Melbourne Office Workers in Driver’s Seat for CBD Revival

If occupancy rates in the Victorian capital are going to continue their stubborn post-Covid creep, corporations and the people that run them will have to listen, according to office sector experts.

Melbourne-based Cushman and Wakefield research manager Glenn Lampard said Melbourne had 600,000sq m of net office stock over the past five years, but the current demand of about 100,000sq m will not cover that space without an increase in vacancy.

Lampard, who was speaking at a Property Council of Australia lunch, said there had been a big cultural shift within the workplace.

“We crunched the numbers ourselves about four months ago, which suggested tenants are likely to want 10 per cent less space under the hybrid model,” he said.

But, Lampard said, in real life Melbourne has a market that’s handing tenants 40 per cent incentives to encourage them into high-end space. At a time when Melbourne office occupancy is sitting at about 57 per cent.

“Now, if you're a tenant, you’re probably not going to take 10 per cent less if someone is offering you a 40 per cent incentive.”

Developers and landlords alike can take some heart from office market research, which showed the desire to be in CBD office space remains positive with demand edging up marginally by an average of 0.1 per cent across the country during the past six months.

However, vacancy rates in hardest-hit Melbourne rose from 12.9 to nearly 14 per cent, due partly to the amount of new stock becoming available.

Lampard said incentives were starting to fall back a little depending upon the market.

“But most of markets have a reasonably high vacancy rate,” he said. “And the way to deal with that is through landlords being competitive with the incentive.

Lampard said many office buildings were getting rid of basement carparking and replacing it with tenant amenity, like gymnasiums. He questioned whether workers would want to drive their cars into the CBD in five years.

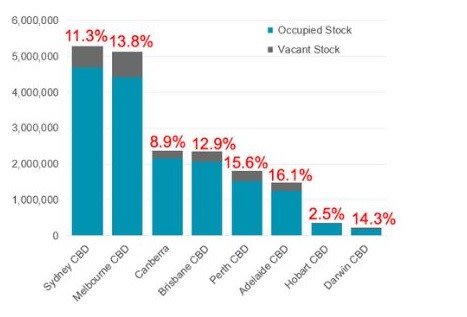

CBDs by occupied and vacant stock (sq m)

^ Source: Cushman and Wakefield

Victorian PCA chief executive Cath Evans told members the new year represented an opportunity for the industry to show leadership in the return to the office, particularly around flexible working.

“There are significant opportunities for the industry to explore in 2023, tempered with challenges around inflation, rising interest rates and the continuing imperative to encourage more Victorians back into their offices,” Evans said after the lunch.

“Our data clearly shows that premium office space is really living up to its name, with elevated demand a significant feature of the market in the six months to January. We have no reason to think this will change anytime soon.”

But the new-age adage “a flight to quality” is just one of the challenges facing downtown Melbourne.

There has also been a “significant increase” in the new fringe—those types of properties built around ESG (environmental, social and governance) principles—that were easier to provide in fringe Melbourne than the centre of the city.

Lampard said there had been a big uptick in the Cremorne-Richmond area.

“This is the extraordinary thing that I've found, clients that are looking at developing speculative builds in fringe neighbourhood, based on our changes in work behaviour,” he said.

“Richmond and Cremorne started, ironically, because of the strength of retail market.

“Old retail strips are starting to thrive again on the back of hospitality which is taking up most of the vacancies. So in fact it is the amenity that is governing this.”

Lampard pointed to the relatively young age of the buildings, which he said were attractive to tenants.

“The new fringe locations have done better than any of us expected with respect to their take up. But look at the ages. They are significant buildings, and they’ve all been built in just the last couple of years. This is a trend that’s already happening and will continue to happen.

“It is very difficult to understand why so many developers would be looking to still consider speculative office developments in the current market, particularly in the CBD,” Lampard told The Urban Developer.

“Given that we have a substantial amount of office space, currently sitting vacant.”