Getting Started in Property Development (Part Two): Finance and Legal Structures

There is a perception in the industry that property developers are inherently intuitive creatures with an entrepreneurial flamboyance that is more Donald Trump than Warren Buffett.

While this is is indeed true in some instances, the reality is that property development is a game of risk versus return – a game best suited to those that can navigate through complexity and risk.

In this second instalment of our Getting Started in Property Development series – delivered in partnership with the Applied Property Development Institute (APDI) – we take a look at some of the principles behind the legal and financial side of the property development process.

The Invisible Structures of a Property Development

The property development process is a long and complex life cycle that starts with the acquisition of a development site and finishes with the settlement of property, such as residential units, a commercial building or a land subdivision.

Between these two bookends exists a multitude of milestones that represent different phases of the development process.

These milestones can include:

Lodging a planning application

Receiving a development approval (DA)

Launching a pre-sales or pre-leasing marketing campaign

Sourcing land and construction funding

Appointing a construction contractor

Practical Completion (PC) of a development

Settlement of property and release of funds .

As the development progresses, the developer typically needs to invest more capital in the project and, as time goes on, the stakes (i.e. the risk of losing that capital) get higher.

Under the physical "bricks and mortar" are a series of invisible structures that, more than any other item, define success in property development: legal and financial structures.

An Introduction to Property Development: Legal Structures

At their very core, legal structures create obligation between two or more parties and are an essential part of ensuring that the relationship between risk and return is managed effectively by the developer.

Throughout the development process, there are a suite of legal agreements and structures that are required to undertake a project.

These may include:

Site acquisition – A contract of sale between the owner of the land and the property developer. These contracts vary from state to state, however can generally fall within the following categories:

Standard contract of sale

Conditional contract

Put and/or call option

Sales/leasing contracts – A contract between the property developer and a future purchaser or tenant of the property. Again, these contracts vary from state to state, however can generally fall within the following categories:

Contract of sale

Agreement for lease

Disclosure documentation

Agency agreements – A contract between the property developer and the appointed agent to sell or lease the new development.

Construction contract – A contract between the property developer and the building contractor to construct the project.

Consultant agreements – A contract between the property developer and professional consultants for services rendered on the project.

Funding agreements – A contract between the property developer and financiers for the provision of funding or investment in the project.

Shareholders agreements – A contract between the shareholders of the corporate structure that undertakes the project.

While the agreements above provide a brief summary of some of the legal structures that are required to undertake a development, they are just the tip of the iceberg!

Over the course of this series, we will continue to explore more of these concepts to provide you with a deeper understanding of the nature and importance of legal structures in property development.

An Introduction to Property Development – Finance Structures

At a financial level, the same principles of risk and return still apply.

Every developer, even the most well-heeled, has a limited pool of capital to work with.

In industry parlance, this is referred to as equity, however in layman’s terms, we’re talking about cash...cold, hard, CASH!

There is always pressure on property developers to use their equity in a way that optimises the return on this capital. This is referred to as the return on equity (ROE).

However, nearly all property developers use leverage (a.k.a. DEBT) to boost their return on equity.

For example, let’s assume a project’s TOTAL COST is $10 million.

Typically, a property developer will fund 25% of this cost ($2.5m) with equity and the balance ($7.5m) would be funded by a financier, typically a bank.

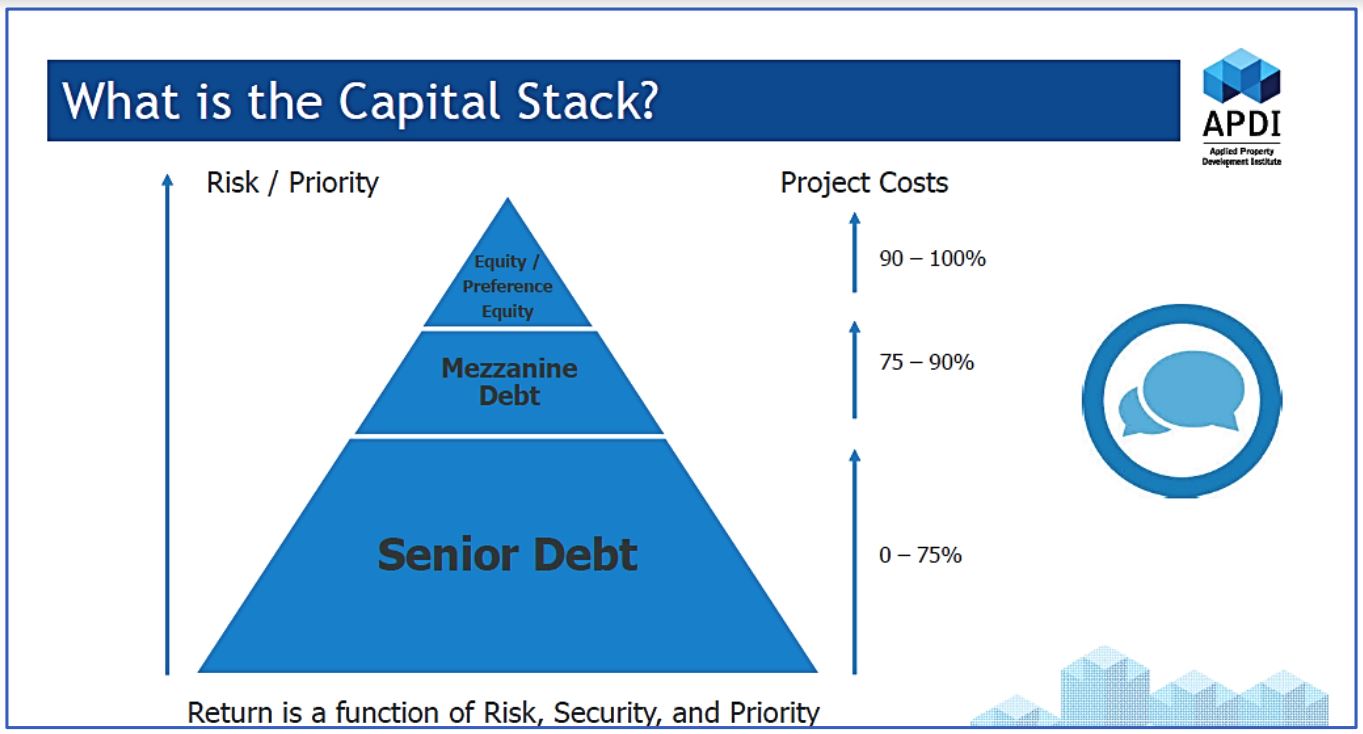

The way that the total funding (equity plus debt = $10m) is structured is referred to as the capital stack (refer to the image below)

For property developers, the structure of the capital stack is a constant focus to ensure that the limited pool of equity that every developer has is utilised in a way that generates the most profit for an appropriate level of risk.

How you actually do that is a conversation for another time!

Want to learn more about the property development process?

The Urban Developer is proud to partner with the Applied Property Development Institute (APDI) to deliver this educational content series.

Established in 2014, APDI has grown to become Australia’s premier membership-based education provider for the property development industry.

Registrations for APDI's 2018 intake have now commenced.

Course modules include Site Acquisition and Structures, Property Market Dynamics, Project Investment Analysis and Development Management.

For further information or to enrol in one of our courses, register with APDI by clicking here.