NOMINATIONS CLOSE SEPTEMBER 12 RECOGNISING THE INDIVIDUALS BEHIND THE PROJECTS

NOMINATIONS CLOSING SEPTEMBER 12 URBAN LEADER AWARDS

Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

SubscribeDespite a 33 per cent fall in activity across Australia’s capital markets this year, deals are still moving ahead with $5.6 billion in transactions recorded.

According to new research by Knight Frank, investors across capital markets remained engaged despite high levels of caution with fundamental shifts in demand and supply at both a macro and micro level.

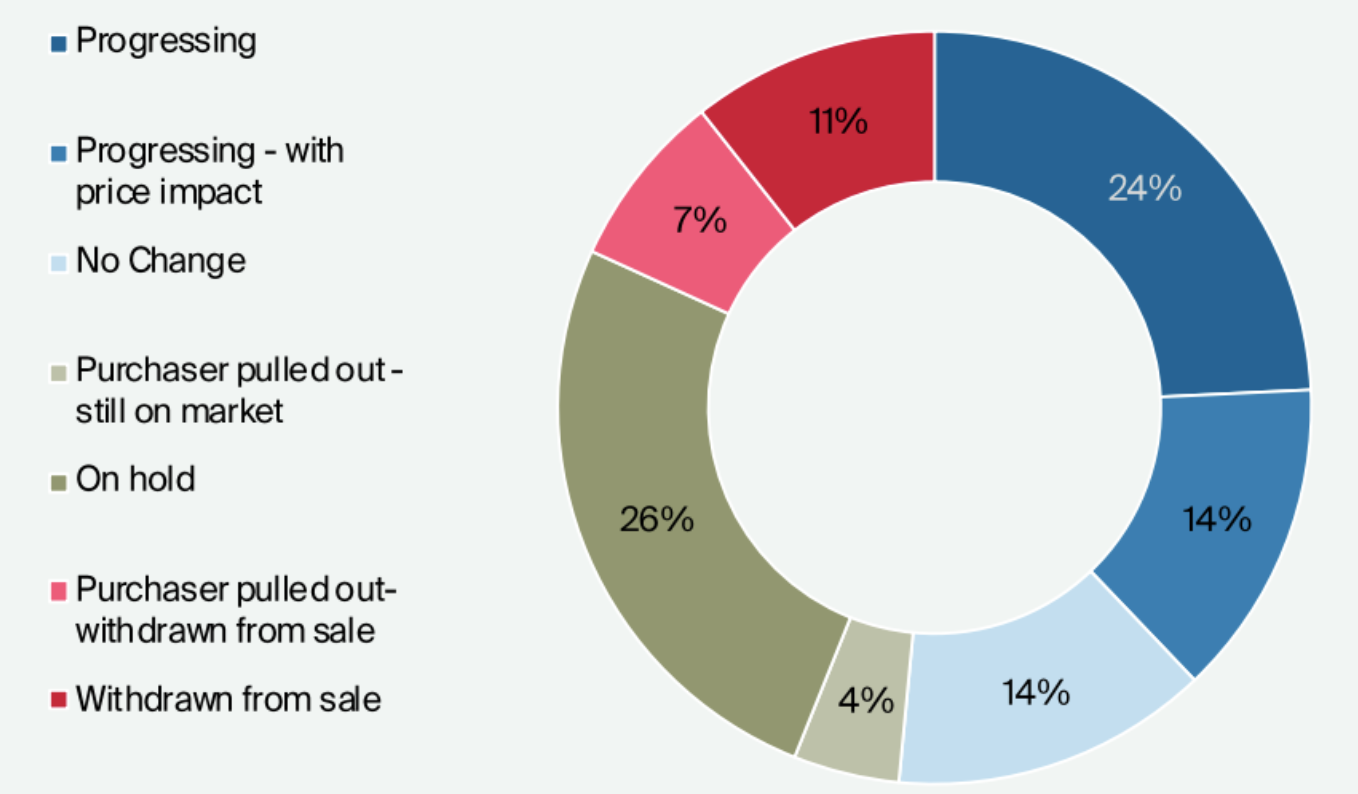

Across 60-plus active sales campaigns Knight Frank found that 52 per cent were progressing or had seen no change, while 26 per cent had been put on hold.

Knight Frank said that across office, industrial, retail and hotel sectors transactions had held up despite a sharp hit in the hotel sector and a drop in commercial property sentiment.

Status of asset sales March to April

^ Source: Knight Frank Research

Knight Frank chief economist Ben Burston said pre-Covid investors were focused on identifying rental growth potential in particular sub-markets and sectors, in a market that had seen a broad and sustained uplift.

“We expect to see a shift in focus toward income security. With this in mind we will see a flight to quality with prime, long-let assets to benefit from continued strong investor demand but secondary assets to see discounting.”

Prime industrial has emerged as the most defensive asset class in the initial market response to Covid-19, while secondary assets or those with high exposure to discretionary brick and mortar retail tenants are less favoured.

“Industrial assets, particularly prime distribution centres leased to non-discretionary retail or 3PL providers, will fare well due to more limited tenant risk because they are not as reliant on employment to drive demand and are not as impacted by restrictions on movement,” Burston said.

Market sentiment across capital markets has also held steady during the first quarter of 2020.

According to the latest NAB commercial property index, confidence around office markets was the strongest, with sentiment falling by just 3 points to +26 while sentiment around industrial fell by 7 points to +7 while retail dropped 2 points to -28.

According to Knight Frank, office tenants are opting to put their lease requirements on hold during Covid-19, with a smaller proportion withdrawing requirements since the shutdown began.

Office leasing mandates tracked through March and April saw 42 per cent put on hold, while only 11 per cent had opted to stay put or cancelled their requirement.

Brisbane had the lowest amount of leasing mandates on hold, with 30 per cent on hold, compared to 36 per cent in Sydney and 65 per cent in Melbourne.

“While businesses with an immediate requirement for space will proceed with their plans, others are preferring to wait until the virus is contained before agreeing to new lease commitments,” Burston said.

“At a sectoral level, the early evidence suggests that office demand from businesses in the tech sector has been more resilient, and also from those in healthcare and pharmaceuticals.”