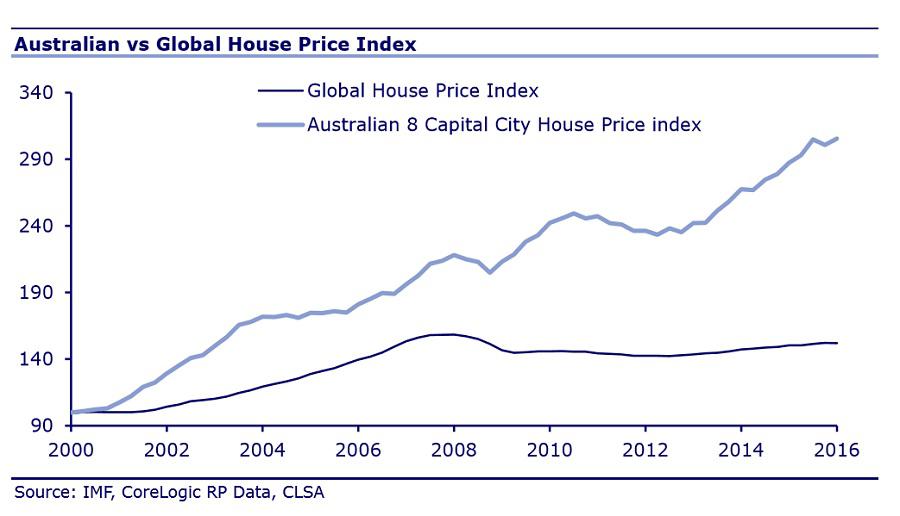

Sydney didn’t gain its status as the second least affordable city in the world over night. Sydney's property pricing is an issue that has been percolating for the past two decades.

According to Conisbee, the data suggests a lack of infrastructure investment and proper urban planning traces back to the administration of former Premier Bob Carr who, in the year 2000 declared Sydney as ‘closed’.

“Maybe it was a bit of a throw away comment but since that time there's been very low development levels in Sydney with regards to pretty much every single aspect of commercial and residential property.”

In this time we’ve also seen other factors such as the Global Financial Crisis which stalled new construction across Australia’s five top cities and many parts of the globe.

So What Has Been Holding Sydney's Property Market Back?

“Melbourne is a city that is also very expensive but is significantly more affordable than Sydney, which has built around 30% less housing than Melbourne since the turn of the century.”

Whilst Sydney’s property market supply issues have been restricted by an under-resourced and complex planning process, there is light at the end of the tunnel.

“Part of the problem with Sydney was the amount of very small councils, which made the planning system quite tricky. Many of those smaller councils have now been amalgamated which makes it far easier for people to get their planning approvals put through.”

Another positive reform has been the recent changes to NSW Strata Legislation, a body of legislation that hadn’t been changed for over 40 years.

One of the crucial changes that will assist developers - and therefore supply - relates to the compulsory acquisition of unit complexes that occupy high-density land parcels. Under the new legislation, developers will now only be required to receive the consent of 75% of the owners to sell, as opposed to 100%.

So Is There Hope on The Horizon? And Who Are The Winners and Losers?

A recent infrastructure spending boom, unprecedented new construction activity, council amalgamations and strata reform means that Sydney’s longer term prospects are looking fairly promising.

However, what about the short to medium term? How is the pressure of affordability going to be alleviated?“Nationally we are seeing a drive to affordability. It is pushing up the popularity of places like the Central Coast, Hobart and outer Melbourne. It is also making regional areas with strong economic bases such as Newcastle more popular,” says Conisbee.

Newcastle CBDThe Central Coast: The Next Hot Spot for Owners?

REA Group, through their realestate.com.au and realcommercial.com.au platforms, track the browsing habits of their enormous audience to understand where demand lies.

“The Central Coast is overwhelmingly coming up as the area outside of Sydney that is quickest selling, with certain suburbs within the region registering the fastest moving in popularity.”

According to Conisbee, the Central Coast has become a popular point of relocation for many reasons. It has a direct system of access to the Sydney CBD resulting in a longer, but simpler commute - a trade-off that many are happy to make.

“You can buy a four bedroom, two bathroom, two car garage home for well below a million dollars which is extraordinary value compared to inner Sydney.”

Whilst the Central Coast is of particular interest for Sydney buyers, other regional locations have also seen a rise in browsing activity, such as Bowral and Wollongong.

The Flow-On Effect - Commercial, Retail and Employment on The Rise.

Interestingly, Sydney’s unaffordability is contributing to the Central Coast emerging as a regional retail, commercial and employment hub.

“As we see people move up to the Central Coast, it's creating a workforce of white collar employees, that is creating business growth as well. So there's been this interesting dynamic on the Central Coast that is in result of the challenges from affordability in Sydney.”

Nerida Conisbee - Chief Economist at REA Group

Nerida Conisbee will be speaking at The Urban Developer’s upcoming sold out Insight Series ‘2017 Residential Market Outlook- A Developer's Perspective’.