Why Now Might be the Best Time to Invest in Brisbane Hotels

The Brisbane hotel market may finally be at a point of increased transactional activity as market indicators for an improvement in the Queensland economy are falling into place.

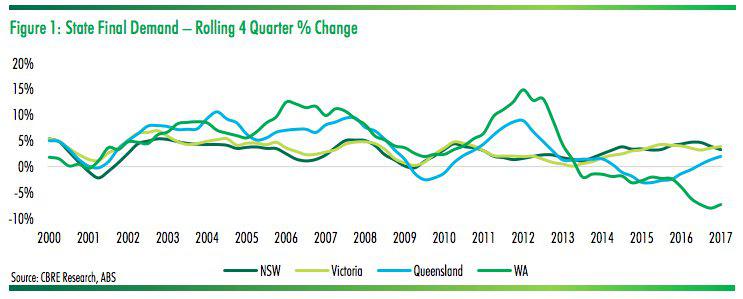

Queensland has recorded its best performance since June 2013 for state final demand, increasing by two per cent to June 2017, according to the latest CBRE research, Viewpoint: Sun rising in the Sunshine State.

New South Wales and Victoria continued their growth at 3.3 and 3.9 per cent respectively. Western Australia continues to suffer from the mining sector downturn, recording a fall of 7.4 per cent for the year.

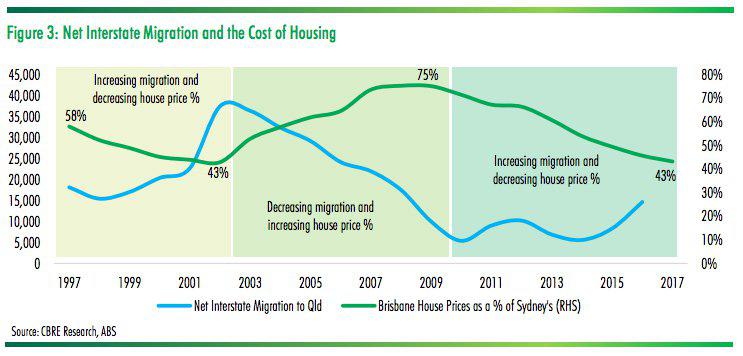

The report points to net migration picking up as a good indicator of the future strength of the Queensland economy driven in part by the house price differential between Sydney and Brisbane. Housing affordability is a key driver of migration. The differential is back towards favourable levels for Brisbane seen in the early 2000s.

[Related reading: 7 Major Projects Add $12bn to Brisbane's Economy]

NAB’s Monthly Business Survey consistently shows Queensland outperforming the national average with regards to both business conditions and business confidence indicating that there is a "renewed belief in the economic future of the region.”

Additionally, there are a number of major projects under way which will boost the appeal of Brisbane as a destination for both domestic and international visitors.

It is estimated there are $30 billion worth of investment across a number of projects including the Queens Wharf development, new international cruise terminal at Port of Brisbane and second runway at Brisbane Airport.

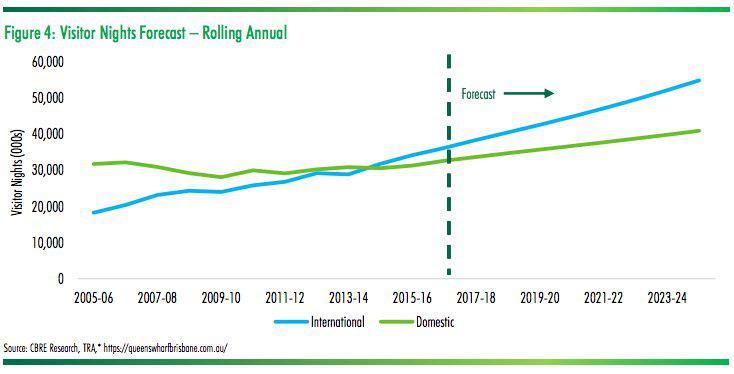

[Related reading: How Queen’s Wharf Will Help Shape Brisbane’s Public Realm: Urbis]The rolling annual forecast of visitor nights to Brisbane in terms of domestic and international visitor nights is showing a positive upward trend and will benefit from the ever-increasing Chinese visitor growth to this country with the number of Chinese tourists to Australia expected to triple by 2025.

The raft of proposed developments for Brisbane are seen as strong demand drivers for increased tourism to Brisbane, and whilst their impact on forecast visitor numbers is yet to be determined, they may generate for Brisbane a bigger share of the growth than anticipated.

Whist Sydney and Melbourne are the traditional destinations for many investors CBRE believe that now might be the time to enter the Brisbane hotel market for a successful investment.