Office Demand Deficit Fuels Subleasing Spike

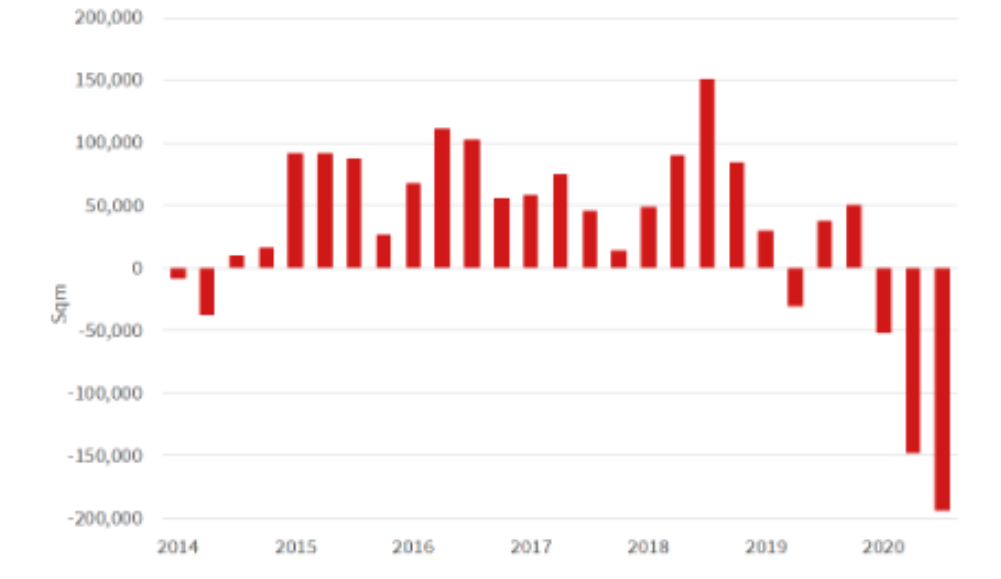

A sharp increase in sublease availability, particularly in Sydney and Melbourne's CBDs, has seen a negative net take-up of space of 194,000sq m nationally across the third quarter.

According to recent figures from real estate agency JLL, five of the six monitored CBD office markets recorded negative net absorption over the quarter, as businesses contract or defer decisions about their space requirements.

JLL Australia head of research Andrew Ballantyne said the economic and health crisis had continued to negatively impact business confidence while the trend towards working from home has seen demand continue to deteriorate and increase the amount of space being offered.

“Corporate Australia is the new landlord in town, with a sharp increase in sublease availability across the Sydney CBD and Melbourne CBD,” Ballantyne said.

“A number of organisations are assessing headcount expectations for the next 12 to 18 months and releasing excess office space,” Ballantyne said.

“The observation in Australia is replicated across developed economies, with US sublease availability surpassing the levels recorded in the financial crisis and ‘tech wreck’.”

Subleasing data, which reveals a more complete picture of the overall health of an office market—and is otherwise masked by the headline vacancy rate, is included in JLL’s vacancy tally.

Australian CBD office markets net absorption

^ Source: JLL Research

The Sydney CBD recorded a loss of 94,500sq m of net absorption over the quarter, while the city’s sublease availability increased to 130,000sq m, 2.6 per cent of total stock.

Vacancy has increased from 5.8 per cent at the onset of the pandemic to 10.2 per cent.

The Melbourne CBD, which has been particularly hard-hit by the pandemic disruption, recorded a negative net take-up of 70,000sq m over the quarter pushing office vacancy to 11.3 per cent, from a low of 3.4 per cent in the first quarter.

Recent Property Council of Australia research revealed daily occupancy in Melbourne’s CBD buildings is at 7 per cent, dramatically lower under the lockdown provisions than in other cities.

Melbourne, which is now the largest office market in the country, has also recently absorbed a swathe of developments across 2020, including 80 Collins Street, 311 Spencer Street, 130 Londsdale Street, 477 Collins Street and 447 Collins Street.

The Brisbane CBD recorded a net absorption loss of 21,000sq m, increasing the city’s headline vacancy rate by 0.8 percentage points to 13.6 per cent, while the Perth CBD recorded a loss of 4,800sq m over the quarter.

Government employee-dominated Canberra was the only CBD office market to record positive net absorption, adding 7,000sq m to be the only CBD office market recording a single-digit vacancy rate, sitting at 8.4 per cent.

Related: Confidence in the CBD Will Drive Growth

JLL Australia head of office leasing Tim O’Connor said the sharp deficit in demand had opened up opportunities for businesses in the sub 500sq m cohort of the market, with improved enquiry and deal activity for smaller offerings recorded across the country.

“This is an important first step towards improved activity in the leasing market,” O’Connor said.

“While larger occupiers are putting on hold their office space decisions based on the short term given the uncertain economic conditions, what we are seeing is decisions being made in relation to pre-commitment given the longer lead times involved.”

Tide to turn on face rents

Face rents in major CBD office markets, which have been forecast to drop sharply due to a greater acceptance of working from home in workplace culture, have been holding firm despite weaker market conditions, according to CBRE.

CBRE’s head of office occupier research Joyce Tiong said the tide could soon turn as a swathe of sublease space enters the market.

“Overall tenant demand remains weak and with sublease vacancy exceeding previous peaks we may see face rents start to fall as incentives continue to rise,” Tiong said.

“Trend is also a trend towards tenants seeking large upfront incentives, as opposed to the incentive being spread out over the course of the lease term.”

Tiong said Adelaide has outperformed the other CBD office markets, with net face rents increasing by 0.6 per cent, mainly driven by the addition of Charter Hall’s GPO Exchange project.

CBRE said that while leasing activity remains constrained, Melbourne recorded the strongest growth in tenant moves resulting from new additions while Brisbane was the only CBD market not to record an increase in sublease stock.