Institutional Investors Record $4.7bn in Office Deals

A tightly-held market, rather than a reduction in demand, has seen a fall in transaction volumes over 2018 with investors struggling to capture prime city fringe and suburban office space across Australia.

According to analysis by JLL, investors spent more than $4.67 billion on city fringe and suburban office space across the country in 2018, short of 2017’s record high of $6.29 billion yet above the long-term historical average.

Sydney remains the most active metropolitan market with $2.45 million in sales recorded over 2018, with population growth, low unemployment rates and strong leasing activity with above trend rental growth continuing to drive investor interest across the sector.

Parramatta in particular has become "the jewel" in New South Wales' commercial market in recent years, benefitting from the state government’s "Decade of Decentralisation" policy with $375 million in office sales recorded over 2018.

Melbourne’s total $1.21 billion result was across two sub-markets – the Melbourne fringe recording sales of $973.4 million and the south east suburbs posting $237.7 million. Chinese and Hong Kong buyers were active, spending $422 million across eight assets.

Related: Office Vacancy Rates Hit Decade Lows

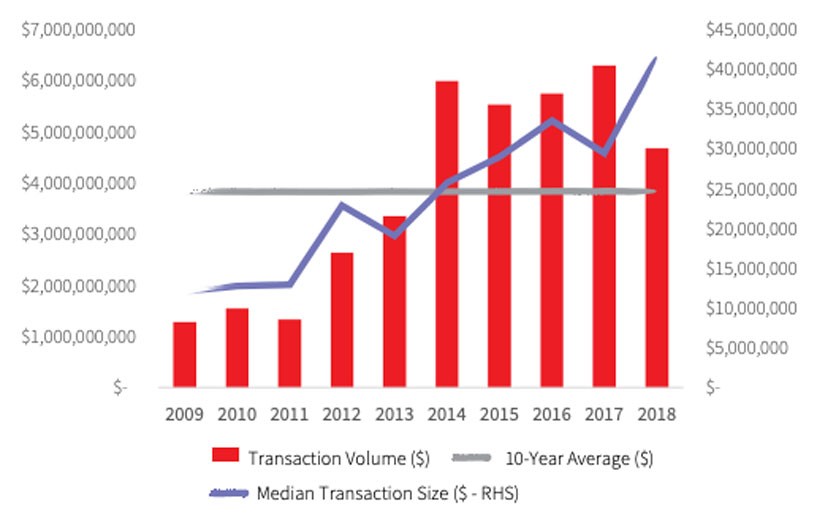

Metropolitan office market transactions over time

According to JLL, Brisbane, Perth, Adelaide and Canberra metropolitan office markets, having experienced challenging physical market conditions in recent times, were showing tangible signs of recovery.

Brisbane’s metropolitan market recorded $842.1 million in sales, ahead of Perth with $136.4 million, Adelaide with $30.6 million and Canberra with $35.4 million.

Though well above the 10-year average of $3.84 billion, the total investment in Australia’s metropolitan office markets in 2018 fell short of 2017’s record high of $6.29 billion.

“The reduction in transaction volumes was not a symptom of reduced investor demand, but related to a shortage of available product,” JLL head of metropolitan sales and investments in Australia Marty Janes said.

James noted that the composition of investors within metropolitan office markets was also evolving with the emergence of institutional investors, accounting for 46 per cent of purchases over 2018, complimenting the historically strong interest from private capital sources.

“As a result of demographic, structural and economic considerations with the viability of large-scale commercial office developments has led to institutional investment and a more diverse range of capital sources,” Janes said.

Despite rising levels of institutional investment across metropolitan markets, private and high net worth investors remain active in terms of acquisitive activity with private developers becoming increasingly priced out of metropolitan markets as they struggle to meet return thresholds.

“Institutional investors are starting to identify larger-scale opportunities outside of the CBD and will deploy significant capital into assets where they can generate strong risk-adjusted returns,” Janes said.

“However, boutique fund managers have identified unsatisfied demand in this market and have an opportunity to invest in volume rather than one large-scale project.”

According to JLL, yields in the Sydney fringe market for prime stock are ranging between 5 per cent and 5.25 per cent.

In North Sydney they are between 5 per cent and 5.5 per cent, while in the Melbourne fringe market they are between 5 per cent and 5.5 per cent.

Looking forward

Moving forward, JLL anticipates a broad range of capital sources competing for metropolitan office assets, with strong pricing benchmarks being set across most sub-markets.

“In Sydney and Melbourne, it will be the ability to secure product which will provide exposure to the rental growth story, JLL noted.

“A focus on product differentiation will lead to higher occupancy rates and stronger performance as incentives shift downwards from cyclical highs.”

“Existing private investors and high-net-worth individuals will have the opportunity to crystallise significant capital gains and will continue to seek out value-add and smaller-scale opportunities for repositioning.”