Approvals Slump as November Wipes Out October Gains

The value of building approvals slumped in November, according to Australian Bureau of Statistics data, while the number of homes approved this financial year continued to fall.

Across Australia, the value of total building approvals [including non-residential] fell 9.2 per cent, following an 8.1 per cent jump in October.

Meanwhile, the value of total residential building fell 2.1 per cent, on the back of a 2 per cent decrease in new residential building and a 2.4 per cent fall in alterations and additions.

The number of home approvals was up for the month but also softer than the previous month at 1.6 per cent for November in seasonally adjusted terms, compared with an 7.2 per cent increase in October.

ABS head of construction statistics Daniel Rossi said approvals for private sector homes excluding houses increased 6.7 per cent, also down on the previous month when a 17.4 per cent rise was recorded.

“Approvals for private sector houses fell 1.7 per cent following a 2.9 per cent October increase,” he said.

“Despite the monthly increase, total homes approved have been lower this financial year.”

In original terms, 70,900 homes were approved between July and November in 2023, compared to 81,954 for the same period in 2022.

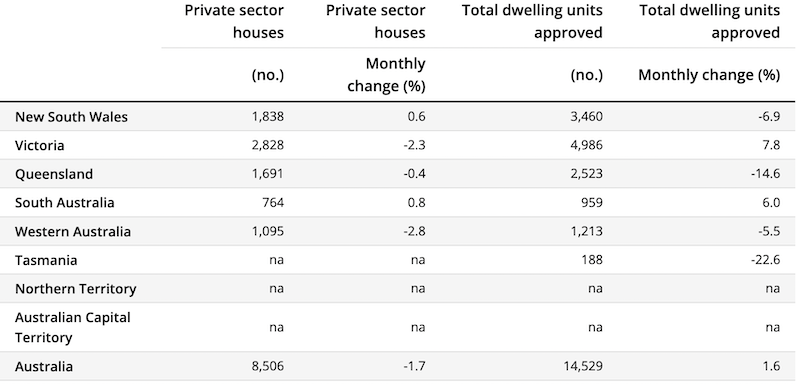

Total home approvals increased in Victoria (7.8 per cent) and South Australia (6 per cent) but fell in Tasmania (-22.6 per cent), Queensland (-14.6 per cent), NSW (-6.9 per cent), and Western Australia (-5.5 per cent).

Value of buildings approved by building type

Approvals for private sector houses were driven lower by Western Australia (-2.8 per cent), Victoria (-2.3 per cent), and Queensland (-0.4 per cent). South Australia (0.8 per cent) and NSW (0.6 per cent) rose in November.

HIA chief economist Tim Reardon said the fall in the latest figures meant approvals in the three months to November were lower by 8 per cent compared with the same period in the previous year.

He said the rise in interest rates was the primary cause of the slowdown and that the low volume of building approvals throughout 2023 meant the volume of homes beginning construction would continue to slow.

“Other leading indicators of activity in the housing market, such as new home sales and housing finance data, are also consistent with ... this projected slowdown,” he said.

“A continued fall in the number of new homes approved indicates a slow start to the Australian government’s ambition to build 1.2 million new homes in five years starting mid-2024.”

Homes approved, November 2023, seasonally adjusted