New Report Uncovers Global City Trends

Knight Frank, the independent global property consultancy, recently launched

Global Cities: The 2017 Report, examining the market performance of 31 global cities across the world in light of three major trends shaping the times. These trends included:

Negative interest rates have reduced investors’ expectations on what constitutes an acceptable return, which is drawing capital towards real estate.

Despite the volatile economic environment, the avalanche of technological innovation continues to drive demand for property on a global scale.

Fast-growing cities are centre stage in the digital and creative revolutions, and in many of those at the forefront, supply is not keeping pace with demand for both commercial and residential real estate.

Findings from Global Cities: The 2017 Report

Prime office rental forecasts

Of the global cities analysed, 12 are in Asia-Pacific – a region continuing to grow in economic importance globally. The prime office rents forecast from Q4 2015 to Q4 2019 however show a huge range of future performance prospects:

Asia-Pacific markets show a huge range of growth prospects, with Sydney projected to see the strongest growth of 27.5% and Singapore the weakest with a forecast rental decline of 14.0%.

Kuala Lumpur and Beijing are also expected to experience negative growth at -1.1% and -4.4% respectively.

Shanghai (19.2%), the only Chinese city on the top 10 chart, sits in the sixth position, a notch down from Melbourne (19.3%).

Asia-Pacific cities experienced the highest rental growth across the 21 global cities tracked.

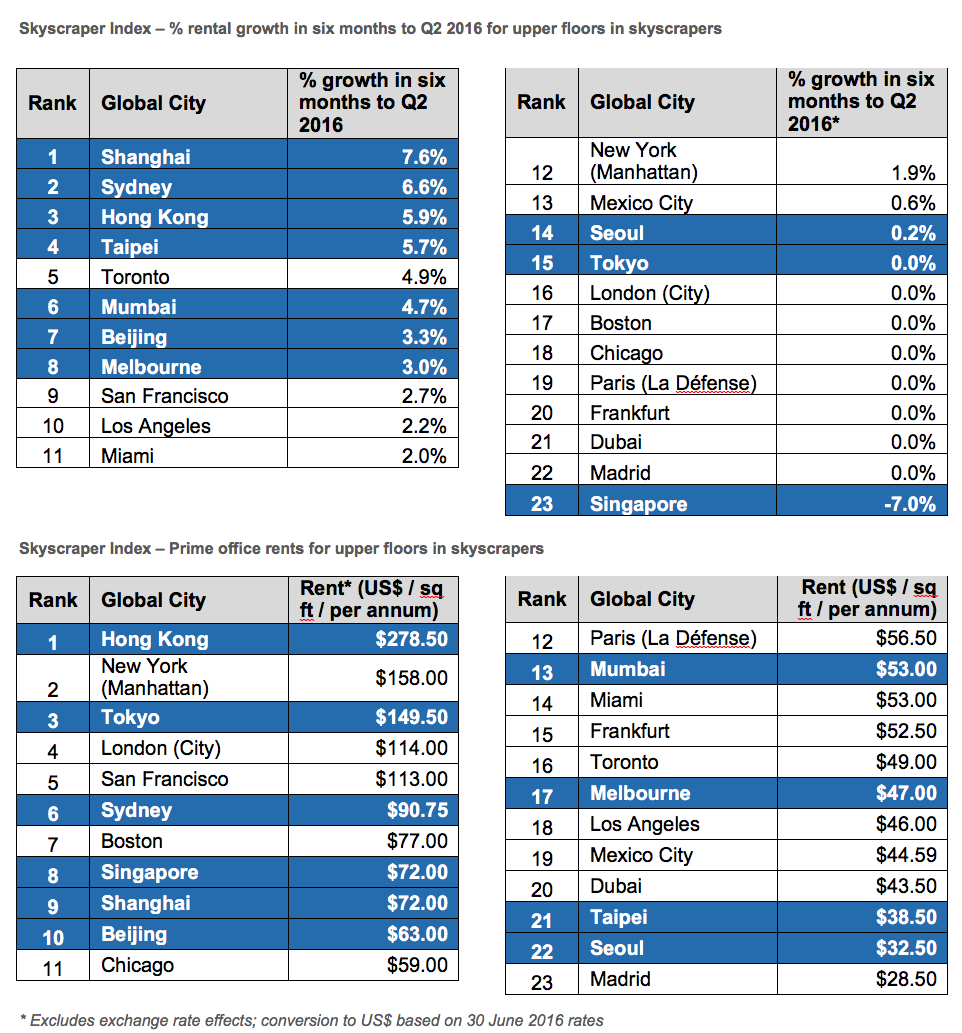

Skyscrapers in Shanghai recorded the strongest rental growth in the first half of 2016, at 7.6%, followed by Sydney (6.6%), Hong Kong (5.9%) and Taipei (5.7%).

Melbourne sits at eighth position, with 3.0% growth over H1 2016.

Singapore sits at the bottom of the chart with a decline of 7% attributed to significant new supply and a slowdown in the local economy.

Hong Kong remains the most expensive city to rent a prime office space, at US$278.50 per sq ft. This is significantly higher the runner-up New York (Manhattan) where rents have reached US$158 per sq ft.

According to Knight Frank’s Head of Office Agency, Australia John Preece, Shanghai’s skyscrapers saw the strongest rental growth rates over the first six months of the year"Tight vacancy rates in the city’s Lujiazui district are likely to further encourage rental growth over the coming months," he said.

“In terms of actual rental levels, Hong Kong’s skyscrapers remain the highest in the world, and with demand likely to outstrip supply for the foreseeable future in the city’s central business district Central, we expect the city to retain its top position in the Index.”

Offshore capital investment into Australia

Knight Frank’s Head of Institutional Sales, Australia James Parry said, the lower-for-longer interest rate environment around the world continues to accentuate the attractiveness of prime real estate in the world’s leading business hubs.

"It is the dynamic cities attracting new sources of growth, including the wave of creative and technology industries that continue to be high on long-term investor’s wish lists," he said.

“Offshore investment into Australia continues to increase. Money is flowing in particularly from all Asian countries, including new entrants from Japan.

“Globally, New York and London remain the largest markets for overseas capital by some way. The success of these financial giants in attracting institutional capital from around the world is down to the huge liquidity and their strong occupier fundamentals.

"In the UK’s capital, despite near term jitters following Brexit, pricing looks to be relatively unchanged and we expect it to continue to be one of the key global markets.

"In Asia, Shanghai saw the largest amount of foreign capital invested in the last 12 months, and as the market continues to mature, this is offering buyers attractive growth prospects in China’s financial capital.”

In relation to Australia’s office markets, Mr Parry said rents are going through a period of dramatic growth in Sydney and Melbourne.

“On a global scale, yields remain generous, so Australia is a positive investment offering internationally with yields compressing. Even on an effective yield basis, it’s still very appealing as incentives are contracting,” concluded Mr Parry.