House Price Slump Not Improving Affordability: Report

Capital growth of house prices has been slowing for more than a year in Australia’s largest cities, but despite the cool-down placing downward pressure on property prices housing and rental affordability declined slightly for the December quarter.

While housing affordability declined in the majority of states and territories over the quarter, research from the Real Estate Institute of Australia and Adelaide Bank reveals it improved in Victoria and the Northern Territory.

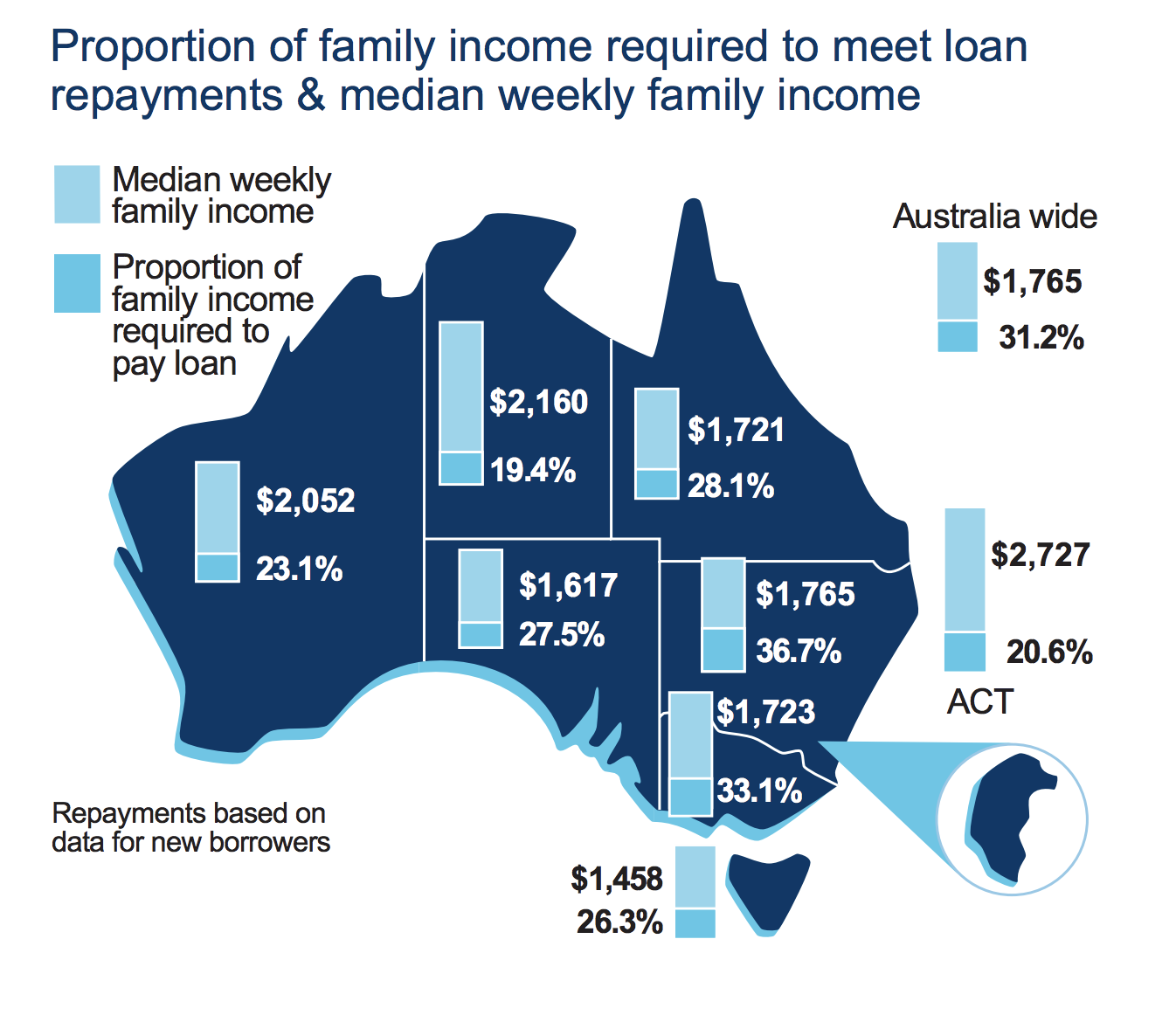

The report shows the decline in affordability for the period is attributable to an increase in average mortgage payments through increases in interest rates, “negating the drop in house prices and increase in household payments”.

REIA president Adrian Kelly said Tasmania, which experienced the largest decline, was “hardest hit”.

“With the proportion of income required to meet loan repayments increasing to 26.3 per cent, an increase of 1.6 percentage points,” the report found.

