Cromwell Pulls Final Overseas Stake with European Sale

Brisbane-based Cromwell Property Group has offloaded the last of its overseas interests, selling its European arm for $457 million.

The REIT has entered into a binding agreement for the sale of Cromwell’s European fund management platform and associated co-investments for to Stoneweg SA Group, a Geneva-headquartered, multi-strategy real estate investment manager with more than €4.0 billion of assets under management.

Cromwell said the transaction “is consistent with the group’s commitment to simplify the business to transition to a capital-light funds management model”.

“The exit from the European business allows Cromwell to be focused on its core competencies in Australia and New Zealand and positions the platform for future growth,” the company said in a release.

Citigroup Global Markets Australia Pty Limited and UBS Securities Australia Limited acted as financial advisers, and Linklaters as legal adviser for the deal.

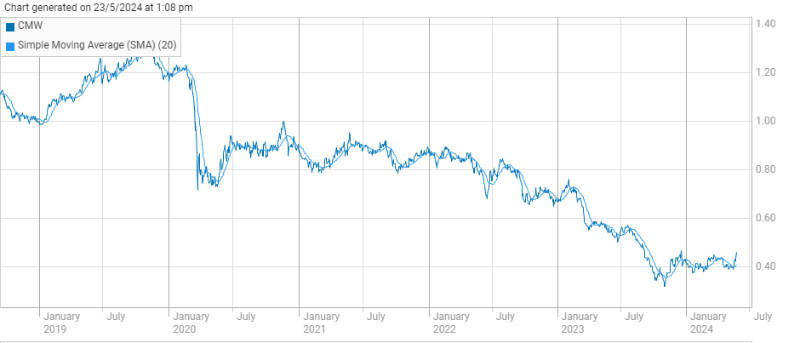

Going down:

Cromwell’s ASX shares have been trending downwards for the past few years.

Since hitting a high of $1.345 on November 5, 2019, CMW has shed about two thirds of its value to close on May 22 this year at $0.435.

It traded as low as $0.310 on October 31, 2023.

Cromwell chair Gary Weiss said the European offload was a turning point for the group.

“In the current operating environment, numerous options were considered to simplify and derisk the business and we believe that this transaction will provide the debt reduction and working capital needed to move forward in a focused and value-accretive way,” he said.

Chief executive Jonathan Callaghan said that since December, 2021, the group had divested $1.6 billion of non-core assets and investment positions locally and offshore.

“Cromwell will continue to own and manage a high-quality Australian portfolio of commercial assets valued at $2.4 billion with its long-standing, well-respected funds management platforms in Australia and New Zealand also managing an additional $2.4 billion of assets, supported by a strong balance sheet to fund new investment opportunities to build meaningful long-term value for our investors,” Callaghan told the market.