February Listings Surge Strongest for a Decade

Capital city activity surged across the busiest February for new listings for more than a decade.

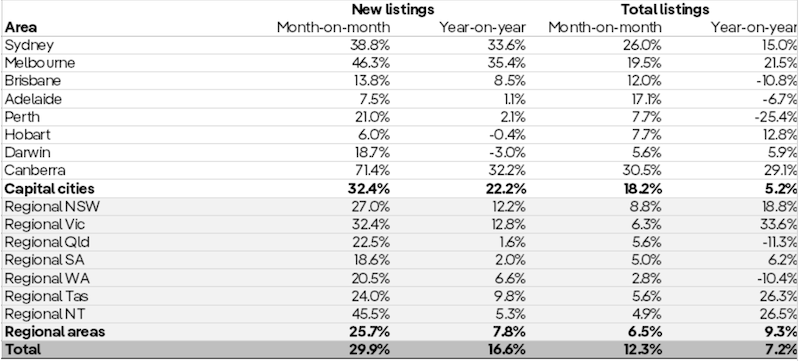

According to the PropTrack Listings Report for February 2024, new listings on realestate.com.au were up 16.6 per cent nationally last month compared with last year, driven largely by the combined capital cities recording their highest number of new listings for a February since 2012.

The capitals listings were up 22.2 per cent year-on-year.

New listings increased by 29.9 per cent month-on-month nationally in February.

Sydney topped the list, up 33.6 per cent, with Melbourne up 35.4 per cent year-on-year, marking the busiest February for Sydney since 2012 and at least 2010 for Melbourne.

PropTrack Listings, February 2024

Brisbane and Adelaide showed modest growth in new listings, up 8.5 per cent and 1.1 per cent from this time last year respectively, but still recorded fewer than typical new listings for a February compared with the past decade.

Choice remained limited for Perth buyers, with total listings down 25.4 per cent compared to February 2023.

Regional areas had a slower pace of new listing growth than capital cities—up 7.8 per cent year-on-year for last month.

Rentals rocky ride continues

Meanwhile, rental availability became even more challenging in February as the national vacancy rate fell to a record low, according to PropTrack’s Market Insight Report.

The national rental vacancy rate fell 0.12 of a percentage point (ppt) to sit at 1.07 per cent in February, with capital cities (-0.14 ppt) and regional areas (-0.07 ppt) experiencing a decline in availability for the month.

The national rental vacancy rate hit a new low of 1.07 per cent in February, after falling 0.12 ppt. Rental markets tightened in Sydney (-0.18 ppt) and Melbourne (-0.16 ppt) over February to be at their lowest vacancy rate on record.

Both capitals are now 0.3 ppt lower year-on-year, the equal largest annual decline of the capitals.

Perth (-0.13 ppt) and Adelaide (-0.05 ppt) remain the two tightest rental markets in the country, with their vacancy rates sitting at 0.75 per cent and 0.83 per cent respectively.

Regional markets are also facing limited availability, with the regional vacancy rate 0.22 ppt lower year-on-year.