Australian Housing Upswing Spreads Across Nation

The upswing in Australia’s housing marker has spread, with four in five markets recording a rise in the past three months.

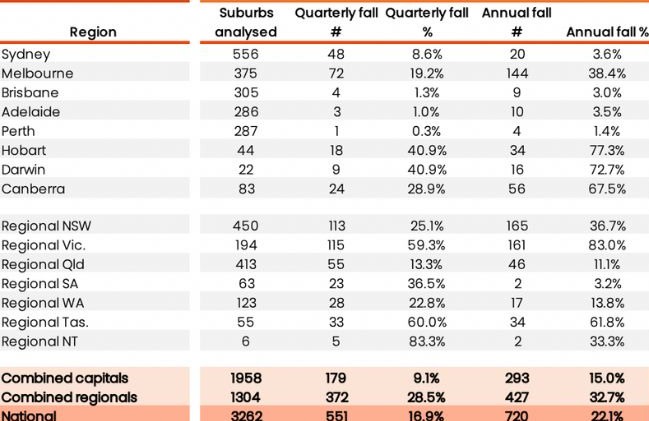

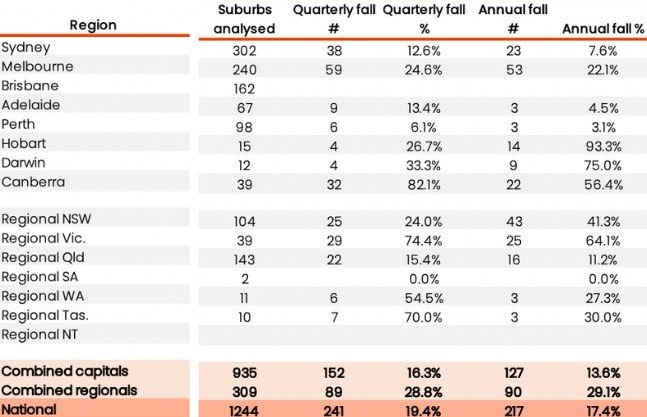

According to data from CoreLogic’s online Mapping the Market tool, updated with data to the end of October, 2023, values in 83.1 per cent of house markets and 80.6 per cent of unit markets rose during the past three months.

CoreLogic head of research Eliza Owen said this broadly reflected continued growth in the Australian housing market despite high interest rates and weakening economic conditions.

“It’s often noted that Australia is not one housing market and we’re currently seeing increased diversity in capital city market performance,” Owen said.

“That’s reflected in city-wide growth rates, the various levels of supply that’s available in some cities over others, and it’s reflected in the different suburbs we analyse in this report.

“At one end of the spectrum, suburb-level analysis reflected the extraordinary growth trend across cities such as Adelaide, Perth and Brisbane.

“In these cities, total listings levels are low, city-wide capital growth is running a bit over 1 per cent per month, and migration trends from overseas and interstate favour more housing demand.”

Capital cities running at high speed

In Brisbane, each of the 162 unit markets analysed had values rise in the past three months, while of the 305 house markets, just four saw a quarterly decline.

These were the higher-end suburbs of Kalinga and Windsor as well as the more affordable Redland spots of Macleay Island and Lamb Island.

In Adelaide, just 3 per cent of house markets had a decline in the quarter, but there was a notable portion of unit markets in decline (13.4 per cent, or 9 of the 67 suburbs analysed).

In Perth, there was one suburb where house values fell in the past three months, Mount Hawthorn, but, Owen said, even there the house market sustained just a mild decline of 0.2 per cent.

Portion of suburbs recording quarterly, annual falls in values: Houses

“Remarkably, 98.1 per cent of the house and unit markets across Perth rose in value during the past three months, and 96.3 per cent of suburb home markets in the WA capital were at record high values at the end of October.”

Capital cities running at mid-speed

Owen said Sydney and Melbourne were running at mid-speed, where city-wide capital growth was 2.5 per cent and 1.2 per cent respectively for the past three months.

“The pace of growth across these markets has slowed from the middle of the year, when the June rate-hike surprised financial markets and many economists’ predictions,” she said.

“Growth in Sydney markets are strongest across relatively expensive house markets, with Five Dock houses topping the three-month capital growth ranking (up 8.4 per cent).

Portion of suburbs recording quarterly, annual falls in values: Units

“In Melbourne, it was the more mid-priced unit market of Moorabbin which topped the list, increasing 7.4 per cent.”

Capitals that are flat or falling

In Hobart and Darwin, 41 per cent of house markets had a quarterly decline.

Owen said overall, Hobart home values ticked 0.3 per cent higher for the past three months, but capital growth trends have been shaky and total listings were trending around 47 per cent higher than the previous five-year average.

“The city values have fallen in three of the past six months. Declines across Hobart houses were led by a 3.2 per cent fall across the relatively expensive market of Sandford.

“Canberra has also had relatively flat capital growth and particular weakness in the unit market—32 of 39 unit markets analysed in the nation’s capital had a quarterly decline, the steepest in O’Connor, which was down 4.1 per cent.”

Across regional markets, conditions are equally diverse, with regional Queensland the strongest house market and regional SA the best performing unit market.