Home Build Times Lag, Number of Approvals Down

The residential construction industry has been dealt a double dose of bad news with fresh data showing the time to build a new home has blown out by almost six weeks, while building approvals across the country fell by more than 20 per cent in the past year.

Both economists and industry watchdogs are blaming higher interest rates, rising construction costs, labour shortages and planning lags for the results.

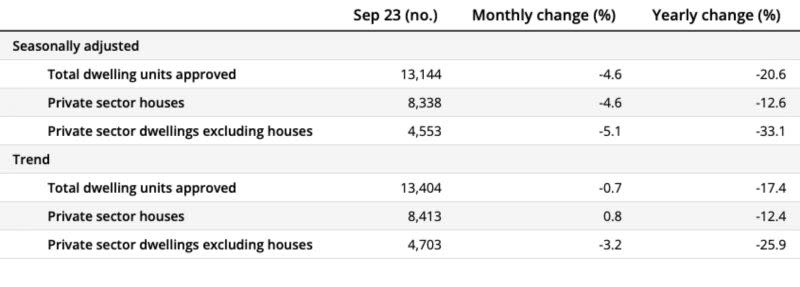

The latest figures from the Australian Bureau of Statistics show total national building approvals for private homes fell 4.6 per cent to 13,144 in September.

While that figure was in line with expectations, it does mean total home building approvals have fallen 20.6 per cent in the past 12 months.

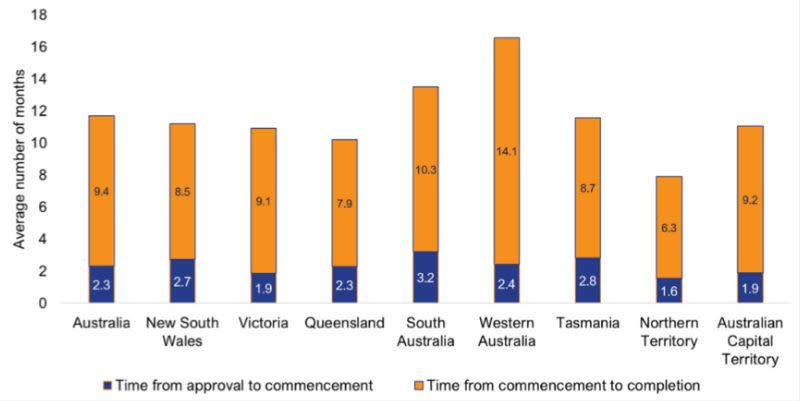

Meanwhile, Master Builders Australia—the building and construction industry’s national lobby group—released figures to show the average time to build a detached house has increased by almost six weeks.

“During 2022-23, the average build time for detached houses increased from 10.3 months to 11.7 months,” MBA chief executive Denita Wawn said as the analysis was announced.

Wawn said a new townhouse was taking 14.9 months from approval to completion, compared to 13.5 months the previous year. Apartment build times had shortened to 28.8 months from a record 30.6 months.

“However, apartment building times are still far slower than was normal before the pandemic,” she said, when in 2015-16 it took just 21 months to complete a build.

Master Builders expects in the next 12 months home starts will decline by 2.1 per cent to about 170,100, below the 200,000 it said is needed each year to meet population growth.

Wawn blamed a combination of labour shortages, broken supply chains and other Covid restrictions.

“This is on top of the already formidable set of impediments in the form of planning delays, insufficient land release and red tape,” she said.

Oxford Economics Australia’s senior economist Maree Kilroy also points to the combination of higher interest rates, construction delays and rising building costs for the seasonally-adjusted fall in home building approvals.

“While underlying housing demand is receiving a boost from record migration, the housing supply environment remains very challenging,” Kilroy said.

“The prospect of another rate hike in November does not make things easier.”

The Reserve Bank figures show private house approvals also softened by 4.6 per cent to 8338 in September, with mixed results by region.

After coming off strong gains in August, Victorian approvals fell 9 per cent and Western Australia was down 12.7 per cent.

New South Wales was up 1.1 per cent and Queensland also showed a marginal improvement, up 0.7 per cent.

Kilroy said they expected national housing commencements to slide below 150,000 this financial year.

“There is movement on the housing policy front but planning lags mean it will take until the back half of the decade to see an activity boost,” she said.