Home Mortgage Arrears Rising, RBA says

The number of homeowners behind on mortgages have climbed back to 2010 levels, although the Reserve Bank says this does not pose a risk to the financial system.

In an address at a property industry summit, the RBA’s head of financial stability Jonathan Kearns said weak income growth, housing price falls and rising unemployment in certain areas have contributed to the rise in mortgage arrears.

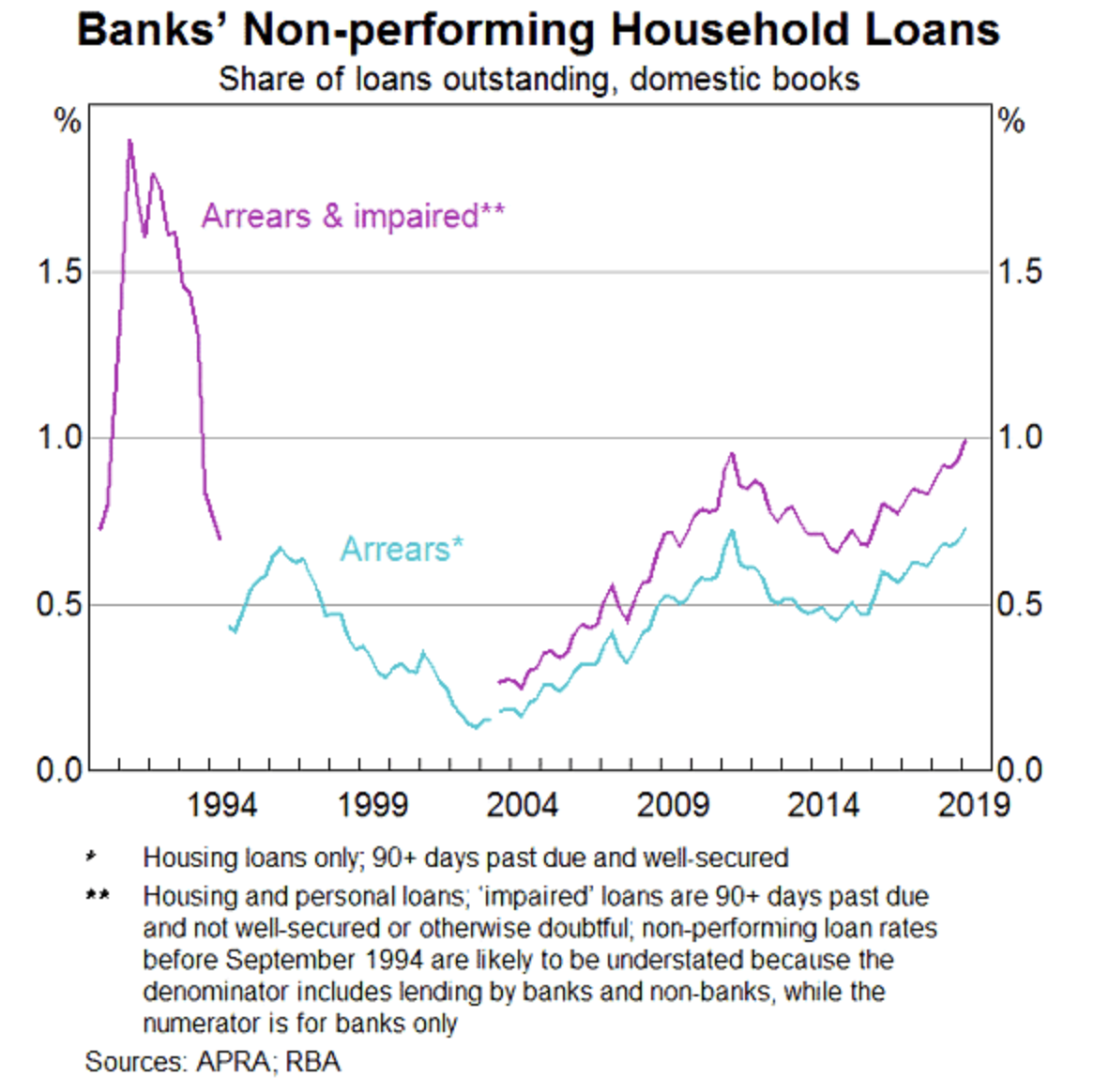

“The share of banks' housing loans in arrears is now back around the level reached in 2010, the highest it has been for many years,” Kearns said.

“But arrears are still well below the level reached in the early 1990s recession.”

“Housing arrears have risen but by no means to a level that poses a risk to financial stability,” Kearns said.

Moody’s Investors Service this week said it expects mortgage delinquencies to rise moderately in the coming quarters.

A number of interest-only mortgages are due to convert to principal and interest loans by the end of 2020, which Moody's expects will cause delinquencies as borrowers are burdened with higher monthly repayments.

While personal misfortune, such as ill health, a relationship breakdown or death, unrelated factors to economic conditions, are often related to loan arrears, weak economic conditions drive cyclical upswings.

