Residential Building Work Flat as Labour Woes Drag On

Residential construction work was all but flat across the past quarter as the effect of labour shortages continue to be felt.

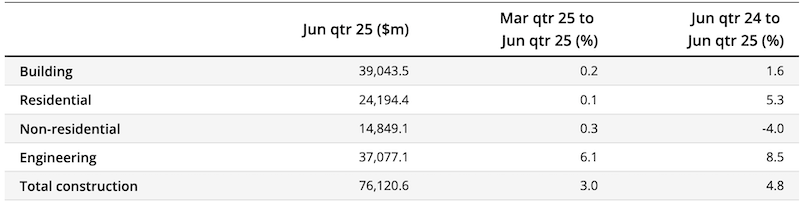

According to data from the Australian Bureau of Statistics, across the June quarter the value of building work done rose 0.2 per cent to $39.04 billion, while residential work value was just 0.1 per cent higher at $24.19 billion (chain volume measure) in seasonally adjusted terms.

Total construction work done rose 3 per cent to $76.12 billion.

Oxford Economics Australia economist Michael Dyer said after the strong run in approvals to the end of 2024, attached homes had led the way, up 2.8 per cent for the quarter to offset a soft result for houses (-1.6 per cent).

“Over the full financial year, $95.71 billion of work was undertaken, up 4.5 per cent on the prior year,” he said

“There are pockets of capacity improvement, but labour shortages persist and are set to limit activity across the medium term.

“Issues with connecting utilities across the major cities may also drag.

“Dwelling completions were weak to start 2025, which saw the downwards trend in the backlog of work since late 2022 broken.

“Enduring efforts to clear the remainder will continue to support activity over the rest of 2025.”

Dyer said he estimated total homes commencements would lift over the 2025 financial year, with all build forms contributing.

Value of construction work done, chain volume measures, seasonally adjusted estimates

He said the Albanese government’s flagged pause to further changes to the National Construction Code for residential building until the National Housing Accord concludes, and the fast-tracking of some development assessments, would have an affect on the rest of the year.

“More broadly, we are increasingly optimistic about the impact of a series of state level initiatives and policies in drawing out apartment projects, particularly in the key Sydney and Melbourne markets,” Dyer said.

A firm pipeline of public works is under way, most notably a series of major hospital developments which broke ground over the financial year, he said.

“Project valuations also continue to come in to the upside, especially for large government projects,” Dyer said.

“We expect this will maintain a floor under non-residential construction near term. The cash rate cutting cycle is advanced, but it will take some time to flow through.”

Engineering (non-building) construction activity rose in seasonally adjusted terms over the June quarter to $37.08 billion, up 6.1 per cent on the previous quarter.

This was driven by the private sector, up 13.5 per cent.

“The government-funded transportation infrastructure boom is approaching a peak, with publicly funded road construction activity and railway work forecast to top out over the next year,” Dyer said.

“Boosted by continued work to decarbonise the electricity grid and the ongoing rebound in mining investment, the private sector is positioned to become the predominant driver of activity.

“Industry capacity constraints and rising construction costs remain the key downside risks to this pipeline of work.”