Resale Profits Slump to Five-Year Low

Almost 90 per cent of Australian homes sold during the second quarter of 2018 saw a profit, with total resale gains hitting $15.68 billion.

However, a recent market pulse check from property data firm Corelogic indicates the share of resales at a profit was at its lowest since October 2013.

Over the June 2018 quarter, 89.8 per cent of capital city properties resold for a profit, down from 91.3 per cent the previous quarter as well as being lower than the 92.7 per cent a year earlier.

The 10.2 per cent of residential properties resold at a price lower than the previous purchase price resulted in a gross resale loss of $469.4 million.

Related: Renters on Top as Housing Prices Fall: REIA

A total of 91.5 per cent of houses sold at a profit nationally and 85.2 per cent of units saw a profit yet both houses and units recorded a fall in profit-making re-sales over the quarter.

“Houses consistently record a higher proportion of resales at a profit than units,” Corelogic head of research Tim Lawless said.

“This may be attributed to the underlying land value of detached houses, which is a significant part of the overall value, but, it’s also because unit markets can be more prone to oversupply than house markets.”

Investors continue to be more likely to resell their properties at a loss than owner-occupiers.

Over the second quarter of 2018, 9.8 per cent of owner-occupied properties sold at a loss compared to 10.1 per cent of investor owned properties.

"Owner occupiers may be more prepared to sell at a loss if they are purchasing their next home at an equivalent or greater discount,” Lawless said.

“Investors have taxation rules to consider, and could be more prepared to incur a loss because unlike owner-occupiers they can offset those losses against future capital gains.”

Related: Property Values Have Halved in These Towns Since 2008

Over the June 2018 quarter, houses resold at a loss had typically been owned for 6.6 years, while those resold at a profit had been owned for 9.2 years.

Units resold for a loss had typically been owned for 6.9 years while those resold for a profit had been owned for 7.8 years.

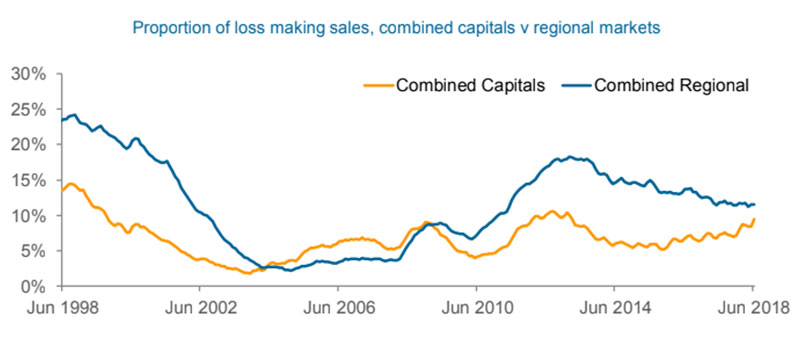

Market insights also revealed capital city properties that were being resold were more likely to sell for a profit than those in regional markets.

Over the past three months the gap has narrowed though, due to a decline in resales at a loss in regional markets and an increase across the combined capital cities.