Home Values Diverging Across Cities, Regions

Outside of Melbourne, Australia’s capital cities recorded slightly better conditions in comparison to July, with the rate of decline easing over the past two months.

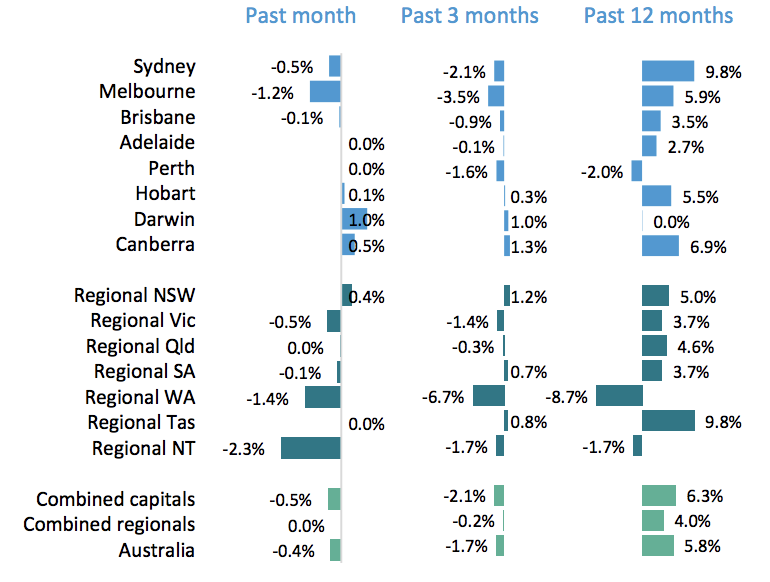

While Australian home values recorded a 0.4 per cent fall in August, Corelogic’s home value index shows five of the eight capital cities recorded steady or rising values in the month.

The rate of decline eased in Sydney and Brisbane, while home values held firm or showed a subtle lift across the remaining capitals, Corelogic’s head of research Tim Lawless said.

The monthly index shows how stage four restrictions are impacting Melbourne’s housing market, with dwelling values falling by 1.2 per cent over the month, after recording a similar fall in July, and leading the national 0.4 per cent decline.

“[Thus] demonstrating the impact of a worse viral outbreak relative to other cities, along with a larger demand-side impact from stalled overseas migration,” Lawless said.

“It’s not surprising to see Melbourne as the weakest housing market considering the extent of the virus outbreak, and subsequent restrictions, which have weakened Victoria's economic performance,” he said.

Melbourne home values have declined by 4.6 per cent through the pandemic period to date.

Corelogic house price index: August

| Month | Quarter | Annual | Total Return | Median Value | |

|---|---|---|---|---|---|

| Sydney | -0.5% | -2.1% | 9.8% | 12.9% | $860,182 |

| Melbourne | -1.2% | -3.5% | 5.9% | 9.5% | $667,520 |

| Brisbane | -0.1% | -0.9% | 3.5% | 7.3% | $503,128 |

| Adelaide | 0.0% | -0.1% | 2.7% | 6.9% | $444,021 |

| Perth | 0.0% | -1.6% | -2.0% | 2.1% | $443,777 |

| Hobart | 0.1% | 0.3% | 5.5% | 11% | $490,743 |

| Darwin | 1% | 1% | 0.0% | 6.7% | $393,386 |

| Canberra | 0.5% | 1.3% | 6.9% | 12% | $636,324 |

| Combined Capitals | -0.5% | -2.1% | 6.3% | 9.8% | $633,745 |

| Combined Regionals | 0.0% | -0.2% | 4% | 8.8% | $395,761 |

| National | -0.4% | -1.7% | 5.8% | 9.6% | $552,689 |

^ Source: Corelogic

Capital Economics maintains its forecast that house prices across the eight capital cities will eventually fall by 8 per cent from their peak as a result of the forecast increase in unemployment and softer consumer confidence.

“We think that house prices will continue to fall,” Capital Economics senior economist Marcel Thieliant said.

“That said, record-low borrowing costs and increasingly attractive affordability should limit the downside.”

Corelogic’s monthly index comes as the Reserve Bank, which held the cash rate steady at 0.25 per cent on Tuesday, released new research on Australia’s household debt.

The research paper, “How Risky is Australian Household Debt?”, looks at how reliant Australia’s house prices have been on the flow of new debt, especially in recent years, but suggests that the risks arising from Australian household indebtedness are “more subtle than sometimes conveyed”.

The RBA paper notes that stress tests show banks are well placed to handle a severe downturn in the economy due to lending standards, and that most of the debt is held by households that have significant equity backing their loans and are less likely to become unemployed in a downturn.

“Banks appear resilient to a severe downturn thanks to moderate loan-to-valuation ratios on residential mortgages; and the distribution of debt does not appear to heighten wealth effects on consumption,” report authors Jonathan Kearns, Mike Major and David Norman said.

Change in Australian dwelling values

Regional housing markets outperform capitals

Regional home prices continue to hold up, highlighting the increase in divergence between virus “hotspots” and the rest of Australia.

Lawless said the performance of Australia’s housing markets are intrinsically linked with the extent of social distancing policies and border closures, directly impacting labour market conditions and sentiment.

“We are likely to see a diverse outcome for housing markets around Australia looking forward, depending on how well the virus is contained and the region’s exposure to other factors such as its reliance on overseas migration as a source of housing demand.”

The index notes that regional markets continue to outperform their capital city counterparts across Australia’s largest states, likely due to their relatively low density and lower price points.

“Unlike their capital city counterparts, which usually receive 85 per cent of net overseas migration, most regional markets have avoided the drop in demand caused by the pause in migration.

“The normalisation of remote work through the pandemic could make proximity to major cities less of a factor in home purchasing decisions,” Lawless said.

Rental demand

Nationally, capital city rents held up better than housing values, according to Tuesday’s figures.

Capital city dwelling rents are down 1.4 per cent compared with the 2.3 per cent drop in dwelling values, for the period since March.

But despite the apparent resilience, Lawless says a more substantial performance gap is opening up between houses and units across the rental sector.

“Since the end of March, capital city house rents are down by a modest 0.3 per cent, while unit rents have fallen a more substantial 3.5 per cent with rents underperforming relative to house rents across every capital city,” he said.