Housing Lending Cheap, Not Yet Risky

New data suggests changes to mortgage lending rules in the near future are unlikely, despite rapidly rising home values.

Recent data from the Australian Prudential Regulation Authority (APRA) suggests that while the proportion of loan originations that could be “higher risk” showed a slight increase through the December quarter, the regulator saw no evidence of a “material relaxation in lending standards”.

Indicators of lending standards are being watched carefully. Borrowing for the purchase of residential property hit a record $28.8 billion in January 2021, up 34.8 per cent from the decade average. This has also contributed to housing values reaching a new record high.

So far, however, the December 2020 quarter has not shown any major deterioration in lending standards, suggesting there is no need for interventions in the form of tighter credit policies.

The December 2020 quarter is of particular importance, because it marks a positive turn in Sydney and Melbourne dwelling values coming out of COVID-related restrictions.

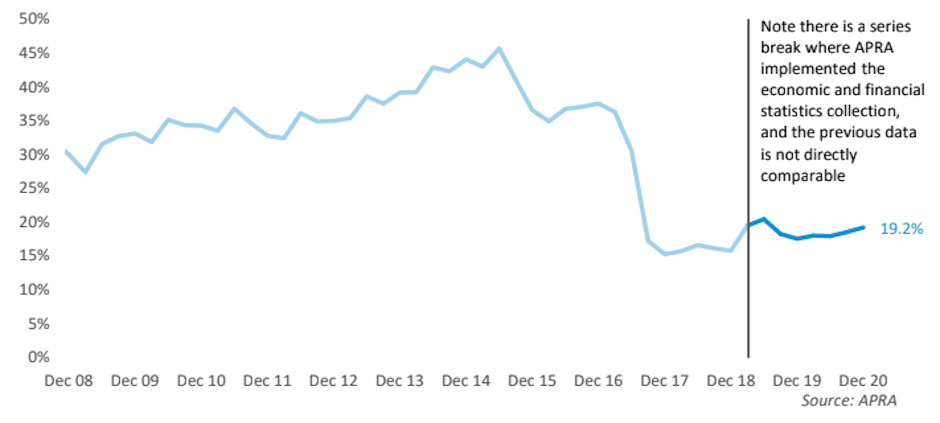

The portion of new mortgages lent on interest only terms hit 19.2 per cent in the December 2020 quarter, up from 18.5 per cent in the previous quarter.

This is not far from the 18.7 per cent average seen during the past two years. It is also well below the record high of 45.6 per cent, which was recorded during the June 2015 quarter.

However, it is worth noting there have been improvements to collection of banking statistics, and the historic series is not directly comparable with recent data.

Portion of new home loans funded on interest only terms, quarterly

Interest-only loan structures have generally been more popular among investors, who are eligible for tax deductions on their interest payments.

Considering investors remain around record lows as a share of total lending, the risk to financial stability from interest-only lending to this segment of the market remains low.

A key area that regulators are likely to be watching is the proportion of interest only lending to owner occupiers.

The number of interest-only loans to owner occupiers increased by 32.5 per cent during the September quarter and comprised a series high 45.7 per cent of interest only loan originations.

A sustained lift in owner occupiers not paying down their loan principal could place upwards pressure on household debt levels, creating stability risks when interest rates eventually rise.

The portion of new home loans originated on a loan-to-income ratio of greater than, or equal to six times reached 7.0 per cent of loans over the December 2020 quarter.

This is the highest across the series, which commences from March 2019.

Loans originated with a debt-to-income ratio of six or more made up 17.2 per cent of mortgages originated in the quarter, which was also a series high.

APRA did not express concern around this metric in their report, arguing the share of debt-to-income lending was “within its historical average”.

Increased demand across Sydney and Melbourne property markets, as is being seen at the moment, will test debt-to-income ratios.

This is because the house price-to-income ratio across Sydney has averaged around 8.5 since 2013, and has averaged 7.5 across Melbourne since 2015.

As housing prices rise at a time when incomes are expected to remain relatively flat, there is the potential for both loan-to-income and debt-to-income ratios to lift further, which is likely to be seen as a riskier outcome by regulators.

The proportion of loans originating on high loan-to-value ratios (LVRs) also rose for owner occupiers and investors.

The portion of new home loans originated on a loan-to-value ratio of 80 per cent or more increased to 42.0 per cent across all borrowers in the December 2020 quarter, up from 39.9 per cent in the previous quarter to be the highest proportion on record.

The jump was greater in the owner occupier space, where 45.7 per cent of loans were originated on an LVR of greater than or equal to 80 per cent and 14.1 per cent of loans were greater than or equal to 90 per cent.

The regulator argued this increase reflects greater participation of owner occupiers in the market, particularly first home buyers.

First home buyers may be accessing housing through loan guarantors, or even the first home loan deposit scheme, which reduced the risk of low-deposit home loans.

The latest data from APRA indicates there is no blow-out of risk in mortgage lending, despite the recent surge in property prices across Australia.

The publication follows a recent address from RBA governor Phillip Lowe, who reiterated the strategy of maintaining a low cash rate for years to come, which is likely to continue supporting housing demand.

But a deterioration in lending standards can be mitigated, as we’ve witnessed before.

This could be achieved by tightening serviceability assessment rates, loan sizes relative to incomes or debt (LTI or DTI ratios) or loan sizes relative to home valuations (LVR).

In a recent statement, the Council of Financial Regulators reiterated that while lending standards were generally being maintained at this stage, they have responses up their sleeves if lending conditions do become risky.

While APRA’s December quarter statistics show a trend towards “riskier” styles of lending, the magnitude is not likely to be large enough to trigger a regulatory response; but if this trend continues, or indeed accelerates, it becomes more likely we will see a regulatory intervention aimed at curbing financial stability risks related to the housing sector.