RBA Ending Hikes Will Be Good News for Renters

As inflation moves past its peak, the RBA is getting closer to the end of rate hikes.

This could be good news for renters because growth in rent values usually tracks roughly with movements in the cash rate.

Not only is the cash rate expected to peak this year but each of the major banks is now forecasting a reduction in the cash rate through 2024.

Annual rent growth, while still high, has gradually been trending lower since a peak in December 2022.

How are rents and interest rates related?

Rents and interest rates move together over time, so a peak in the cash rate may indicate that growth in rent values is also at (or near) a peak. Figure 1 illustrates this correlation, showing Australia’s cash rate against annual changes in imputed rent values.

Growth in Rent Value Index (national, homes) v cash rate

There are multiple reasons these two series might move together. For one, rents are an input in measuring inflation. When rents rise, inflation can rise and this prompts the RBA to lift interest rates.

Secondly, interest rates can impact rent. Higher interest rates mean investment property becomes less attractive, which could slow the delivery of new rental stock coming to market and this could push rents higher.

Other factors affecting investment activity can have an impact on the rental market. For example, the uptick in rents over the year to September 2017 may be the result of temporary restrictions on investment lending from APRA in late 2015.

Rental supply dropped off in 2019 as housing markets went through a broad-based decline, and investor interest in property waned.

Have higher rates forced rent increases?

Investors may have increased rents to help fund higher mortgage costs but it’s unlikely rents have been increased to the full extent of interest cost increases.

ATO tax data from the 2020-21 financial year indicated close to half (47.1 per cent) of Australian property investors were negatively geared, meaning rents were not covering interest payments on many investments even before interest rates started to rise.

To put recent rate hikes in perspective, CoreLogic monthly median rent values are estimated to have increased $225 a month over the year to June.

However, mortgage costs of a new investment loan are estimated to have increased by $948 a month on the median Australian home value.

Investors who have no mortgage or a small mortgage may have also taken advantage of tight rental market conditions to increase the return on their investment properties.

Irrespective of mortgage costs, rents can generally only rise substantially if the rental market is competitive and tenants cannot find alternative accommodation to bargain with; in other words, rents rise when demand for rental accommodation is outweighing supply.

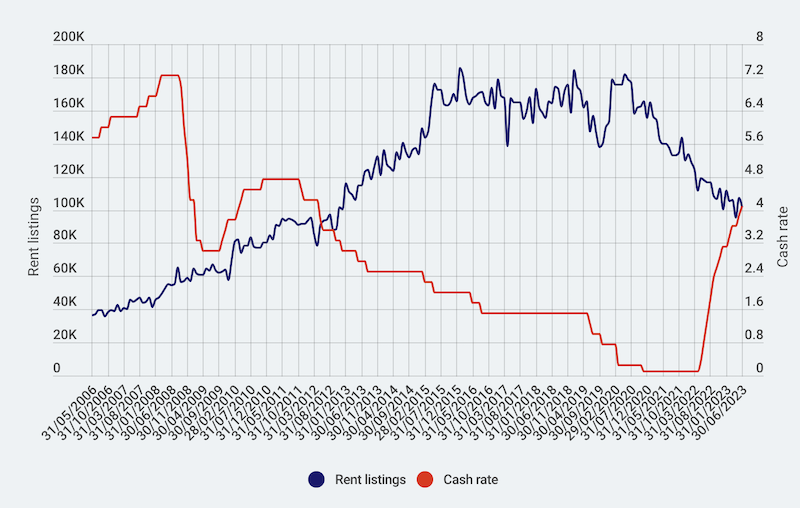

Looking at rental supply in the context of rate movements (second graph), it’s clear that a tightening in the rental market occurred well before interest rates started to rise.

The rental market started to tighten in mid-2020, while the cash rate wouldn’t go up for another two years.

The rental market tightened from a number of factors besides interest rates, including investor uncertainty, less share-housing and higher income growth. Higher interest rates have slowed investment activity through 2022 and the first few months of this year but they haven’t been the sole cause of rental increases.

Total monthly rent listings versus cash rate

Rent growth is expected to slow in 2024 for a number of reasons:

As renting becomes less affordable, tenants may turn to re-forming share-houses, which will reduce rental demand.

Construction cost increases are easing and fewer approvals means the construction space may also unwind next year. As the elevated pipeline of residential homes under construction are completed, renters who may have been waiting for new homes to be completed can exit the rental market.

2024 may see a lift in rental supply from government initiatives around social and community housing provision and build-to-rent projects will gradually flow into the market.

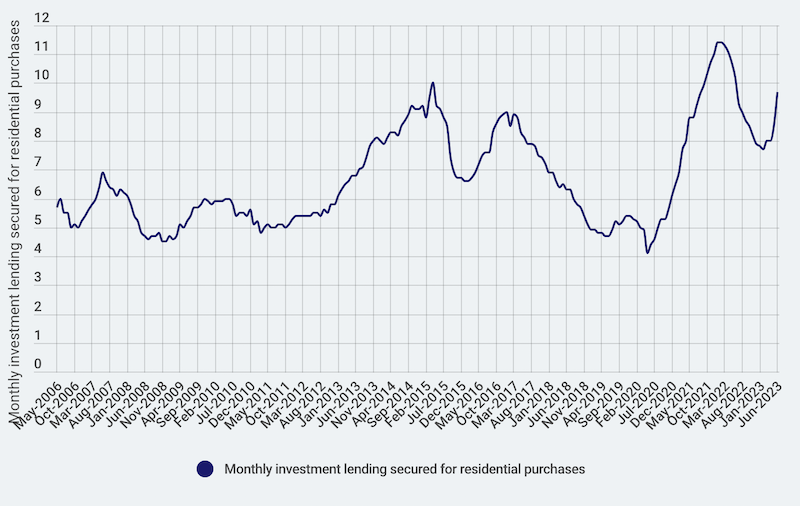

Housing finance data shows investors are already returning to the housing market and this bounce-back is likely to be stronger in 2024 if interest rates decline and home values continue to rise. Figure 3 shows the monthly volume of housing finance lent for investment property purchases, which shows investor activity ramping up, coinciding with the start of a recovery in the CoreLogic national Home Value Index through March.

Monthly investment lending secured for residential

purchases ($ billion)

While national rent values have never recorded an annual decline in the CoreLogic series, rent growth is likely to continue moderating. Canberra rent values are down 2.8 per cent in the year to June (albeit off the back of a 17 per cent uplift through Covid), and annual growth in regional rents has slowed to 4.9 per cent in the year to June, down from a peak of 12.5 pet cent in the year to November 2021.

While conditions will vary at a granular level, the rental market as a whole is likely to loosen in 2024.

Author

Eliza Owen

Head of CoreLogic Residential Research Australia