Million-Dollar Suburbs Decline as Covid Upswing Evaporates

The number of so-called millionaire suburbs in Australia has declined.

A record number of suburbs had a median house price of $1 million this time last year, but many of the new entrants on the list have dipped back below the magic mark, according to CoreLogic.

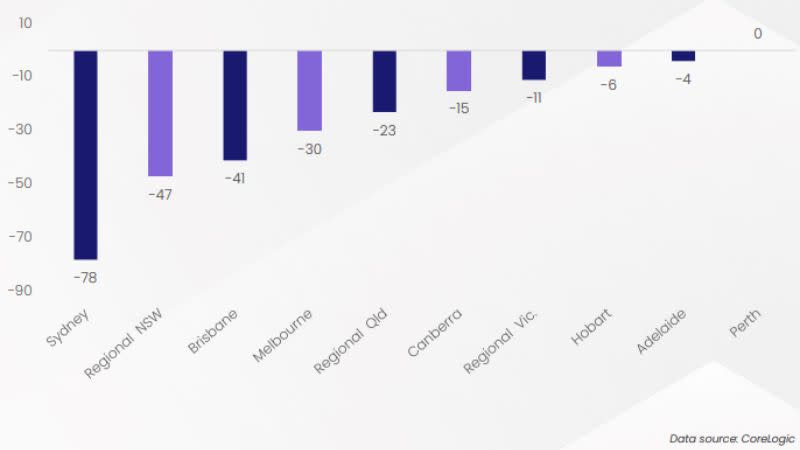

In 2022, 28 per cent of suburbs—1243 across Australia—had joined the million-dollar club—but in May of this year that had dropped to 988 suburbs—22.3 per cent of those analysed.

Only one new suburb recorded a $1 million median—Burns Beach, a coastal suburb 34km north of Perth CBD.

Sydney had the most with 62 suburbs coming in below the seven-figure mark. CoreLogic economist Kaytlin Ezzy said it was “unsurprising”.

“While declines across Sydney’s more expensive markets were some of the greatest across the country, many of these markets had a relatively high starting point allowing them to retain the seven-figure price tags,” she said.

“The trend among the suburbs where values have fallen below $1 million is in the more affordable locations on Sydney’s outer mortgage belt and fringe areas. Despite recording smaller declines it’s these suburbs where median values have dropped [below the] million-dollar threshold.”

Castle Hill, Fairfield, Granville and Liverpool were among suburbs to leave the milion-dollar-median club.

Regional New South Wales and Brisbane, where seachange and treechange trends had buoyed markets during and after the pandemic, were just behind Sydney.

During the year, the number of million-dollar markets in the Central Coast halved from 33 to 17, for instance. while 41 neighbourhoods in Brisbane dipped below the $1-million mark, as did the Sunshine Coast, down 13; and the Gold Coast, where 10 suburbs dropped below the line.

These included Wellington Point, Murrarriw, Aspley and Everton Park, as well as Maroochydore and Noosaville on the Sunshine Coast, and Helensvale and Burleigh Heads on the Gold Coast.

Net change in $1-million house and unit markets, 2022 to 2023

In Melbourne, 30 suburbs, including Footscray and Chelsea Heights, dropped back while 15 suburbs in Canberra were under the mark.

“These regions benefited greatly through the Covid upswing, with flexible working arrangements, lifestyle benefits, and relative affordability, all of which made them attractive option for buyers,” Ezzy said.

“However, the Covid surge in values also made these markets more sensitive to the rising cost of debt, with many recently minted million-dollar suburbs falling below the seven-figure mark.”

CoreLogic said its national Home Value Index experienced the sharpest decline on record, falling 9.1 per cent in 10 months.

National home values have recovered 2.3 per cent over the past three months, it said, but they remain below the recent peak by 6.9 per cent, and many markets are still recording home values significantly higher than the start of the pandemic.

Unit prices, however, remained more steady across the board, except in Sydney where apartment prices in16 suburbs fell below the $1-million mark.

With interest rises expected to continue, at least in the short term, it will also impact home value buoyancy.

“Historically, increases in the cash rate have put downward pressure on market values and many economists and banks have lifted their forecast for where rates might peak following June’s increase,” said Ezzy.