Denser Development Should be Allowed 'As of Right' Allow Key Corridors

Rising incomes, falling interest rates and rapid migration has led to an eight-year-long house price boom which has significantly amplified the gap between rich and poor.

Housing ownership is increasingly dependent on how high your income is and who your parents are with low-income younger Australians bearing the brunt of the dramatic decline in home ownership.

In a new report from the Grattan Institute, Housing Affordability: Re-imagining the Australian Dream, the think tank said that home ownership rates are falling among all Australians younger than 65, and especially so for those with low incomes.

The report recommends building an extra 50,000 homes a year for a decade to leave Australian house prices 5 to 20 per cent lower and stem rising public anxiety about housing affordability.

NIMBYism, and community opposition to development is also responsible for worsening housing affordability, with the report blaming planning rules for constraining supply and preventing development.

Related reading: Apartment Building Marks Strong Start to 2018

Decline in Home Ownership Among Young Australians

Home ownership had plummeted among Australians aged 25 to 34, dropping from 61 per cent in the early 1980s to just 44 per cent in 2016. Ownership among Australians aged 35 to 44 had plunged from 75 to 62 per cent.

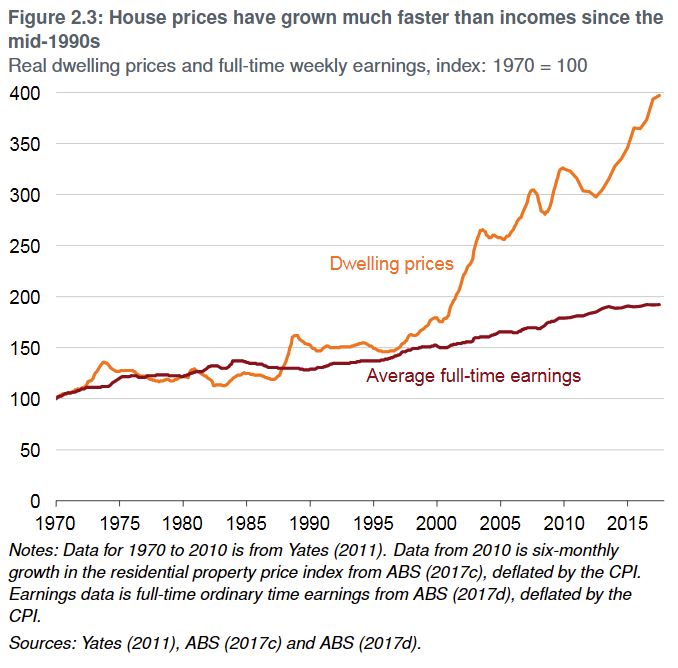

Average house prices have increased from around two to three times average disposable incomes in the 1980s and early-1990s, to around five times more recently.

Australian spending on housing has increased from about 10 per cent of total pre-tax household income in 1980 to 14 per cent today. The bottom fifth of earners are spending 28 per cent of their disposable income in either rent or mortgage payments.

Related reading: Increasing Supply is no Panacea for Housing Affordability

Grattan chief executive John Daley made no bones about who he felt was responsible for the current state of housing affordability, identifying two decades of government that “preferred the easy choices”.

“The politics of reform are fraught because most voters own a home or an investment property, and mistrust any change that might dent the price of their assets. John Daley

“But if governments keep pretending there are easy answers, housing affordability will just get worse. Older people will not be able to downsize in the suburb where they live, and our children won’t be able to buy their own home.”

"The Commonwealth government can improve housing affordability somewhat – and immediately – by reducing demand. It should reduce the capital gains tax discount to 25 per cent; abolish negative gearing; and include owner-occupied housing in the Age Pension assets test.

--Grattan Institute “Housing Affordability: Re-imagining the Australian Dream” report

Unless the states are prepared to reform their planning systems, the Commonwealth should consider tapping the brakes on Australia’s migrant intake."

Migration

The Institute identified migration as a major concern with Australian cities, particularly Sydney and Melbourne, struggling to cope with unprecedented levels of population growth.

“Migrants have benefited incumbent Australians by raising incomes, increasing innovation, contributing to government budgets, smoothing over population ageing and diversifying our social fabric […] but it is also true that immigration is affecting house prices and rents,” the report said.

“Australia’s migration policy is its de-facto population policy. The population is growing by about 350,000 a year. More than half of this is due to immigration.”

The report also said that since 2005, net overseas migration has averaged 200,000 people per year, up from 100,000 in the previous decade, and will increase to around 240,000 per year over the next few years.

Daley also warned of the “catastrophic” risk of a mortgage rate rise on all income groups.

The report contains 13 policy recommendations the institute says will improve housing affordability in Australia.