Fuel and raw material costs in Australia are continuing to rise as the impact of overseas conflicts continues to reverberate through local supply chains.

According to Rider Levett Bucknall (RLB) Oceania research and development director Oliver Nichols, escalating conflicts in the Middle East and Ukraine are “driving up fuel and raw material costs, which, combined with domestic challenges like labour shortages, rising interest rates and evolving regulations, threaten to slow project delivery, inflate costs and reduce investment appetite”.

The global quantity surveyor has just released its Q2 Construction Market Update for Australia, detailing how national construction costs are being affected.

“Fuel prices remain a central concern,” RLB said in the update.

“They are not only integral to the transportation of materials but also to the manufacturing processes of energy-intensive building products such as concrete, asphalt, and plastics.

“Economists warn that any further escalation in the Middle East—particularly one that disrupts oil flows through the Strait of Hormuz—could lead to a sharp spike in global energy prices.”

Those rising costs and supply chain delays are now risking project budgets, timelines and feasibilities, the report found.

“Similarly, large-scale infrastructure projects—many of which are publicly funded—face the risk of cost overruns, delays, or scope reductions, which could impact everything from health, education and social housing initiatives to transportation networks,” Nichols said.

“Developers, contractors, and designers now face the dual challenge of managing domestic constraints while navigating an increasingly volatile global market,” RLB said in the report.

“With investor sentiment already fragile, even modest increases in material costs can trigger project reassessments, postponements, or cancellations.”

Nichols is also worried about rising numbers of sub-contractor and small-to-medium enterprise insolvencies.

“As long as geopolitical tensions persist and domestic challenges remain unresolved, Australia’s construction industry will continue to operate in a climate of heightened risk and constrained opportunity,” Nichols said.

Construction costs predicted to outgrow CPI in 2025

The report said tier one contractor and subcontractor markets are in near-capacity operation in South Australia where there is growth forecast for the defence, healthcare, renewable energy, residential and infrastructure sectors.

It is a similar situation in the Australian Capital Territory, thanks to major and residential projects, including the new North Canberra Hospital and the Canberra Theatre Redevelopment.

Western Australia’s construction market is also at near-capacity and prices are increasing due to skilled labour shortages and rising wages, although the state government is attempting to ameliorate that.

Regional projects and complex high-value metropolitan projects are the main areas of focus.

Cost escalation due to labour shortages, productivity levels, wage increases and delays in getting specialist electrical and mechanical components imported is an issue for Sydney’s construction market, the report said.

And major public infrastructure projects continue to create competition for skilled labour.

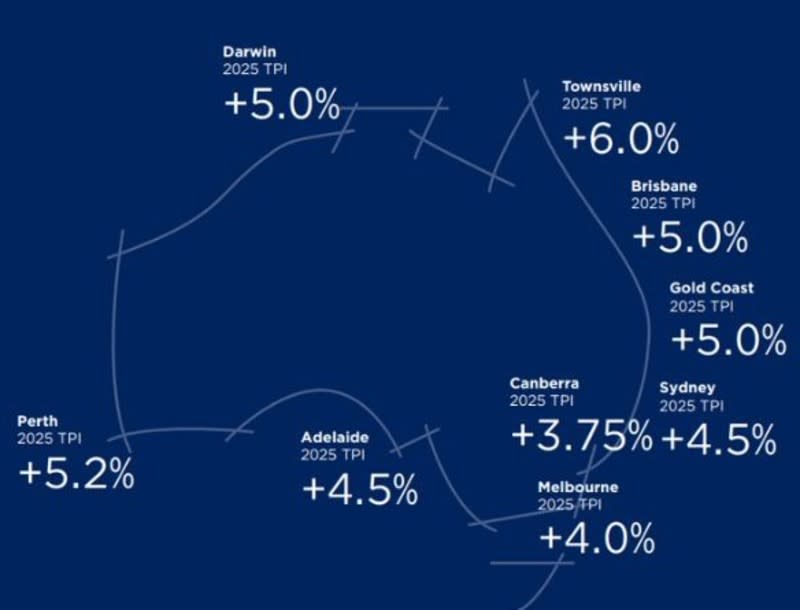

Annual tender price index uplift (percentages), Q2, 2025

In Brisbane, construction costs are at a slower pace than in previous years, the report said.

Tier one contractors’ pipelines are dependent on government projects for health, prisons, education and infrastructure but the private sector is facing cost pressures in making projects feasible.

On the Gold Coast, overall construction costs in the tier one contractor market continue to rise, albeit at a slower pace, while improved subcontractor availability is helping to ease pricing pressures.

The Queensland Government has also reviewed several major capital works programs, reducing the number of tendered projects in Townsville, making pricing less opportunistic, RLB said.

The Northern Territory Government is investing $2.74 billion in infrastructure development, including new public housing, health, education and prison upgrades across the territory.

In Melbourne, labour shortages and economic strain continue to challenge the construction industry, driving up labour costs, delaying project timelines and affecting feasibility and delivery.

Material prices are showing early stabilisation but global inflation and residual supply chain disruptions are still increasing input costs.

Builder insolvency increases are reducing competition and placing pricing pressure on contractors, the report said.