Australia ‘Needs 20,000 More Apartments Each Year’

Australia needs to build an additional 20,000 apartments each year to keep up with demand, according to Charter Keck Cramer research.

Charter Keck Cramer national executive director of research Richard Temlett said Australia’s population growth trajectory was continuing upwards, putting pressure on housing supply.

“We cannot continue to soley rely on greenfield markets to deliver more dwellings, many of the greenfield markets are at capacity,” Temlett said.

“There is a large amount of notional greenfield land supply, but not a lot is actually build-ready.”

Temlett said in order to meet demand in the next 10 years, Australia needed to create a policy landscape that would facilitate one of the largest home-building cycles since the 1950s.

Temlett said NSW Premier Chris Minns’ announcement of a plan for a Parisian-style two-to-six-storey infill was “brave and forward thinking”.

“In many housing sub-markets, we need to be building upwards. This will mean that there have to be some unpopular decisions made. Sydney needs it more than any other city,” he said.

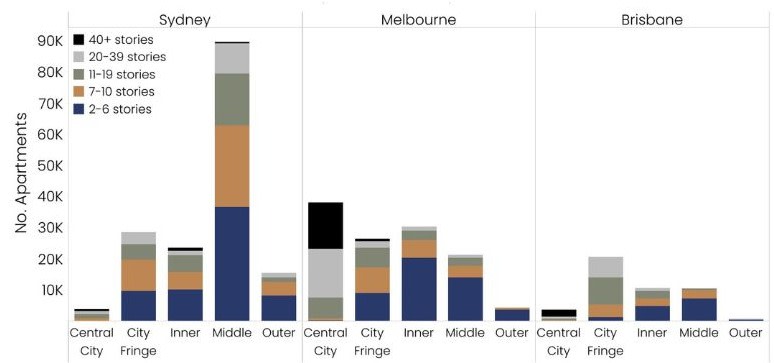

Apartment completions by region and height

“But going upwards doesn’t have to mean towers of more than 10 storeys,

we can be doing two-to-six-storey buildings in many locations, like global cities such as Paris. It’s not an eyesore … there’s such a misconception that density means we’re going to more than 10 levels in our backyard.

“But you can get density in areas where there’s already train stations and infrastructure, which will in fact support further demand for local retail and commercial uses and increase property values.”

Analysis of apartment development between 2013 and 2020 indicated about 40 per cent of the supply was medium-rise projects, and much of the supply was built in middle ring suburbs close to public transport, employment hubs, retail and lifestyle amenity.

Temlett said there was a role for both build-to-rent and build-to-sell apartments in addressing housing shortfalls.

“Build-to-rent in the short term will have to do a lot of the heavy lifting given the state of the pre-sales market and loss of foreign investors in the build-to-sell apartment market,” he said.

“We have had extremely strong population growth, but it’s naturally going to pull back a bit as various types of visas issued during COVID start to expire.

“At pre-pandemic levels we weren’t oversupplied, but we did have more overseas investors. They’re still there, but we need to incentivise them back into the new housing markets.”

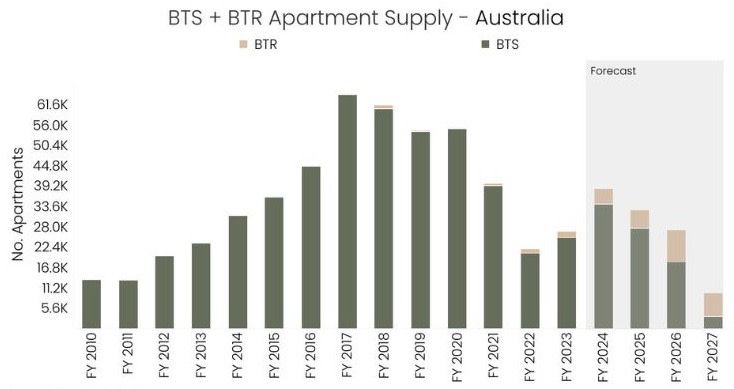

Apartment supply forecast

Temlett said peak levels of build-to-sell apartments (about 60,000 per annum) were developed between 2017 and 2020, due to policy settings in place, including off-the-plan investor incentives, lower taxes on buyers and investors and first home buyer grants.

Temlett said Charter Keck Cramer indicated that nationally at least 72,000 build-to-rent and build-to-sell apartments needed to be built each year to hit housing targets and policy framework needed to encourage this.