One-Third of Households Financially Worse Off After Covid-19

Nearly half of Australians aged 18 years and above have experienced a hit to household finances from Covid-19 during the period from mid-March to mid-April.

The results come from the latest Australian Bureau of Statistics survey, which measures Covid-19 impacts on financial stress, stimulus payments received, psychological distress, and contact with family and friends.

The ABS results shows 45 per cent of Australian have had their household finances impacted for the period measured from 14 March to 17 April as a result of the pandemic.

It’s the second ABS household impacts of Covid-19 survey, which collected information from 1028 people. The scope of the survey took in people over 18 years of age, in private dwellings across Australia.

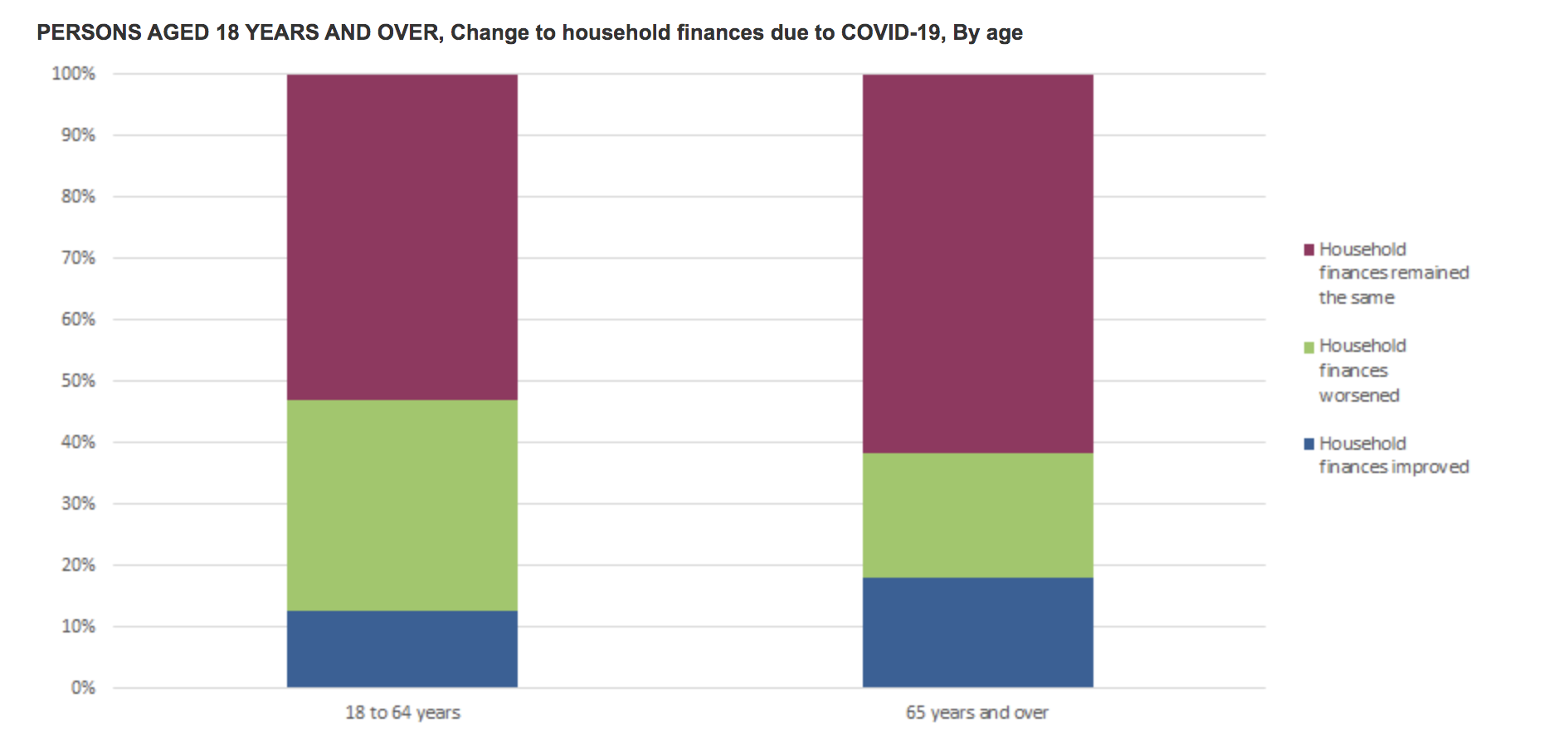

One third of Australians (31 per cent) reported that their household finances had deteriorated over the period measured from March to April. The results also show that one in seven (14 per cent) reported an improvement in household finances.

Related: Build 30,000 Social Housing Dwellings to Boost Jobs: Acoss

ABS program manager for household surveys Michelle Marquardt says the majority of Australians, 81 per cent, said their household could raise $2,000 for something important within a week, Marquardt added that a “small number of Australians reported experiencing financial hardship”.

“One in 13 Australians (7.5 per cent) said their household lacked the money to pay one or more bills on time, and one in ten (10 per cent) had to draw on accumulated savings to support basic living expenses,” Marquardt said.

The survey also highlighted changing patterns in how Australians are keeping in touch with each other and differences among age groups as to changes in emotional and mental well-being.

Of those who have received the first one-off $750 economic support payment, 53 per cent said the payment was added to savings or not yet used, and 17 per cent said the payment was used towards household bills.

Australians aged 65 years and above were more likely to have added the stimulus payment to savings or not yet used (71 per cent) it than those aged 18 to 64 (37 per cent).