Melbourne, Sydney Hardest Hit as National House Prices Fall

National property prices have fallen for the first time since the global pandemic with analysts now saying the top-to-bottom market decline will be between 10 and 15 per cent.

Figures released by CoreLogic show home prices across the country fell by about 0.1 per cent in May, but Sydney, down 1.0 per cent, and Melbourne, -0.7 per cent, continued to record the biggest month-on-month falls.

The main cause of falling prices was poor affordability, rising mortgage rates, a change in spending away from housing and a decline in home buyer confidence.

Canberra, Australia’s second most expensive property market behind Sydney, saw housing prices fall 0.1 per cent after nearly three years of consistent, positive growth.

While housing values continued to rise across the remaining capitals, the growth was not enough to offset the depreciation in Sydney, Melbourne, and Canberra, which pushed the combined capitals index -0.3 per cent lower over the month.

Sydney has been recording progressively larger monthly value declines since February, while Melbourne has fallen across four of the past six months.

Shane Oliver, AMP’s head of investment strategy and their chief economist, said the decline came after what he called a massive 28.6 per cent gain in prices from their pandemic low—the biggest gain over 21 months since 2003.

“The main driver of the downturn is the upswing in interest rates,” Oliver said.

“With fixed mortgage rates roughly doubling during the past 12 months combined with an increase in the interest rate serviceability buffer from 2.5 to 3 per cent, this has substantially reduced the amount new home buyers can borrow and hence their capacity to pay.”

He expects a 10 to 15 per cent fall in home prices.

“National average property prices have likely now peaked and we continue to expect a peak-to-trough fall of around 10 to 15 per cent, reflecting the combination of poor affordability, rising fixed mortgage rates, and monetary tightening from the RBA pushing up variable rates by around 2 per cent out to mid-next year.”

“While the RBA is set to continue raising interest rates, the negative wealth effect from falling home prices will limit how much it ends up raising rates by as it does not want to crash house prices and the economy.”

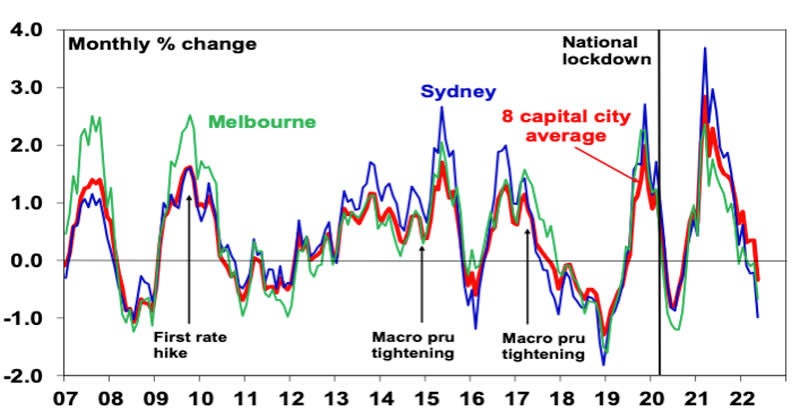

Average capital city home prices

^Source: Corelogic, AMP Capital

CoreLogic research director Tim Lawless said regional Australia had also come off peak growth rates with the annual growth trend easing to 22.1 per cent, down from its January peak of 26.1 per cent. He said it was likely to trend lower through the rest of the year.

“Considering we are already seeing the pace of growth easing across most regional markets, it is likely we will see growth conditions softening in line with higher interest rates and worsening affordability pressures,” Lawless said.

The trend in advertised stock levels helps to explain the weaker conditions across Sydney and Melbourne.

Australia-wide, advertised inventory levels remain 10.3 per cent below levels seen this time last year and 28.4 per cent below the previous five-year average. However, stock levels in Sydney and Melbourne are now higher than 12 months ago and against the five-year average.

Sydney’s advertised listings are 5.1 per cent higher than a year ago and 1.5 per cent above the five-year average. Similarly, Melbourne’s advertised stock levels are up 1.3 per cent on last year and 8.1 per cent above average based on the previous five years.

“With stock levels now higher than normal across Australia’s two largest cities, buyers are back in the driver’s seat,” Lawless said.

“Higher listings add to tougher selling conditions more broadly. Vendors in Sydney and Melbourne have faced lower auction clearance rates since mid-April and those selling via private treaty are taking longer to sell with higher rates of discounting.”