Housing values have remained resilient in the face of rate rises and cost of living pressures, inching up during February.

Values posted a broad-based rise for the month according to CoreLogic’s national Home Value Index (HVI), which was up 0.6 per cent in February.

The 20-basis-point acceleration from 0.4 per cent increase in January was the strongest monthly gain since October last year, according to the report.

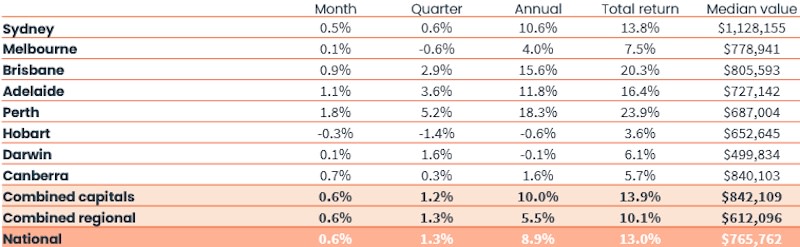

.Each of the capital cities and rest-of-state regions recorded a lift in values for the month, except Hobart where the market fell 0.3 per cent.

“The ongoing rise in housing values reflects a persistent imbalance between supply and demand which varies in magnitude across our cities and regions,” CoreLogic research director Tim Lawless said.

Perth continues to stand out with a substantially higher rate of growth compared to any other region, up 1.8 per cent over the month.

Adelaide (1.1 per cent), Brisbane (0.9 per cent) and the regional areas of SA (1.1 per cent), WA and Queensland (both 1.0 per cent) also show a consistently high rate of capital growth month-to-month.

“These regions are generally benefiting from a combination of comparatively lower housing prices and positive demographic factors that continue to support housing demand,” Lawless said.

Although growth rates in Sydney and Melbourne home values have leveled out, the monthly trend has accelerated, with Melbourne emerging from a three-month slump of negative monthly movements to record a subtle 0.1 per cent rise in February.

Similarly, Sydney home values have moved back into positive territory during the past two months after recording a minor decline in November and December.

“Potentially we are seeing some early signs of a boost to housing confidence as inflation eases and expectations for a rate cut, or cuts, later this year firm up,” Lawless said.

The re-acceleration in value growth has been accompanied by a bounce back in auction clearance rates, which averaged in the high 60 per cent range through February.

Consumer sentiment also recorded a solid rise in February, signaling a lift in confidence.

“Auction results and sentiment have both shown a historically strong relationship with housing trends,” Lawless said.

Change in home values, February 2024

“The rise in clearance rates from the mid 50 per cent range late last year to the high 60 per cent range in February points to a better fit between buyer and seller pricing expectations.

“A rise in sentiment suggests households will have a better ability to make decisions around large financial commitments, like a property purchase.”

lthough the pace of gains has shown some uplift, most regions are still recording value growth well below the highs of last year when the national index rose 1.3 per cent in May.

“Last years’ rate hikes clearly dented capital gains, but higher interest rates haven’t been enough to extinguish growth entirely,” Lawless said.

“The shortfall of housing supply relative to housing demand is continuing to place upwards pressure on home values across most regions.

“However, it’s hard to see a significant rebound in values shaping up given downside factors.

“Affordability constraints, rising unemployment, a slowdown in the rate of household savings and a cautious lending environment, are all factors likely to keep a lid on value growth over the near term.”