Resilient Retail Assets Valuable in Declining Market

Large-format retail and neighbourhood shopping centres are leading sector transactions as investors look for value and development opportunities in the declining retail sector, according to research.

Herron Todd White retail specialist valuer Vanessa Hoey said investors were scrutinising properties on the basis of the type of tenants and how resilient they were to lockdowns.

“If you’ve got a tenant that’s an essential service and not required to lock down, then there’s a greater level of demand for those properties from investors due to the security they provide,” Hoey said.

“When they come on the market there are pretty sharp yields reflecting long-term secure leases and good tenants.”

A Herron Todd White report on transactions in 2021 showed a higher volume of transactions in neighbourhood shopping centres in south-west Sydney, which indicated growing interest in sites with potential for future redevelopment, and one transaction achieved a sub-6 per cent yield.

The report indicated investor opportunities in the market focused on properties with “underlying development potential, properties located in areas undergoing growth and renewal projects, or those with very good tenancy profiles and strong income”.

CBRE’s Australian Retail Market Review for the June Quarter of 2021 large format rents continued to surge ahead.

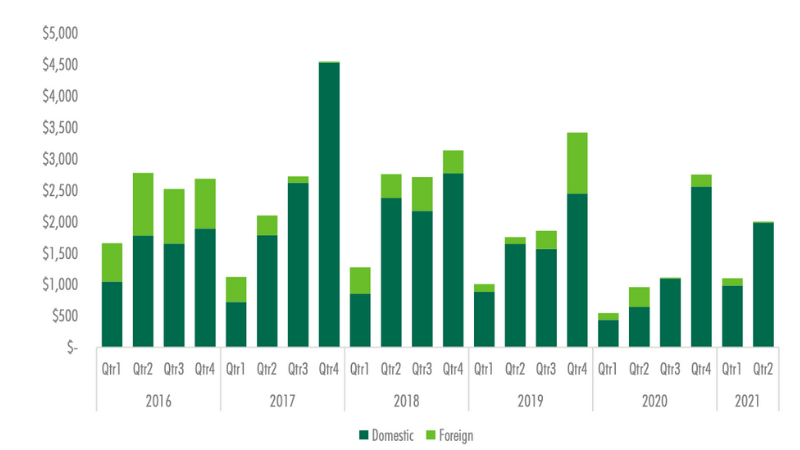

Domestic vs foreign investment in retail sector

^Source: CBRE Research

Large format net face rents nationally went up 9 per cent year on year, while Sydney experienced a 23 per cent increase and Melbourne rents went up 5.5 per cent year on year, which CBRE’s report said was reflective of the uptake of the homebuilder scheme.

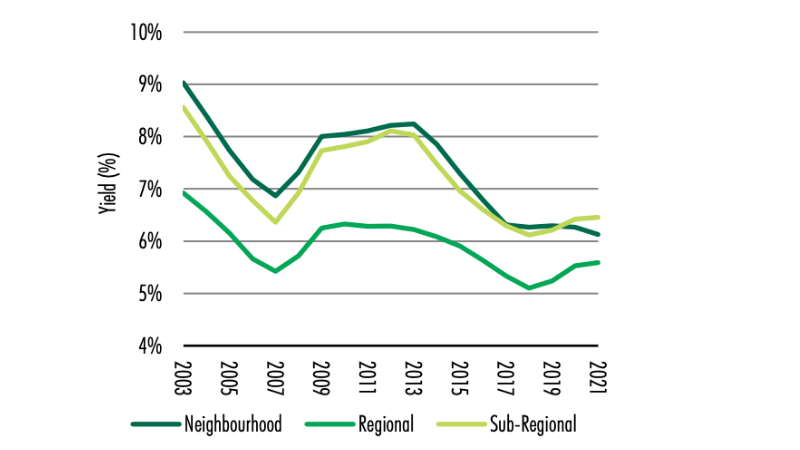

The report has forecast the Sydney CBD retail sector will continue to decline in the face of protracted lockdowns.But there has been sharp yield compression across the retail sector.

“The strongest yield compression came from neighbourhood centres and subregional centres which continue to benefit from strong supermarket sales,” the report said.

Transaction deals were also reported to be “buoyant” in the June quarter.

“Transaction volumes in [the second quarter] totalled up to $2 billion, up 82 per cent on the previous quarter, and up 187 per cent on the same period in 2020, which was heavily impacted by Covid-19 restrictions.”

While the bulk of transactions were to domestic investors, the CBRE report has projected a surge in foreign investment in the second half of 2021 and bigger transaction volumes as more investors are priced out of other commercial sectors.

Sub-regional shopping centre assets led the $1.3 billion in transations during the second quarter, including the $139-million sale of Mirabooka Square in Western Australia and CS Square in Victoria, which changed hands for $136.5 million.

The appetite for large -format retail continues to grow with 10 assets transacted over the past quarter, amounting to $291 million.

The most significant transaction was Newmark Capital’s purchase of Bunnings Eastgarden for $75 millon with an initial yield of 4.14 per cent.

Shopping centre yields

^Source: CBRE Research

Vicinity Centres reported a statutory net loss of $258 million last financial year, primarily due to non-cash property valuation declines, as it looks to diversify income streams through mixed-use developments and capital partnerships.

But the group has forecast a favourable long-term outlook for its assets, which include a number of expansions and developments in the pipeline across Victoria and Western Australia.

In February, Scentre Group, who owns shopping centres across Australia and New Zealand, recorded write-downs of $4.2 billion across its property portfolio, contributing to a loss of $3.7 billion.

Scentre Group chief executive Peter Allen said 2020 had been a “challenging” year, but that the group was working to renegotiate leases and further expanding its offerings across its assets.

“We operate a business and a brand that are important to our customers, and essential to the community,” Allen said.

“Our business fundamentals remain strong and our strategy, focused on the customer, positions the Group for long-term growth."