New Listings Lead as Home Selling Season Heats Up

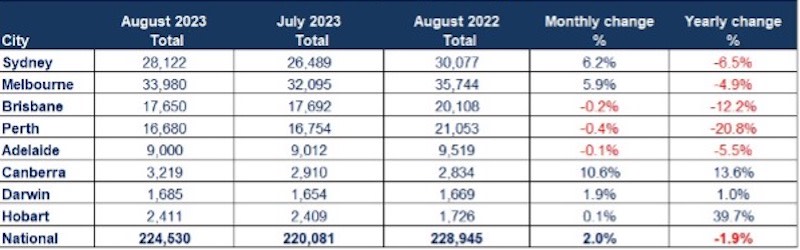

Residential property listings have jumped 2 per cent in August, reaching 224,530 properties nationally as home owners sign up for the traditional spring selling season.

According to the latest data from SQM Research, national residential property listings were up on the 220,081 in July.

The increase was driven by surges in new listings for most capital cities as the weather and the market heated up, SQM said.

The rises were offset by weaker listing conditions in regional Australia.

Sydney recorded a 6.2 per cent increase in total listings for August, driven by a 10.5 per cent increase in new listings.

The NSW capital recorded the largest number of new listings for any August since records began in 2009.

Melbourne recorded a 5.9 increase in total listings driven by a 12.6 per cent increase in new listings, the largest rise in new listings for August in seven years.

Canberra recorded the largest increase for any capital city with a 10.6 per cent increase in total listings, driven by a 22.2 per cent increase in new listings for the month.

Over 12 months, residential property listings nationwide decreased by 1.9 per cent. This was a common trend, with most cities having fewer total listings for the year.

However, Hobart stood out with a notable increase of 39.7 per cent.

Total property listings, August 2023

Nationally, new listings (less than 30 days) rose by 6.9 per cent in August, adding 67,908 new property listings to the market.

Sydney, Melbourne, and Canberra outperformed the national average with increases of 10.5 per cent, 12.6 per cent, and 22.2 per cent, respectively.

Hobart had a significant surge in new listings, with an increase of 15.8 per cent.

However, Brisbane and Darwin experienced a decline in new listing numbers, down 0.6 per cent and 14.2 per cent respectively.

The overall national result was dragged down by a lacklustre regional housing market.

For example, North Coast NSW (encompassing Byron Bay) recorded a 12.5 per cent decline in new listings compared to August, 2022.

Older listings (properties that have been on the market more than 180 days) rose by 2.5 per cent in August and have risen by 23.9 per cent during the past 12 months. Once again, this was driven by a soft regional housing market.

Most cities recorded large decreases in older stock for the month except for Hobart.

SQM Research said that as of August 2023, the number of residential properties selling under distressed conditions in Australia fell to 5180, a further drop of 1.8 per cent from 5277 distressed listings recorded in July 2023.

The decrease in distressed selling activity was mainly driven by falls in Victoria (down 2.4 per cent), Queensland (down 3.4 per cent) and Western Australia (down 5 per cent), compared to last month.

ACT, Tasmania, and the Northern Territory are recording significant rises in distressed selling activity, suggesting acute mortgage stress and possibly weakening state-territory economies.

And property sellers were more confident over the month of August in the capital cities with asking prices rising by 0.9 per cent to stand 7.2 per cent higher compared to August 2022. Asking prices in Sydney rose by 1.1 per cent and Melbourne by 0.2 per cent, indicating a little more caution by Melbourne vendors.

Perth recorded the fastest rises in asking prices, rising by 1.6 per cent for the month to be up 10.7 per cent for the past 12 months.