Developers Big Winners in Lending Battle

First, the bad news. A wave of increasing construction costs is hitting Australia’s property development sector.

Now, the good news.

According to Barwon Investment Partners head of property finance Jonathon Pullin: “It has probably never been a better time to be a developer or property owner wanting to take on debt”.

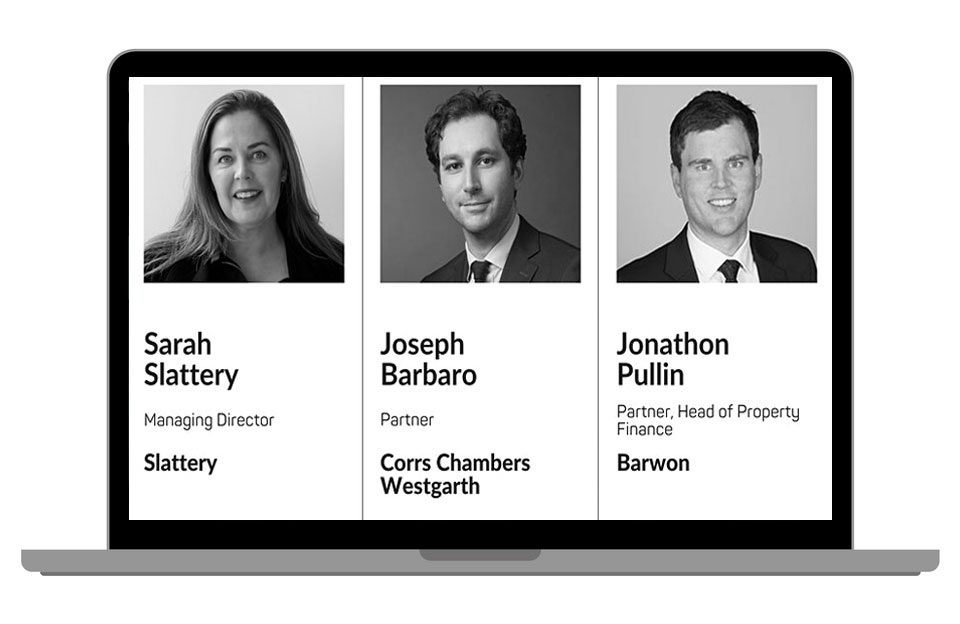

Pullin, who was a speaker at The Urban Developer’s recent Construction and Finance webinar, said Australia’s lending landscape had become increasingly competitive during the past 12 to 18 months.

Record low cash rates are prevailing and there are large amounts of capital available out in the market both on the debt side and also coming through on the equity side.

“The major bank lenders in Australia that have had a rough time of it over the last five or six years, they’re coming out the back of the Royal Commission, they’re coming into a bit more certainty through the Covid journey,” he said.

“And what we’re seeing across the country and in all sectors, they’re starting to become a little more front-footed in terms of wanting to get back into the market and claw back some of that market share that they lost to the larger non-bank lenders.

“Also, on the equity side of things, we’re not only seeing valuations hold up but improve—particularly in the residential side of the market—and a strong level of confidence from buyers.

“Put all that together ... as a property owner or a developer it’s probably never been a better time for you in terms of financing your project and moving it forward.

“There are a whole lot more options out there in the market than what there and all of those options are broadly cheaper than where they were a few years ago.”

Want to better understand the state of the construction funding? Watch our Construction and Funding Forecast webinar here.

Pullin said the major banks had started to loosen some of their traditional covenants to win back business.

“Going back three years, across the market it was a 100 per cent pre-sales requirement for any residential project but you’ll see that’s now more a conversation around 80 per cent coverage and even in some cases lower than that,” he said.

“Funding limits also are increasing. At its worst, only a few years ago, the major banks were typically stopping at 65 per cent, maybe 70 per cent, of total development cost... we’re now seeing it coming up to 75 per cent of total development cost, sometimes 80 per cent.”

Pullin said institutional-grade mezzanine debt lenders were becoming an increasingly accepted part of the capital structure with the major banks working in conjunction with them to win business.

He said non-bank lenders, particularly institutional non-bank lenders, were “very hungry to do business” and broadening their sector and location coverage.

“Non-bank lenders are going up and over where the traditional bank will go to because they know their cost of capital is higher ... but they will bring with it a lesser requirement around pre-sales.

“Typically, we’re seeing them look for 30 to 50 per cent pre-sales just to validate that project is accepted into the market.

“The benefit of these slightly higher cost solutions is projects can get going earlier and it allows developers to potentially lessen further increases in costs that are sitting on the horizon, like that wave of increasing construction costs.

“We are seeing a lot of developers really wanting to get their skates on at the moment and get projects under construction. So, if they don’t have pre-sales yet they’ll make as decision around whether they need to go with a non-bank solution with a lower pre-sales cover.”

Pullin said he expects the lending landscape to become even more competitive over the next 12 to 24 months with the possible emergence of alternate funding structures and some opportunistic lending coming into the market around sectors heavily Covid-affected.

“What does that mean for developers and property owners?

“An increased focus on hard costs from financiers in terms of looking at feasibilities and scenarios, further reductions in lending costs and loosening of covenants around the edges in a requirement to deploy capital.

“So really what you get at the end of day is more options available to developers that hopefully leads to better projects and better outcomes for them.”

Pullin said institutional-grade mezzanine debt lenders were becoming an increasingly accepted part of the capital structure with the major banks working in conjunction with them to win business.

He said non-bank lenders, particularly institutional non-bank lenders, were “very hungry to do business” and broadening their sector and location coverage.

“Non-bank lenders are going up and over where the traditional bank will go to because they know their cost of capital is higher ... but they will bring with it a lesser requirement around pre-sales.

“Typically, we’re seeing them look for 30 to 50 per cent pre-sales just to validate that project is accepted into the market.

“The benefit of these slightly higher cost solutions is projects can get going earlier and it allows developers to potentially lessen further increases in costs that are sitting on the horizon, like that wave of increasing construction costs.

“We are seeing a lot of developers really wanting to get their skates on at the moment and get projects under construction. So, if they don’t have pre-sales yet they’ll make as decision around whether they need to go with a non-bank solution with a lower pre-sales cover.”

Pullin said he expects the lending landscape to become even more competitive over the next 12 to 24 months with the possible emergence of alternate funding structures and some opportunistic lending coming into the market around sectors heavily Covid-affected.

“What does that mean for developers and property owners?

“An increased focus on hard costs from financiers in terms of looking at feasibilities and scenarios, further reductions in lending costs and loosening of covenants around the edges in a requirement to deploy capital.

“So really what you get at the end of day is more options available to developers that hopefully leads to better projects and better outcomes for them.”