Related: Property Market Woes No Boon for Affordability

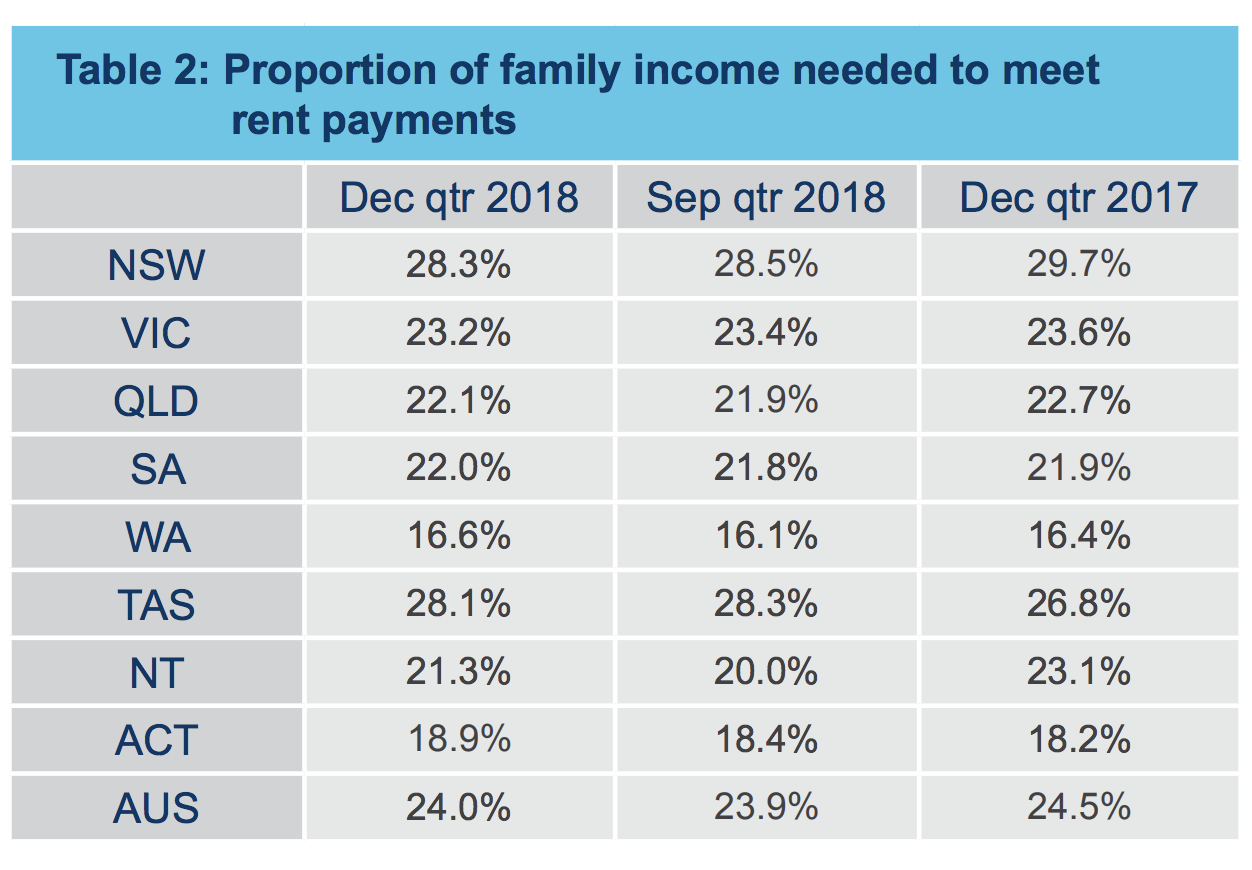

Rental affordability for the December quarter declined marginally with the proportion of income required to meet rent payments increasing to 24 per cent, an increase of 0.1 percentage points over the period.

Although these figures have improved compared to the same quarter in 2017 with a decrease of 0.5 percentage points.

“With the exception of New South Wales, Victoria and Tasmania, rental affordability declined in all states and territories with the largest decline in the Northern Territory,” Kelly said.

“Victoria was the only state or territory in which both housing affordability and rental affordability improved.”

Related: Why Falling House Prices Do Less to Improve Affordability Than You Might Think

New South Wales continues to be the least affordable state or territory for renters, with the State’s proportion of income required to meet rent repayments 28.3 per cent. This is 4.3 percentage points higher than the national level.

On the other end of the spectrum, Western Australia, where the proportion of income required to meet median rents is 16.6 per cent, is the most affordable state or territory to rent a property.

Finance

The number of loans increased across the country by 3.3 per cent for the quarter, with increases seen in all states and territories except Queensland.

The number of first home buyers increased to 29,147, an increase of 3.8 per cent during the quarter.

The report shows Tasmania, the Northern Territory and the Australian Capital Territory experiencing relatively large increases in loans to the first home buyer market.