Interest-Only Lending Falls to Record Low: Report

Measures taken by APRA this year to curb higher loan to valuation ratio lending and investor and interest-only lending shows further signs of taking hold as Corelogic research reveals the proportion of interest-only lending has reduced to a record low.

The latest data on property exposures of Australia’s authorised deposit-taking institutions (ADI) show the perceived riskier areas of new mortgage lending continue to slow.

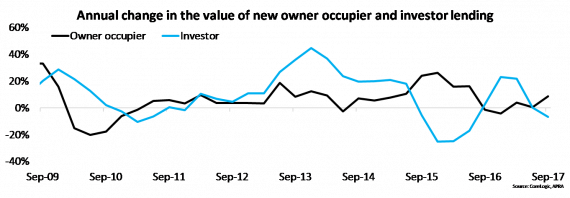

September 2017 quarter data shows the value of lending to investors was actually the lowest it has been since the March 2016 quarter. Of the $98.211 billion provided in mortgages, $30.994 was to investors – a fall of 9.1 per cent over the quarter and 6.6 per cent lower year-on-year.

[Related reading: Housing Affordability Makes Slight Improvement Following APRA's Restrictions]

While investor demand has fallen, the value of owner occupier mortgage commitments continues to rise to its highest quarterly value since December 2015.

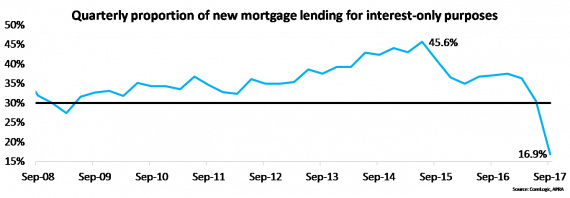

The data showed that total value of interest-only lending over the September 2017 quarter was $16.603 billion (16.9% of new mortgage lending) which was 44.8 per cent lower than the value over the June 2017 quarter and 52.8 per cent lower than it was a year ago.

Corelogic believes that indicates that the higher mortgage rates being incurred by interest-only borrowers are actually curtailing demand more so than the APRA-imposed cap.

Corelogic’s Cameron Kusher said that the data highlights that there appears to be a more prudent approach being taken towards investment and interest-only mortgage lending.

“Of course, the macroprudential policies implemented by APRA were specifically targeting these segments of lending which suggests that they are being successful," he said.

“Over the coming quarters the most interesting developments to watch will be whether investor lending continues to decline, which we suspect it will.

“It will also be interesting to see whether interest-only lending rebounds back to levels closer to the 30 per cent limit or if they continue to languish at much lower levels.”

"If it is the former it indicates that potentially lenders tightened too hard and that there remains demand for this product. Meanwhile, if it is the latter it suggests that demand for interest-only lending has reduced.