Australia’s Largest Healthcare Fund Re-Opens For Development Pipeline

Australian Unity’s $1.2 billion healthcare property trust (HPT), the largest healthcare real estate investment trust (REIT) in the country, will re-open this May to help raise funds for its $500 million development pipeline.

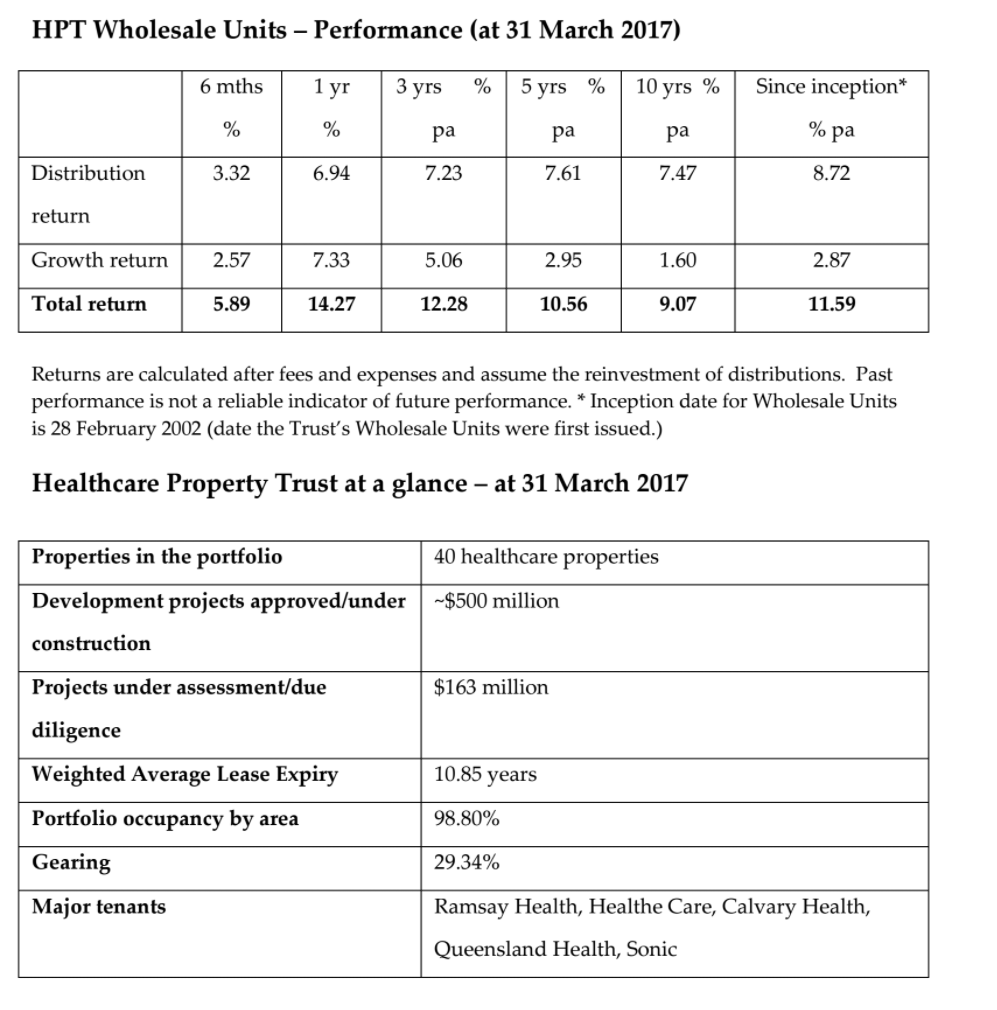

The HPT commenced almost 20 years ago and currently has more than 7,500 investors, owning 40 healthcare assets across Australia’s eastern seaboard.

HPT closed to new investment in April last year due to overwhelming demand and to safeguard the interests of existing investors. It will open for a limited period.

The trust is currently seeking to initially raise approximately $150 million to fund on-going, long-term, brownfield developments at the Valley Private Hospital in Mulgrave, Victoria, Brisbane Waters Private Hospital in New South Wales and the Primary Health Care Medical Centre in Greensborough, Victoria.

"As the HPT has grown and its popularity increased, we have upped the ante on our development activity to build new hospitals and other healthcare facilities in areas where Australians need better access to necessary and sought after healthcare services," Australian Unity Head of Healthcare Property Chris Smith said.

“HPT’s long-term and prudent development approach and its continued work with tenants to secure stable and long term leases is a powerful combination that drives returns for investors."Funds will also be deployed for greenfield developments to construct the Primary Health Care Medical Centre in Robina, Queensland, Tuggerah Lakes Private Hospital in New South Wales and the Specialist Rehabilitation and Ambulatory Care Centre (SRACC) which forms part of the $1.1 billion Herston Quarter redevelopment in Brisbane, Queensland.

The SRACC will be the first public hospital in Australia to be built in a real estate investment trust structure using private capital from investors.

Australian Unity’s Healthcare Property Trust invests in healthcare-related property assets and includes the ownership of hospitals, medical clinics, nursing homes, day surgeries, medical offices, consulting rooms, rehabilitation units, radiology and pathology centres.

In April, HPT completed re-valuations on 11 properties in its portfolio resulting in a net increase of $25.76 million (or eight and a half per cent) from the properties book value immediately prior to valuation.

The increases reflect the quality of the HPT’s assets coupled with capitalisation rate compression driven by the weight of cash continuing to flow into the sector from institutional investors.

“We expect further cap rate tightening for the rest of calendar 2017," Mr Smith said.

Image: Herston Quarter redevelopment in Brisbane, Queensland