Smaller Deals, Industrial Progress Through Slowdown

Transaction activity across Australia’s capital markets has continued to flow despite the Covid-induced uprooting of the office sector, with Knight Frank reporting that two-thirds of its deals has progressed since March.

According to commercial real estate agency's latest capital markets report, 31 per cent of deals under way in March have now settled or are unconditional while 34 per cent are progressing and just under 9 per cent have been put on hold.

While deal completions remained healthy, total turnover across the office, industrial and retail markets during the first half of 2020 was $10.37 billion, 43 per cent below the $18.26 billion recorded during the same period in 2019.

The office market, crippled by ongoing uncertainty around occupancy and rental abatements, has the highest proportion of deals in flux, with 41 per cent still progressing.

The industrial sector, dominated by non-discretionary assets, saw turnover of $3.71 billion in the first half of the year, only 10 per cent below the same period last year, and the highest completion rate for deals of 47 per cent.

Retail, which had already been subject to fluctuating investor demand across 2019, has seen turnover fall a further 45 per cent, with $1.74 billion in transactions completed.

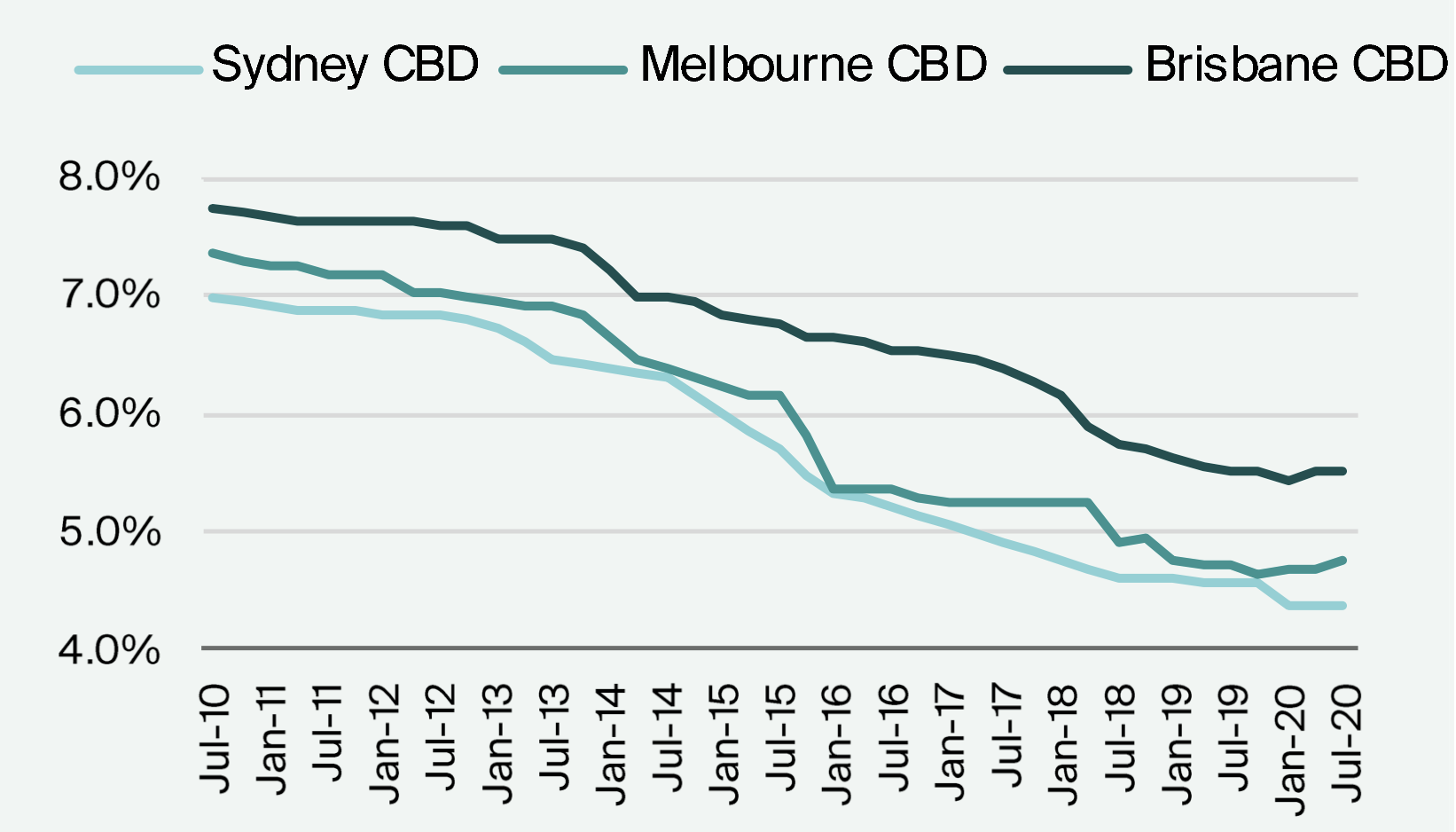

Prime CBD office market yields

^ Source: Knight Frank Research

Knight Frank chief economist Ben Burston said a gradual recovery in liquidity within the commercial market was on the horizon following a a pullback from investors “adjusting” to the new environment.

“Core real estate will remain highly sought after but greater priority will be given to stability and length of income and this will favour prime assets than can easily adapt to social distancing and cater to changing occupier requirements,” Burston said.

Over 2020, smaller commercial deals have been easier to progress during Covid, with less than 25 per cent of assets in the $50 million-plus range completing.

Deals ranging between $5 million and $50 million have remained more difficult to see through, with 9 per cent unconditional and 24 per cent settled since March.

Sales of under $5 million had a 56 per cent completion rate for deals over the same period.

Knight Frank national head of capital markets Paul Roberts said activity across institutional-grade assets, of $50 million-plus, remained strong, with increased demand for assets with limited short-term tenant risk.

“It has been more difficult to achieve completion on larger deals, where we typically see interest from interstate or offshore investors and more intensive due diligence processes,” Roberts said.

“These deals are taking some time to complete, with more than 75 per cent still in progress.”

Deals in Victoria’s commercial markets have slowed down further since the second wave emerged in July, and remain 43 per cent down on 2019.

The uncertainty across Melbourne has left 42 per cent of deals pending, 33 per cent of which are on-hold for “more favourable timing”.

In Sydney, just under half of active deals remain in progress. The city also recorded the highest percentage of properties—27 per cent—withdrawn from sale.

Business as usual for Brisbane’s office market

According to Knight Frank, deals in Brisbane’s commercial markets performed best over the the last six months, with only 21 per cent of deals withdrawn and 46 per cent completed.

Roberts said Brisbane had seen the highest levels of completions, followed by Sydney and then Melbourne, due to its low exposure to lockdowns.

“To date, Brisbane has been fortunate to have less time under restrictive lockdowns than its southern counterparts, which has buoyed activity,” Roberts said.

More than 90 per cent of Brisbane’s completed deals were below $25 million, with private buyers more active within the depressed market.

The city’s fringe markets have also been buoyed by renewed developer interest and investment, with a spate of commercial schemes lodged since March.