Foreign Investment in Residential Real Estate Fell 69% Last Year

The foreign acquisition of Australian assets is affected by a number regulatory, fiscal and monetary “push” and “pull” factors.

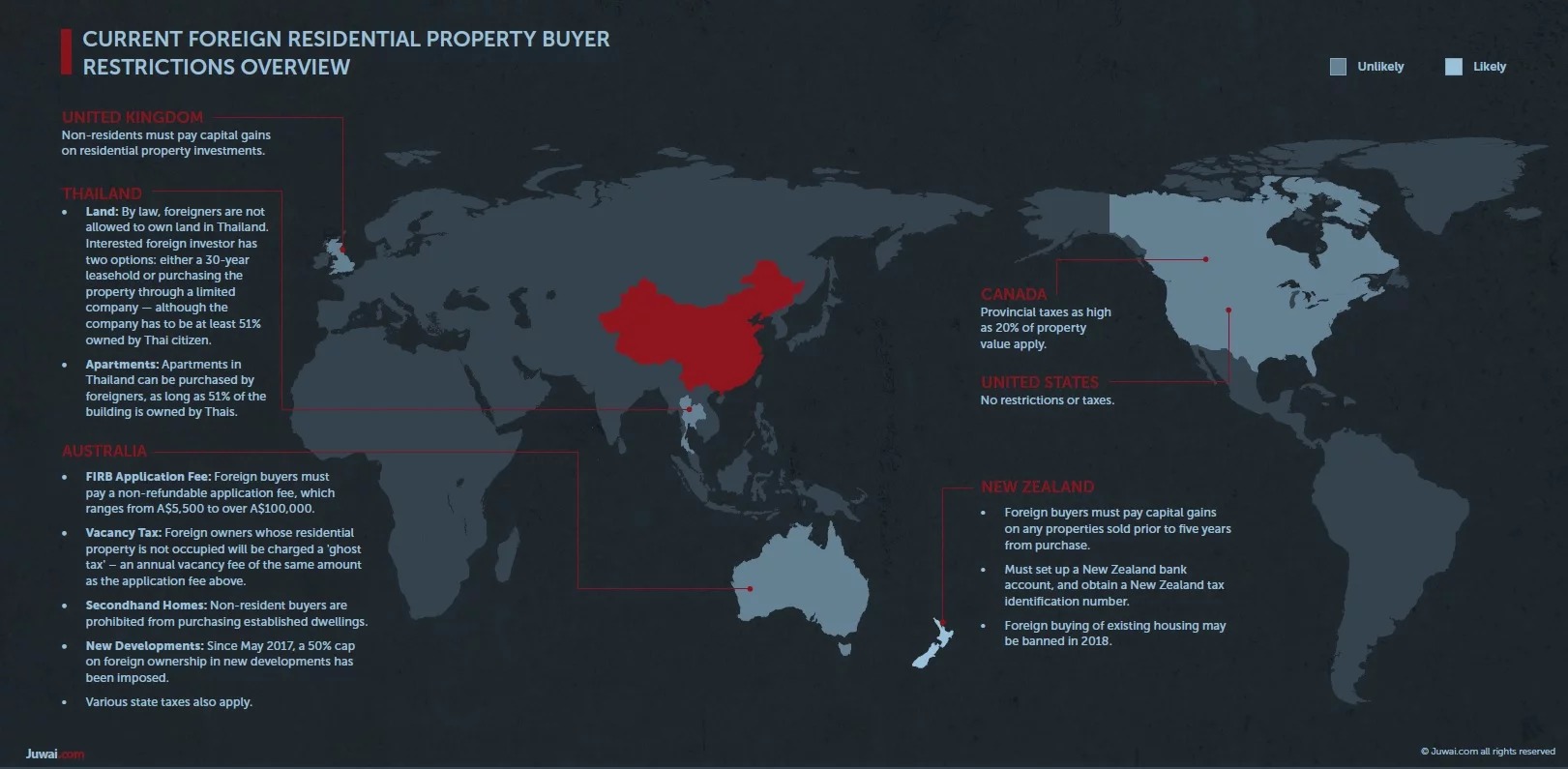

Within different asset classes, sensitivity around issues such as security, nationalism and housing affordability have also shaped legislation and decision-making on foreign investment.

Capital directed towards different assets fluctuates as a result.

A recent factor “pushing” demand away from Australian residential property is the proposed removal of the capital gains tax main residence exemption for foreign residents. The measure eliminates a crucial incentive to owning a home in Australia as a foreign resident and could see temporary tax residents, such as expatriates, sell their properties before moving away.

“Pull” efforts include mandates from overseas governments that limit foreign investment. In China for example, capital outflow controls were implemented in reaction to depleted foreign currency reserves.

Last month’s Foreign Investment Review Board report outlined the value of assets that had been approved for foreign acquisition.

Related: Foreign Investment in Australian Property Tumbled in 2017: FIRB

Foreign investment in residential real estate

In the 2015-16 financial year, residential real estate was the largest asset segment approved, at $72 billion. This fell to $25 billion the following year, representing a year on year decline of 69 per cent.

While the dramatic fall is attributable to an organic decline in foreign buyer activity, the drop is also attributable to changes in application fees, taxes and development marketing quotas.

However, this decline was not as drastic in the commercial real estate segment. Commercial real estate assets approved for acquisition fell from $50 billion in 2015-16, to $44 billion in 2016-17 – a decline of just 12 per cent.

This also made commercial stand out as the second highest value segment approved for foreign acquisition. Commercial made up 23 per cent of approved assets, behind the services segment which attracted $54 billion in approvals (28%).

Amid continued policies limiting foreign acquisition of Australian residential real estate, simplification of the foreign investment framework was made for commercial assets over the 2017-18 financial year.

Related: Chinese Investment Fell 60% Last Year

Foreign investment in commercial real estate

Many assets are subject to a screening process by FIRB, and in commercial real estate, the subject to screening depends on the asset value. Recently, commercial properties treated as subject to a low $55 million assessment threshold were reduced. This was done partially by removing land that falls within “prescribed airspace”.

Previously, prescribed airspace applied to most commercial properties in the central business districts of Australia’s major cities. The change in the threshold makes it easier for foreign individuals to acquire commercial land up to $261 million, or in the case of an agreement investor country, the threshold is $1.1 billion. These countries include China, New Zealand and the United States.

Another feature of the commercial real estate approvals recorded in the FIRB report, is that the average value approved was far higher, at $94 million in 2016-17, as opposed to $82 million in the previous year.

This reflects one of the main differences between residential and commercial markets: the participation of institutional buyers with large pools of capital makes the segment more resilient, particularly at the high end of the market.

This is reflected in Corelogic transaction data, with an estimated 79 per cent of commercial properties transacted across Australian CBDs acquired by institutions, rather than individuals, in 2016-17.

This is up from an estimated 77.5 per cent in the previous financial year.

This is not to say that smaller, regional commercial assets are performing as well as the high-end market.

Corelogic commercial auction results suggest the average weekly clearance rate of commercial property over the June quarter is shaping up to be 60 per cent, down from 64 per cent in the previous quarter.

Average auction volumes have also generally been lower, with an average of 40 auction events each week, down from an average of 50 in the previous period. However, unlike the residential space, policy around foreign acquisitions are relatively accommodative.