Western Sydney Highest Default Risk in Australia

More than half of the top 10 high-risk regions for default are in Western Sydney, according to March data released by CreditorWatch.

CreditorWatch chief economist Anneke Thompson said the crunch was down to four key factors.

These were low median income, high population density and low ranking on the Australian Bureau of Statistics’ index of relative social advantage, and index of economic opportunity.

“Western Sydney is the region that we expect to be hit hardest by insolvencies over the next 12 months,” Thompson said.

“Relative levels of debt are high in this region and there are many small businesses that are very sensitive to even slight movements in demand.

“On the other hand, the areas we predict to have the lowest levels of insolvency tend to have many long-term businesses that have more established cash flow and much lower levels of debt.”

Worst insolvency risk areas

| Rank | Region | State | Default rate last 12 months | Default rate next 12 months | Change |

| 1 | Melton - Bacchus March | VIC | 5.26% | 7.01% | +1.75% |

| 2 | Fairfield | NSW | 5.17% | 7.06% | +1.89% |

| 3 | Kogarah - Rockdale | NSW | 5.12% | 7.13% | +2.01% |

| 4 | Southport | QLD | 5.77% | 7.31% | +1.54% |

| 5 | Bankstown | NSW | 5.84% | 7.37% | +1.53% |

| 6 | Surfers Paradise | QLD | 5.08% | 7.38% | +2.3% |

| 7 | Auburn | NSW | 5.87% | 7.43% | +1.56% |

| 8 | Ormeau - Oxenford | QLD | 5.86% | 7.45% | +1.59% |

| 9 | Canterbury | NSW | 5.54% | 7.55% | +2.01% |

| 10 | Merrylands - Guilford | NSW | 5.68% | 7.8% | +2.13% |

Food and beverage continued to rank the highest as discretionary spending feels the pinch with high levels of inflation and interest rate hikes.

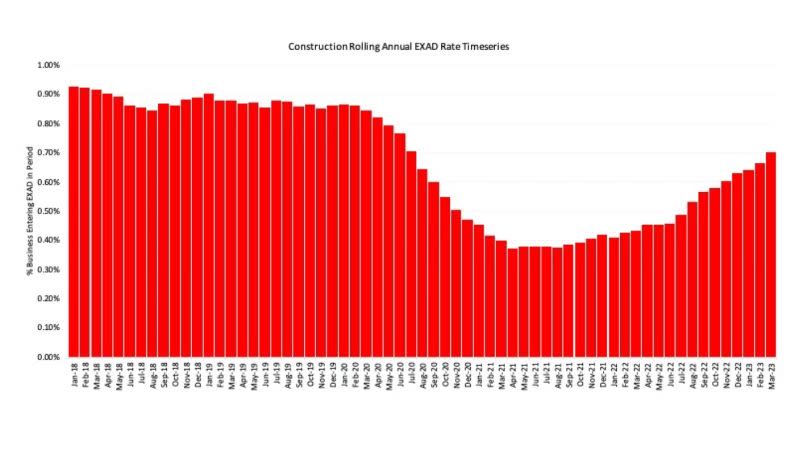

Construction is however, a close second with the rolling 12-month average insolvency rate now at 0.7 per cent.

“It is the cost side that is really damaging to this sector at the moment, with many projects being completed at a substantial financial loss to the builder due to the price the owner pays being fixed at the time of contract signing,” Thompson said.

Construction rolling external administration 2018-2023

And there are no signs of slowing down with CreditorWatch data indicating there were further insolvencies to wash through the market.

While rolling data shows the construction has still not reached pre-pandemic rates in excess of 0.8 per cent, the trend is on its way up.

Newly released statistics from ASIC show 1538 construction-related companies have entered administration or had a controller appointed in the nine months to March 26—dwarfing the 818 company collapses recorded for the same period last financial year.

More broadly insolvency data shows that 831 companies had administrators appointed last month, compared with an average of 720 for the same month between the 2016-17 and 2018-2019 financial years.