Auction Slump Signals Residential Roller Coaster Ride

The residential property market in Australia continues to be challenged by social distancing measures and weaker economic activity, with preliminary clearance rates falling to 29.3 per cent during the Easter long weekend.

Corelogic figures recorded a very subdued 636 homes scheduled for auction across the nation’s combined capital cities—a figure which, even in the midst of the coronavirus downturn, isn't in itself unusual given that the Easter weekend is traditionally one of the quietest weeks of the year.

But the preliminary auction clearance rate of 29.3 per cent is the lowest preliminary result recorded since Corelogic commenced auction reporting in 2008, dragged down by a withdrawal rate of 57 per cent as the market continues to feel the impact of coronavirus containment measures banning on-site auctions and viewings.

And the preliminary clearance rate—collected from 472 results so far—is likely to plunge even lower, and withdrawal rates higher, as more results are collated, according to Corelogic’s analysts.

“Looking forward, we are expecting the withdrawal rate to ease as fewer auctions are scheduled, with vendors preferring private treaty methods of sales, or preferring to defer their listing until some certainty returns to the market and economy.”

CoreLogic head of research Eliza Owen said that despite the short-term outlook, there was still cause for optimism.

“Looking ahead, the next few months will present an unprecedented challenge to the auction market and the housing market more broadly.

“However, once the virus is contained, property is looking increasingly better-placed for a recovery because of the high levels of monetary and fiscal stimulus available.”

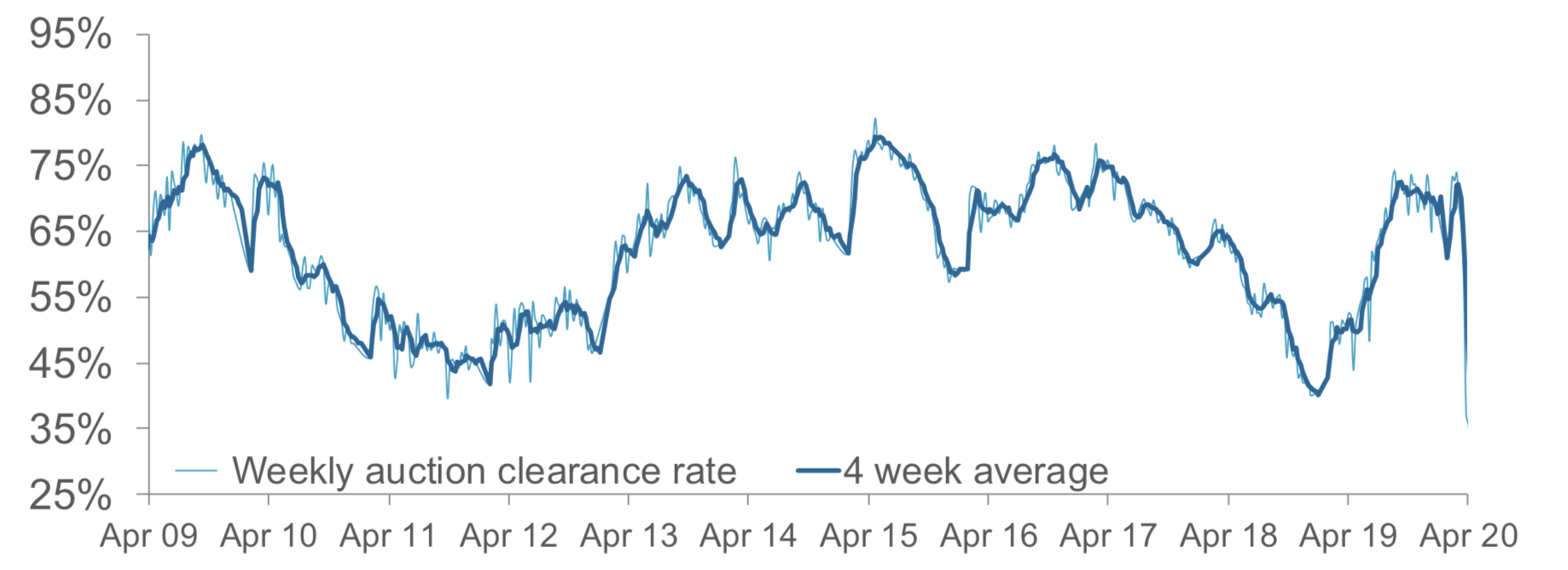

Weekly clearance rates, combined capital cities

For now, the monetary, fiscal and social policies rolled out by the federal and state governments may already be helping to soften the blow for the rental market, at least temporarily.

SQM data shows Australia’s residential rental vacancy rate remained stable at 2.0 per cent in March, with the total number of vacancies Australia-wide now at 67,371 vacant residential properties.

Most states recorded minor 0.1 per cent declines in vacancy rates, with the exception of Sydney, Melbourne and Darwin, which were stable.

SQM managing director Louis Christopher said the minor decline in most capital cities’ vacancy rates for March was somewhat surprising given the uncertainty around the economy.

“With job losses, a freeze in migration and an expected sharp rise in short-term accommodation vacancies,we are likely to record significant increases in rental vacancy rates as 2020 progresses.

“Let’s keep in mind our methodology requires a property to be advertised for three weeks or longer before we regard it as unoccupied,” Christopher said.

Capital city asking rents decreased by 3.2 per cent for houses and 2.9 per cent for units for the week ending April 12, with asking rents of $544 per week for houses and $428 per week for units.

“I also note the 3.2 per cent drop in asking rents for houses over the month, which may well be as a result of many short-term accommodation dwellings entering into the longer-term leasing market, and overall, a sign of things to come,” Christopher said.

Sydney, Melbourne, Brisbane and Hobart all recorded decreases in asking rents for both houses and units over the month.

Perth and Adelaide were the only capital cities to record rent increases for both houses and units, with asking prices in Perth increasing by 1.9 per cent for houses and 0.8 per cent for units.

Adelaide recorded a 0.3 per cent increase for houses and 1.4 per cent for units.

Canberra and Darwin recorded increases in house asking rents with Canberra increasing by 2.6 per cent and Darwin 0.1 per cent, however, both cities had declines in unit prices over the month—Canberra by 0.1 per cent and Darwin by 0.6 per cent.

While the impact of the Covid-19 pandemic on the residential property market remains unclear, the Reserve Bank's April Financial Stability Review has pointed to Australia's "strong starting position" for dealing with what's in store.