Sydney and Melbourne Drive Housing Price Fall

What goes up must come down according to the old adage, and if recent forecasts are anything to go by Sydney and Melbourne's housing markets have finally started to slow.

After recent years of property market strength, regulatory changes and tighter credit have hit the nation's largest property markets, with ANZ forecasting a 10 per cent decline.

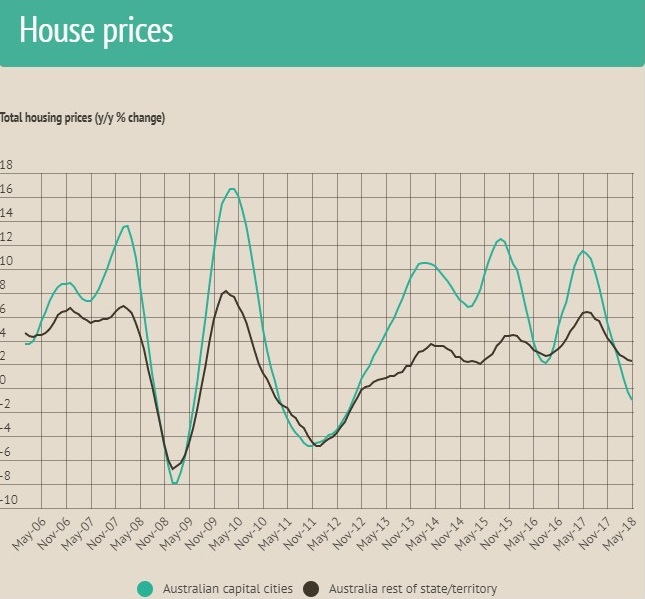

Residential property prices across the country dropped 0.7 per cent in the March quarter 2018, according to ABS data.

ABS chief economist Bruce Hockman charges Sydney and Melbourne, which account for a majority of all housing stock value, with leading the fall.

“Sydney recorded the third consecutive quarter of falling of property prices (-1.2 per cent) and the first annual price fall (-0.5 per cent) since the March quarter 2012, while Melbourne property prices fell 0.6 per cent, the first quarterly price fall since September quarter 2012," Hockman said.

Related reading: House Price Decline ‘Larger than Expected’

The latest research by ANZ senior economists Daniel Gradwell and Joanne Masters shares the same forecast for the two capital cities.

Their research expects Sydney and Melbourne to see housing prices fall around 10 per cent peak-to-trough.

“Investors in particular are finding it harder to access credit, given ongoing policy changes across the lenders,” they said in ANZ’s June housing update.

Across the country Gradwell and Masters expect housing prices to decline 4 per cent in 2018 and a further 2 per cent in 2019.

“Sydney and Melbourne are expected to be the primary drivers of this fall as their high housing prices and highly leveraged households will be more sensitive to tighter credit conditions and rising interest rates."

Related reading: Investor Lending Fell 15% in the Last Year

The good news, Australia’s economic growth is back around its long-term trend and as such the outlook is “broadly positive”.

“In particular, ongoing employment growth, (gradually) improving wages growth, and population growth running at well above average levels should support house prices in the medium term.”

The residential construction pipeline is expected to remain at elevated levels over the next year, however ANZ Research expects residential construction to be around one per cent lower over 2018 and down five to six per cent year on year in 2019 due to weaker approvals.