Material Cost Pain on the Way

The price of energy-intensive materials is continuing to escalate, which will further test project feasibilities in the near term, according to Altus Group forecasts.

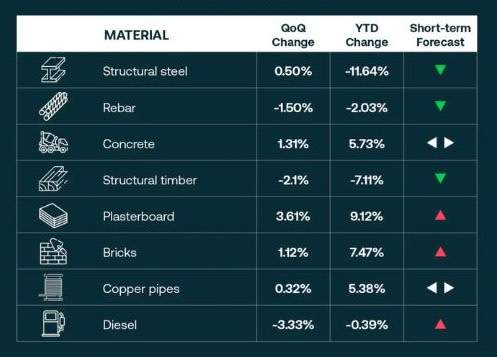

Of the eight construction materials monitored, half have risen over the past quarter, in a trend that is expected to continue.

While the cost of steel has come down more than 11 per cent in the past 12 months, bricks and plasterboard prices are forecast for greater price growth.

In its report, Australian Construction Material Price Outlook—Q1 2024, Altus Group’s materials and commodities data captures the price growth for products that are common across most projects and sectors, and that therefore have the greatest influence on costs.

“Steel prices have stabilised this quarter, with sluggish demand from China and slowdowns in major steel-consuming sectors like industrial and logistics,” the report said.

“Globally, the downturn in residential construction driven by high interest rates and high construction costs have also dampened steel demand, although the World Steel Association predicts a 1.7 per cent rebound over the course of 2024.”

Construction material price trends, Q1 2024

Energy price rises have had a knock-on effect for bricks and concrete in the past quarter but a forecast dip in demand for concrete was expected to ensure prices remained stable in the short term.

But in the longer term as building approvals pick up again to meet housing demand, early-stage materials including concrete, steel and timber were expected to be impacted by strong demand, which could push up prices again.

Increased manufacturing costs and high demand for plasterboard has led to price increases, which are anticipated to continue with a strong pipeline of ongoing projects, according to the report.

Prices for structural timber declined due to poor market demand, however, there is now less structural timber being produced in Australia than 15 years ago, which puts greater pressure on importing products and price sensitivities in the longer term.

Copper is trading at a two-year high but low demand has forced prices down in the current market. Altus Group does, however, indicate BHP’s $39-billion takeover bid of the copper miner Anglo American demonstrated the ongoing confidence in the product and its role in the future of the clean energy transition.

Ongoing conflict in the Middle East is impacting diesel prices, but Altus notes that a number of larger construction firms are moving to biodiesel.