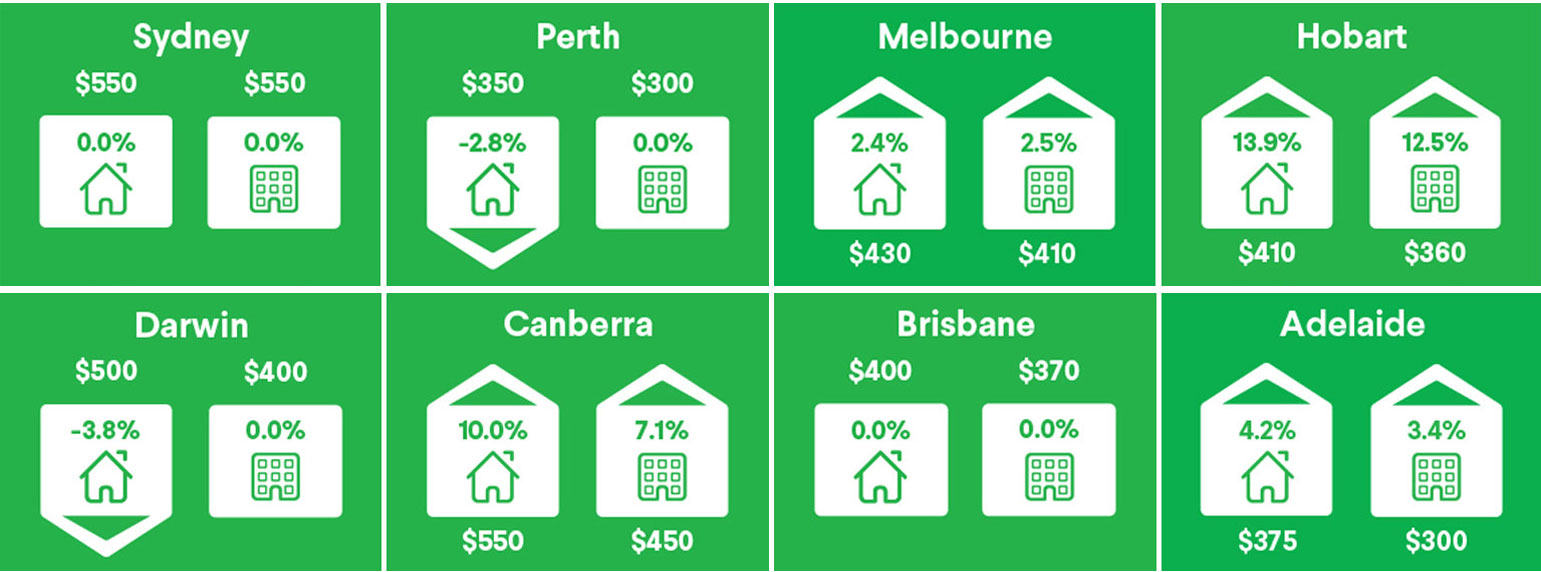

Canberra and Hobart Record Highest Rents in the Nation

Canberra is poised to overtake Hobart as the least affordable rental market in the nation, with Canberra's weekly asking price for rent rising to $550, according to Domain's Quarterly Rental Report.

Rents for units in Canberra have peaked at an all time high, recording the second highest growth, behind Hobart, in both the housing and unit market.

Hobart saw the highest annual growth in median weekly house rental prices with a 13.9 per cent increase to $410 per week, despite a decline over the quarter of 2.4 per cent.

The Tasmanian capital also recorded the strongest rental yield for houses at 5.08 per cent.

Unit rents increased in Hobart to $360 per week, a 2.9 per cent quarterly jump and a 12.5 annual increase, recording the highest increase both quarterly and annually across all capital cities.

“These conditions are indicative of the current affordability issues facing Hobart. While supply continues to deplete, the substantial declines in rental listings appear to have eased,” Domain data scientist Nicola Powell said.

Related: Domain Replaces Catalano with Google Australia Boss

House gross rental yields in Brisbane remained relatively strong at 4.62 per cent with median asking rent for a house in Brisbane resting at $450 a week and $390 a week for units.

“Brisbane remains a tenant’s market with a strong supply of stock providing tenants with greater choice,” Powell said.

“Even though house and unit rental stock remain elevated at near record highs following a number of years of rising supply, conditions appear to be changing downwards, slipping to the lowest level in two years.

Sydney and Melbourne continued to deliver the weakest gross rental yields for houses and units.

Median weekly house and unit rents in Sydney remained flat over the June quarter and year, holding tight at $550 per week.

In Melbourne, house gross rental yields recorded a 5.2 per cent decline. Unit gross rental yields also declined to 4.35 per cent.

“Rent prices in Melbourne remained flat for the quarter and despite an increase over the year, the pace of growth has softened.

"Gross rental yields for houses improved marginally over the quarter, although remain almost on par with Sydney,” Powell said.

“Investor activity is likely to retreat to other city markets and regional areas that either offer prospects of capital growth or higher yields.”

Canberra’s median weekly house rents reached a record high in the June quarter at $550 per week, on par with Sydney.

The 3.8 per cent quarterly jump, was the highest of all capital cities, and a 10 per cent annual increase, the second highest of all capital cities.

The median weekly rental price for houses in Darwin fell 6.5 per cent over the quarter and 3.8 per cent over the year, reaching $500 per week.

Unit rents in Darwin also decreased over the quarter by 2.4 per cent to $400 per week, the highest drop of all capital cities across Australia.