Sydney industrial tenants are looking to move warehouse and logistics operations to Victoria and Queensland to escape the New South Wales’ capital’s critical space shortages and high rents, according to research by global real estate services firm JLL.

JLL head of research Australia Annabel McFarlane said some Sydney occupiers were looking to the other eastern mainland states as a realistic opportunity for making their supply chains work.

“The cost of transport has become a lesser evil in terms of trying to stack up their supply networks, in comparison to trying to find facilities in the right location in Sydney,” McFarlane said.

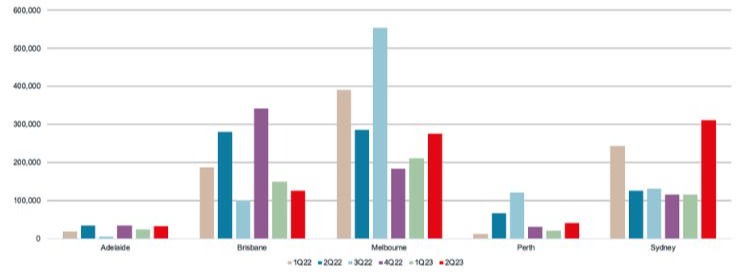

“It’s a trend we’re watching,” she said. “We’re seeing that strong take-up story in Brisbane and Melbourne.”

McFarlane’s comments came during a keynote address to The Urban Developer’s Industrial vSummit, during which the researcher described the sector as “an incredibly positive story”.

▲ JLL head of research Australia Annabel McFarlane.

At around 0.6 per cent vacancy rate Australia’s industrial and logistics property market is now one of the tightest in the world, and at 0.3 per cent Sydney has the lowest rate of any major city.

But McFarlane warned they were also tracking tenants sub-leasing their space into the market.

“The market is changing, it is not as buoyant as it was the middle of the pandemic,” she said.

“For example, in Melbourne we’re tracking 200,000sq m of sub-lease space. Most of it isn’t great, so it’s not actually a huge problem for those developing assets.

“But the reality is for the developer or for the people doing new builds, they are undercutting what is the current rent for those new builds, so we are expecting land values to correct further.”

And she had a warning for tenants.

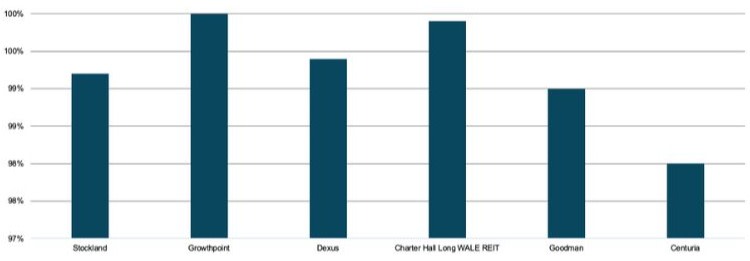

AREIT industrial assets—occupancy (%)

▲ Source: JLL Research, Deloitte Access Economics

Low vacancy rates and the extraordinary growth in rents across all markets, particularly along the eastern seaboard, meant when a typical five-year lease came up to expiry, occupiers could be looking at 40 per cent rental uplift.

“That’s going to keep flowing through as those leases expire and we think that by 2025-2026 you will still see that, particularly coming through Sydney and Melbourne markets,” McFarlane said.

“We know there’s been some slight slowing of rental growth globally, but he's still very, very strong. And Australia during the past 12 months has actually been one of the strongest locations for rental growth.

“It lagged America slightly, and we do see some softening.”

McFarlane told the summit she was not concerned about the future supply of logistics and industrial and logistics space.

JLL is tracking 2.3 million square metres currently under construction across the national market.

Sydney and Melbourne were very strong, although, she said, second quarter pre-commit levels were low.

“But as many will know you don’t want to commit a tenant early on in a piece.

“When it comes to our numbers, we’re not reflecting a demand or take-up story,” she said. “We’re reflecting the fact that tenants are being pushed to wait until closer to practical completion before they’re signed.”

Industrial and logistics gross take up by market

JLL research shows there’s about 1.7 million sq m of supply in the Mamre Road Precinct— the 850ha land package about 40km west of Sydney rezoned for industrial use in June, 2020.

With that kind of supply coming to market, JLL had originally forecast 2024 as a potential year of correction in rents.

McFarlane said they had now adjusted that forecast, largely because of the speed at which services were being delivered to sites in the western Sydney precinct.

In fact, the NSW government has been criticised for its perceived lack of planning and co-ordination over the industrial land package release.

In any case, McFarlane said Australia would likely need between five and seven million square metres of industrial and logistics space during the next four years based simply on the population ratio coming into the market.

“So that’s something to think about, to give you some comfort in terms of the volume of supply that’s coming,” she said. “And it’s probably all going to be needed, and quite soon.”

McFarlane said that historically, industrial had been the riskiest asset class.

“But we think going forward industrial, prime industrial in eastern seaboard markets, will actually be priced, like CBD office,” she said.

“So, industrial’s arrived.”