Frasers Secures Land Parcel for $250 Million Estate

Frasers Property Australia has secured a huge prime industrial land parcel in Melbourne’s northern suburb of Epping for $40 million.

The 63.4-hectare site, located at 410 Cooper Street, will eventually become home to a $250 million masterplanned estate, the first stage of which is expected to be released next year.

The estate will feature pre-lease development, land and build packages as well as selective land sales.

The new site will eventually accommodate up to 250,000sq m of built form, enabling Frasers to service existing and new customers.

“The Epping acquisition is a significant strategic purchase for the business and will further strengthen our position as one of the leading providers of prime industrial product in Melbourne,” Frasers Property Australia southern region general manager Anthony Maugeri said.

“It also compliments Frasers Property’s other well-located industrial land holdings in Melbourne’s south east and west.”

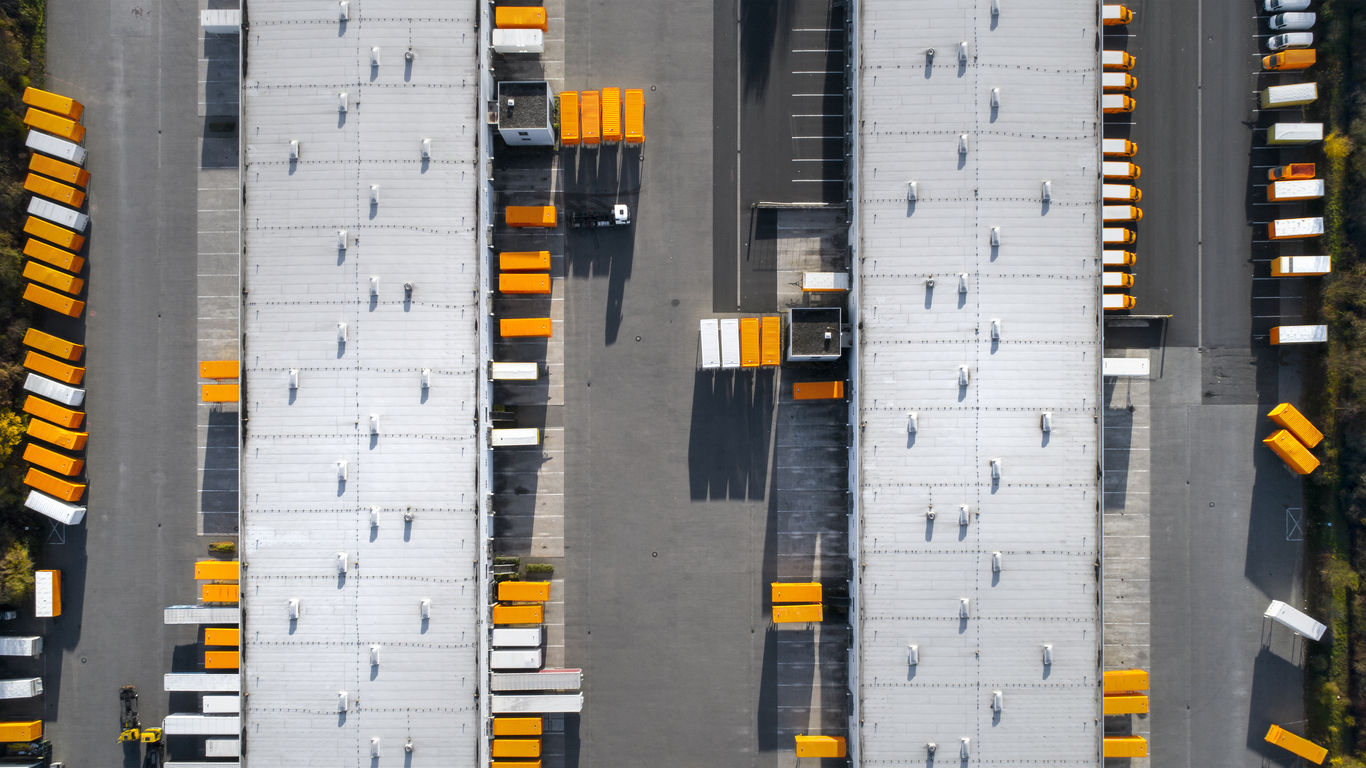

Construction, distribution and food users are predominant occupiers of industrial space in Melbourne’s north where there is both strong demand and tight supply.

Neighbouring properties to the Epping land parcel include Melbourne’s Wholesale Fruit and Vegetable Market and large land occupiers such as Mainfreight, Mission Foods, Chemist Warehouse, Visy, Coles, Bluestar Logistics, Linfox and Toll.

“As the population of Melbourne continues to grow, demand for food production, storage and distribution, housing manufacturing and eight-hour distribution to Sydney, will drive strong demand growth from occupiers in the area,” Cushman & Wakefield industrial director Michael Green said.

“Land values have also been rising in the area, with increases of between 30 to 40 per cent recorded in the past 12 month.”

Melbourne’s northern industrial market consists of approximately 2.2 million square metres of gross floor area.

Currently only a small 40,000sq m of prime industrial space is on offer, a vacancy rate of less than two per cent.

Related: Frasers Property Lists Western Sydney Hotel for $50m

Fraser Property's 2018 profit up 10%

Fair value gains of $640 million on Frasers Property’s investment properties and sales of development projects in Singapore and Australia have lifted results for the group for its 2018 fiscal year.

Net profit increased 10.1 per cent to $765 million from the previous year, while revenue grew 7.1 per cent to $4.34 billion for the 12 months ending Sept 30.

Frasers Property chief executive Panote Sirivadhanabhakdi said the group's balanced approach had served it well over the year.

“We deepened our presence in the logistics, industrial, and business park segments in markets that we are already familiar with, broadening the scale of our platforms in these sectors,” Sirivadhanabhakdi said.

“The Group’s diversification into investment properties in developed markets has helped to smoothen the effects of the inherent lumpiness of development income.”

Twelve facilities totalling 166,500sq m are currently being developed, and the group has also secured 68 hectares of land across five industrial sites in New South Wales, Victoria and Queensland.

On the residential front in Australia, 2,200 units are planned for release in the upcoming financial year, compared to 1,800 units released in 2018.

While 2,300 units are planned for completion and settlement in 2019, compared to over 3,000 units settled during 2018.