Housing Market Downturn Short-Lived

The remarkable lift in the residential sector is set to continue as buyers and sellers make up for lost time.

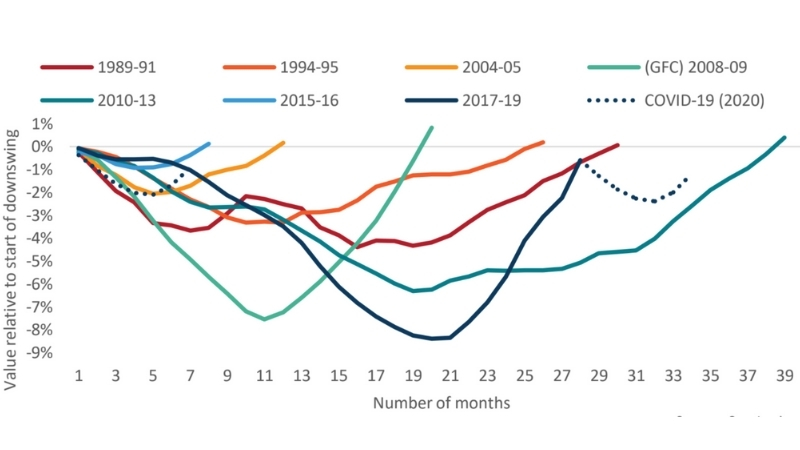

Property prices are on the upswing after what was one of the smaller downturns in history according to Corelogic's Quarterly Economic Review.

Following this slump there was a record increase at 14.5 per cent in the amount of finance secured for properties, driven by owner-occupiers.

The Corelogic report shows nationally, housing market values did not see the large decline anticipated at the start of the Covid.

Housing values fell just 1.9 per cent between March and September before moving into a recovery trend, increasing 0.4 per cent nationally through October and 0.8 per cent in November.

Property price downturns in history

^Source: Corelogic Quarterly Economic Review

Corelogic head of research Eliza Owen said there are a number of reasons the market stayed afloat.

“Relative to previous housing market downturns, the current decline through to November seems relatively mild, with dwelling values just 0.7 per cent below the pre-Covid levels,” Owen said.

“There are numerous factors which have contributed to the prevention of a larger downturn in dwelling values including the institutional, coordinated response to the pandemic, which have seen low borrowing costs, added incentives for first home buyers and the extension of mortgage repayment deferrals limiting forced sales.”

According to the report both Sydney and regional NSW property markets are still on the rise and in Brisbane dwelling prices are at a record high despite unit values remaining 8.9 per cent lower.

In Victoria, the worst-hit state, the market is also on the rise but Melbourne prices still sit 5 per cent below the record reached in March 2020.

Sales activity has also increased in Victoria however the amount of stock could have a dampening effect on the recovery of the metropolitan market according to the report.

Over the 12-13 December weekend auction activity ramped up to 2,537 homes from 2,085 the week before.

The market typically would wind down at this time of year however, according to Corelogic, this high level of activity is expected to remain high leading into the festive period with 2,300 auctions to be held next weekend.