Covid Creates Two-Speed Rental Market

The onset of Covid-19 may be creating a two-speed rental market, with inner-city rents declining faster than those in the outer suburbs.

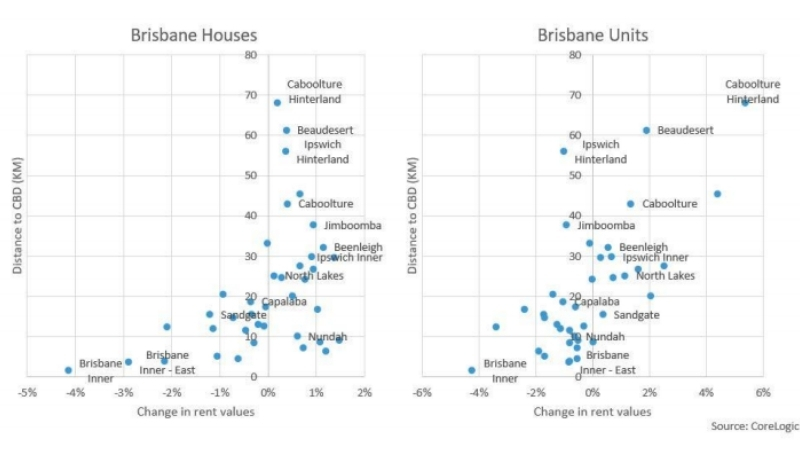

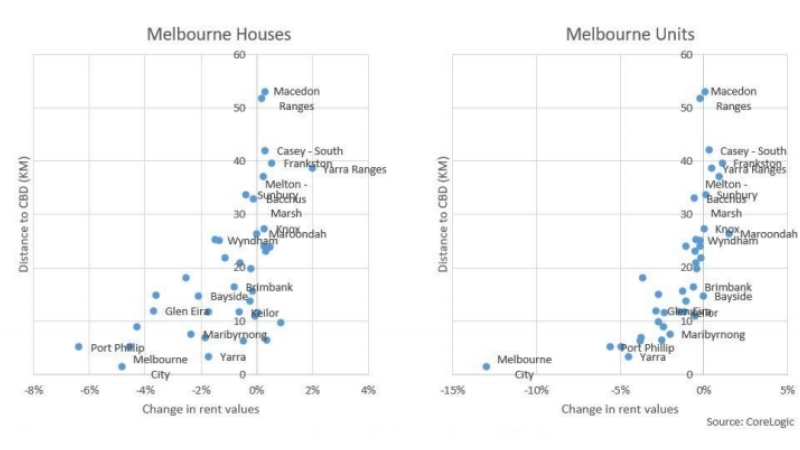

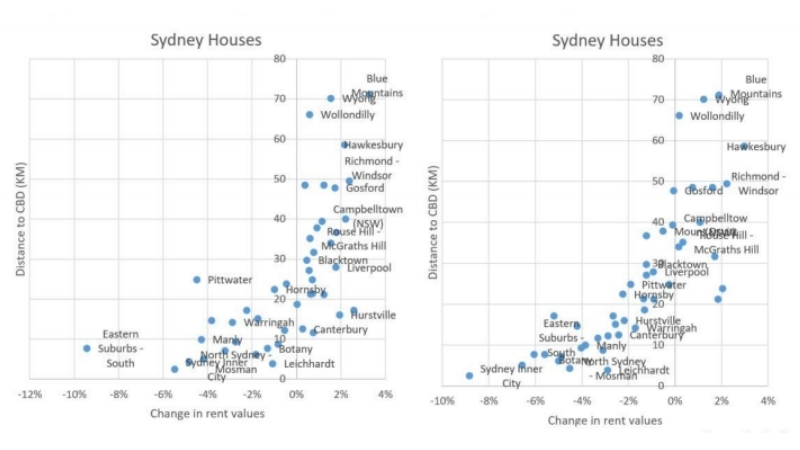

Corelogic data confirms that there is a positive correlation between changes in rent values and distance to the CBD.

This means that the closer a region is to the CBD, the more likely it is that rent values have fallen.

Rent values were analysed across statistical area regions of Brisbane, Sydney and Melbourne—for each region, the median property distance to the CBD was compared with the change in total rental market values from the end of March (which marked national, stage 2 restrictions) to the end of August.

For regions where the typical property is less than 10km from the CBD, the average decline in house rents was 2.3 per cent, and 3.6 per cent across units.

For rental markets 10km or further from the CBD, house rents had actually increased 0.1 per cent, while unit values declined a relatively mild 0.4 per cent.

When examining the capital cities and housing stock separately, the strongest relationship existed between rent changes in Sydney units and distance to the CBD.

These two variables have a correlation coefficient of 0.8, suggesting that the closer a property was to the CBD, the more likely, and steep, rental declines have been through the pandemic.

The average correlation coefficient was 0.6, and the weakest positive correlation was 0.4 across Brisbane houses.

Each graph shows the change in rent values for houses and units across the horizontal axis between March and August, and the distance to the CBD along the horizontal axis.

The scatter graphs show a positive relationship between distance to the CBD and growth in rents.

Change in rent values for Brisbane

Change in rent values for Melbourne

Change in rent values for Sydney

^Source: Corelogic

Why have inner city markets been more affected?

As has been noted in previous research from Corelogic, there are several distinct factors of the Covid-19 downturn that have made inner city rental markets particularly susceptible to a decline in rental values.

These include the relatively high exposure to overseas migration as a source of housing demand.

Where have rents increased?

Of the 125 rental markets analysed, there were 63 regions where house rents increased, and 35 regions where unit rents increased, since the end of March to August.

Rental increases were most common across Sydney and Brisbane, where employment has been less affected by the pandemic, and social distancing measures have eased.

The highest rental value increases were across Blue Mountains houses, rising 3.3 per cent.

The reason for rental value increases in outer-suburban areas are less clear.

On explanation may be that outer-city suburbs have been less exposed to the factors driving declines in demand, such as overseas migration.

Anecdotal reports assert that a draw card for outer-city suburbs are relatively cheap rents, and low density along with remote working lessening the hurdle of travel times from areas located further form the largest employment nodes.

This may have increased rental prices through higher demand.

The analysed data set also revealed that rental value increases have occurred in cheaper rental markets.

However, it is difficult to understand this trend without survey data, and internal migration data for the Covid period will likely not be available until April next year.

It may also be the case that added stimulus to low income households have added to rental demand in areas where rents are usually cheaper.

The tapering of this fiscal support may lead to a more broad-based decline in rents over the next six months.