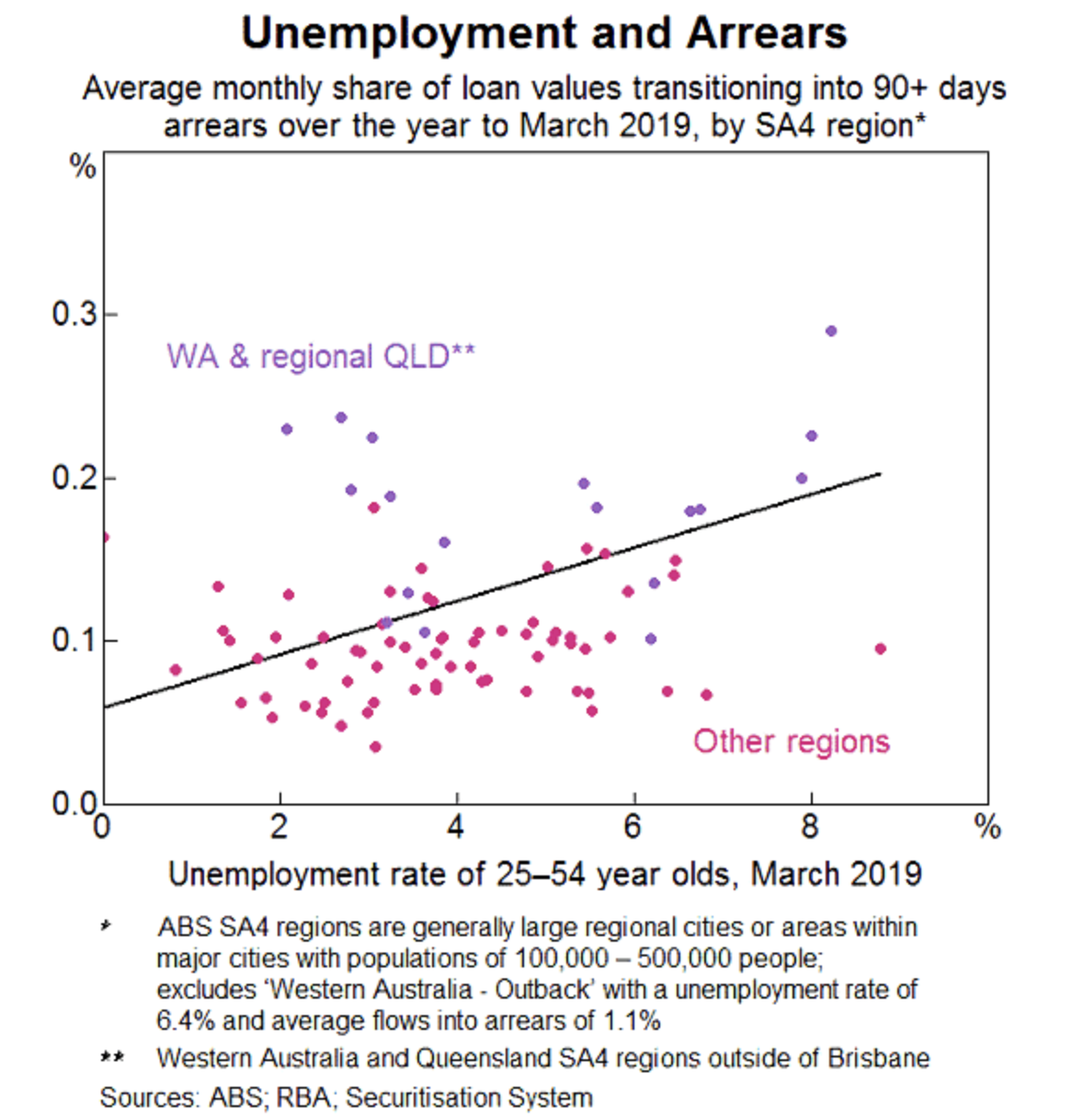

“What we can see across Australia is a clear pattern of more loans going into arrears in locations where the unemployment rate is higher,” Kearns said.

Western Australia and parts of regional Queensland has seen the unemployment rate increase and income growth slow, due to the end of the mining boom, with certain areas subsequently recording larger increases in arrears.

“In Western Australia the arrears rate is now around double the rate in the rest of the country,” Kearns said.

While the increase in arrears level is notable, Kearns said the rate of arrears in Australia is still relatively low internationally, and lower than in many other advanced economies.

The proportion of those behind on loans sits around 1 per cent.

“Another way to look at the arrears rate in Australia is to note that over 99 per cent of housing loans are on, or ahead of, schedule,” he said.

While the nation's economic outlook “remains reasonable” and household income growth is expected to pick up, Kearns said the arrears rate could continue to “edge higher for a bit longer”.

“But with overall strong lending standards, so long as unemployment remains low, arrears rates should not rise to levels that pose a risk to the financial system or cause great harm to the household sector.”

The latest research carried out by Curtin University's Rachel Ong and RMIT University's Gavin Wood reveals a rising number of mature age Australians are carrying mortgage debt into retirement.

The research showed the proportion owing money on mortgages for home owners aged 55 to 64 years of age increased from 14 per cent to 47 per cent between 1990 and 2015.