Borrowing Surge to Ride Out Covid-19 Downturn

Businesses shoring up their balance sheets to ride out Covid-19 has caused a $30 billion surge in credit for March, with business lending growing by its fastest rate in more than three decades.

The Reserve Bank’s credit growth figures showed that while business credit rose by 2.9 per cent—the biggest monthly gain in 32 years—housing credit remained subdued and is likely to slow in coming months.

The lift in business credit—the outstanding loans on bank’s books—equates to about 10 months of “normal lending”, CBA chief economist Craig James said.

The Australian housing market, which has traditionally been more reactive to credit tightening than financial shocks, is expected to deteriorate further as analysts price in “worst case” declines of as much as 30 per cent.

Stability in property markets won’t be helped by negative annual investor lending growth or the fall in housing turnover and market activity.

“Roughly speaking, the monthly amount of new lending to investors is falling just short of the repayment of debt made by investors, so the stock is falling a little each month,” CBA economist Belinda Allen said.

“We expect owner-occupier housing credit growth to soften as well. The exact extent will depend on the speed of which households repay principal debt in this uncertain economic environment.”

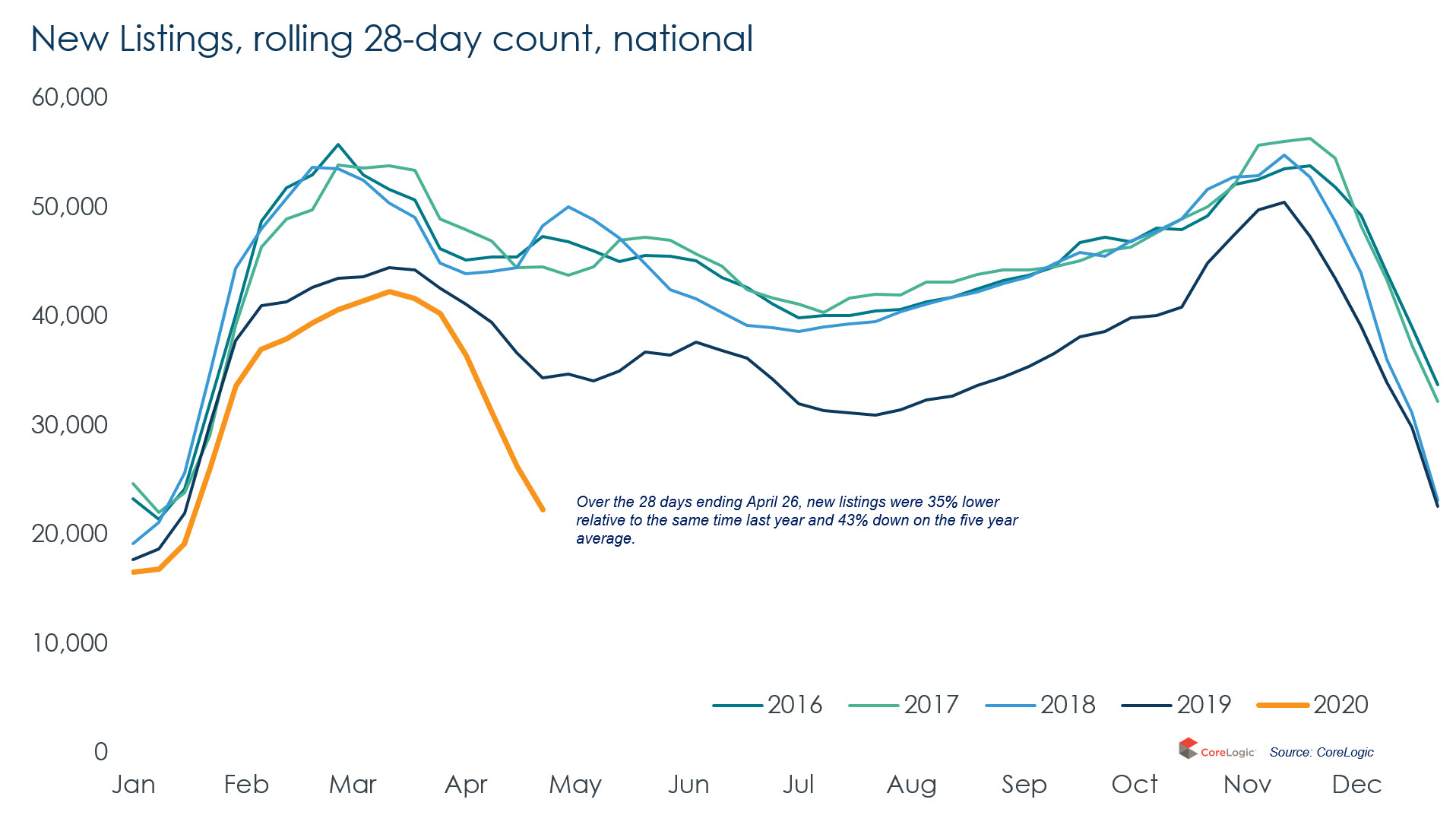

The constraint on housing market activity and subsequent, and dramatic, fall in listings has driven a 30 per cent decline in property sales since the rate of Covid-19 infections started to increase in March 2020.

Corelogic research analyst Tim Lawless said that the drop in advertised supply should help to provide “some insulation” for housing prices as buyers retreat to the sidelines.

New listings likely to fall in coming months

Developers a ‘key risk’ for banks

The Reserve Bank has aired concerns about the outlook for developers, with banks incurring significant losses from construction loans in past downturns.

“While construction lending accounts for a small share of business lending, it has grown rapidly recently,” the bank said in mid-April, adding that non-bank lenders were particularly active in commercial and apartment property markets.

“For developers with projects still under construction but with currently unsold properties, it could be difficult to finalise sales at a profitable price.

“Developers will then be left holding inventory – and debt – on their balance sheets with little or no revenue.

“This is a key risk for lenders.”