Housing Market Shows Signs of Slowing

Exceptional growth in the housing market is keeping new loan commitments close to all-time highs despite a slight dip in February, indicating the residential boom is already losing momentum.

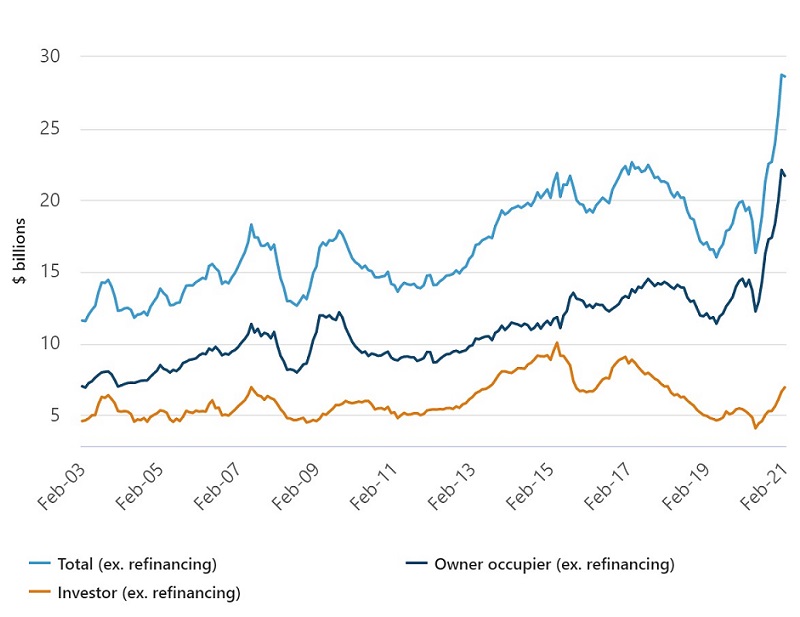

New loan commitments for housing fell 0.4 per cent to $28.6 billion in February 2021, according to the Australian Bureau of Statistics.

The earlier record results were driven by owner occupiers taking advantage of the HomeBuilder grant which pushed approvals up 57.5 per cent for houses while units rose 20.1 per cent on last year.

The increase in buyer activity drove home prices up across all capital cities for houses and units.

While the number of loans and approvals increased, interest rates continued to fall, dropping to an average of 3.14 per cent for existing loans and 2.79 per cent for new loans, according to the Reserve Bank of Australia.

However, housing commitments, prices and approvals could ease in the second half of the year due to the end of the HomeBuilder scheme.

New home loan commitments

^Source: Australian Bureau of Statistics, February 2021 seasonally adjusted.

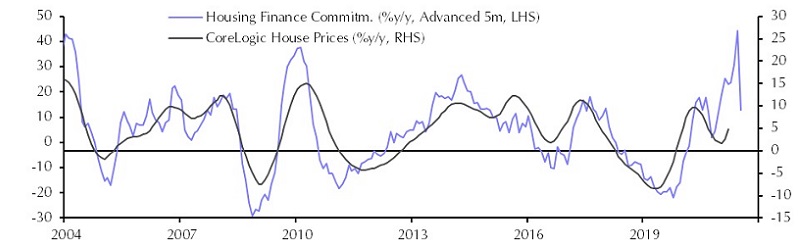

Capital Economics economist Ben Udy said finance commitments and house prices were usually linked.

“Housing finance commitments are consistent with annual price growth rising sharply in the coming months before plunging in the second half of the year,” Udy said.

The market could be at a tipping point, however developers were confident they would have enough work until the international borders reopen.

Housing finance and prices

^Source: Housing Finance Commitments and Corelogic House Prices graph from Capital Economics

ABS head of finance and wealth Katherine Keenan said the value of loan commitments for the construction of new dwellings rose 4.4 per cent, continuing a period of record rises since July.

“Although the HomeBuilder grant, introduced in June 2020, was reduced from January 1, 2021, it was made more widely available to borrowers in NSW and Victoria through increased price caps on new build contracts,” Keenan said.

“The time taken to process home loans meant that construction loan applications made in late 2020, prior to these changes, also contributed to loan commitments reported in February.”

Related: Experts Eye End of HomeBuilder

Keenan said home financing on a state-by-state basis was mixed—falling in NSW and Queensland while rising in Canberra and Victoria—but well up on 2020 levels.

“The value of new loan commitments for owner occupier housing fell 1.8 per cent in February 2021, although it remained 55.2 per cent higher than in February 2020,” Keenan said.

“The fall in February was driven by reduced loan commitments for existing dwellings, although the value of these loan commitments remained 39.7 per cent higher than in February 2020.”

Meanwhile, investors were returning to the market after reaching a 20-year low in May.

The value of new loan commitments for investor housing rose 4.5 per cent to $6.9 billion in February 2021, sitting 31.6 per cent higher than in February 2020.